Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the end of 2017, Payne Industries had a deferred tax asset account with a balance of $36 million attributable to a temporary book-tax difference

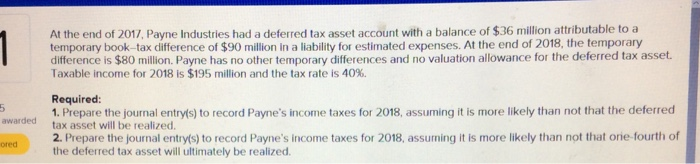

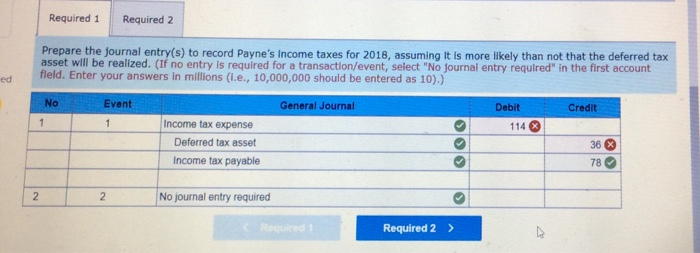

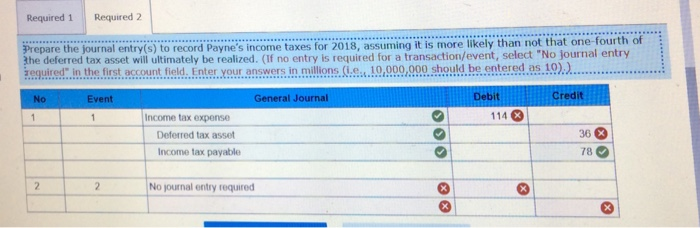

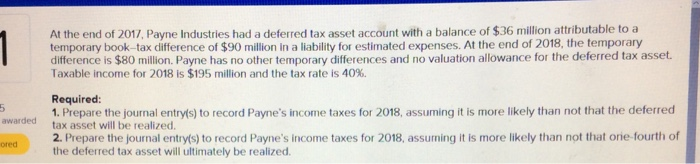

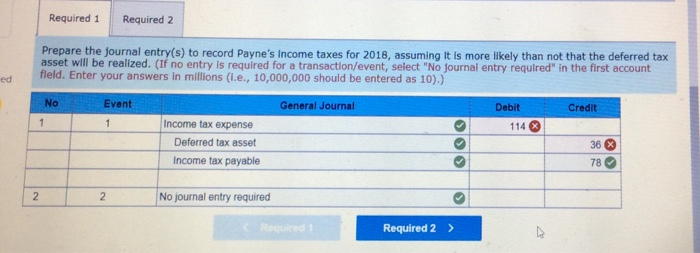

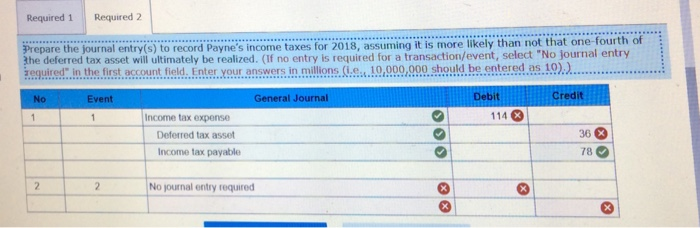

At the end of 2017, Payne Industries had a deferred tax asset account with a balance of $36 million attributable to a temporary book-tax difference of $90 million in a liability for estimated expenses. At the end of 2018, the temporary difference is $80 million. Payne has no other temporary differences and no valuation allowance for the deferred tax asset Taxable income for 2018 is $195 million and the tax rate is 40%. Required: 1. Prepare the journal entrys) to record Payne's income taxes for 2018, assuming it is more likely than not that the deferred awarded tax asset will be realized. 2. Prepare the journal entry(s) to record Payne's income taxes for 2018, assuming it is more likely than not that orie-fourth of the deferred tax asset will ultimately be realized ored Required 1 Required 2 Prepare the journal entry(s) to record Payne's Income taxes for 2018, assuming it is more likely than not that the deferred tax asset will be realized. (If no entry is required for a transaction/event, select "No journal entry required" in the first account ed fleld. Enter your answers in millions (I.e., 10,000,000 should be entered as 10).) NoEvent General Journal Debit Credit Income tax expense Deferred tax asset Income tax payable 114 36 78 2No journal entry required Required 2 Required 1 Required 2 Prepare the journal entry(s) to record Payne's income taxes for 2018, assuming it is more likely than not that one-fourth of the deferred tax asset will ultimately be realized. (If no entry is required for a transaction/event, select "No journal e ze9uired in the first a runt field Enter your answers in.millions( 100,000.hould.beenteredas.102.2 No Event General Journal Debit Credit Income tax expense 114 36 8 78 @ Deferred tax asset Income tax payable No journal entry required

At the end of 2017, Payne Industries had a deferred tax asset account with a balance of $36 million attributable to a temporary book-tax difference of $90 million in a liability for estimated expenses. At the end of 2018, the temporary difference is $80 million. Payne has no other temporary differences and no valuation allowance for the deferred tax asset Taxable income for 2018 is $195 million and the tax rate is 40%. Required: 1. Prepare the journal entrys) to record Payne's income taxes for 2018, assuming it is more likely than not that the deferred awarded tax asset will be realized. 2. Prepare the journal entry(s) to record Payne's income taxes for 2018, assuming it is more likely than not that orie-fourth of the deferred tax asset will ultimately be realized ored Required 1 Required 2 Prepare the journal entry(s) to record Payne's Income taxes for 2018, assuming it is more likely than not that the deferred tax asset will be realized. (If no entry is required for a transaction/event, select "No journal entry required" in the first account ed fleld. Enter your answers in millions (I.e., 10,000,000 should be entered as 10).) NoEvent General Journal Debit Credit Income tax expense Deferred tax asset Income tax payable 114 36 78 2No journal entry required Required 2 Required 1 Required 2 Prepare the journal entry(s) to record Payne's income taxes for 2018, assuming it is more likely than not that one-fourth of the deferred tax asset will ultimately be realized. (If no entry is required for a transaction/event, select "No journal e ze9uired in the first a runt field Enter your answers in.millions( 100,000.hould.beenteredas.102.2 No Event General Journal Debit Credit Income tax expense 114 36 8 78 @ Deferred tax asset Income tax payable No journal entry required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started