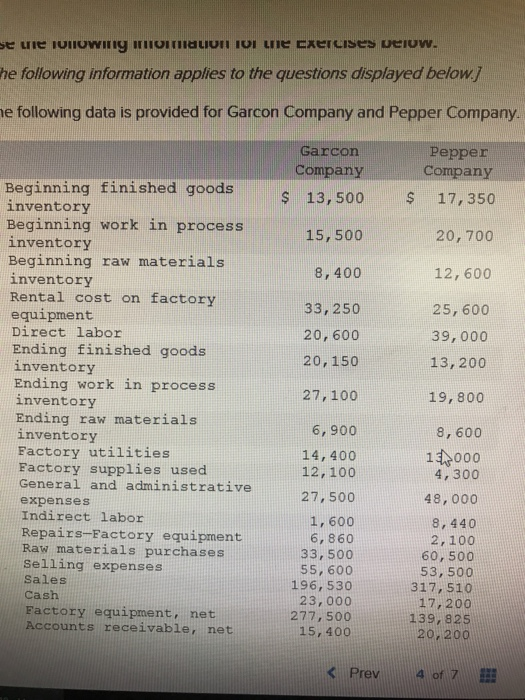

At the end of 2017, records show the company incurred $1,520,000 of actual overhead costs. It completed and sold five jobs with the following direct labor costs: Job 201, $604,000; Job 202, $563,000; Job 203, $298,000; Job 204, $716,000; and Job 205, $314,000. In addition, Job 206 is in process at the end of 2017 and had been charged $17,000 for direct labor. No jobs were in process at the end of 2016. The company's predetermined overhead rate is based on direct labor cost. Required 1. Determine the following. a. Predetermined overhead rate for 2017. b. Total overhead cost applied to each of the six jobs during 2017 c. Over- or underapplied overhead at year-end 2017. 2. Assuming that any over or underapplied overhead is not material, prepare the adjusting entry to allocate any over or underapplied overhead to Cost of Goods Sold at the end of he following information applies to the questions displayed below/ e following data is provided for Garcon Company and Pepper Company. Garcon eppe Company Company Beginning finished goods S 13,50017,350 20, 700 12,600 25, 600 inventory Beginning work in process inventory Beginning raw materials inventory Rental cost on factory equipment Direct labor Ending finished goods inventory Ending work in process inventory Ending raw materials inventory Factory utilities Factory supplies used 15, 500 8, 400 33,250 20, 600 20,150 27,100 6, 900 39,000 13,200 19,800 8, 600 1 000 4, 300 48,000 8,440 2,100 14, 400 12,100 General and administrative 27,500 expenses Indirect labor Repairs-Factory equipment Raw materials purchases 1,600 6,860 33,500 55, 600 196, 530 23,000 277, 500 15, 400 60, 500 selling expenses Sales Cash Factory equipment, net Accounts receivable, net 53, 500 317, 510 17,200 139, 825s 20,200 Prev , a of 7. At the end of 2017, records show the company incurred $1,520,000 of actual overhead costs. It completed and sold five jobs with the following direct labor costs: Job 201, $604,000; Job 202, $563,000; Job 203, $298,000; Job 204, $716,000; and Job 205, $314,000. In addition, Job 206 is in process at the end of 2017 and had been charged $17,000 for direct labor. No jobs were in process at the end of 2016. The company's predetermined overhead rate is based on direct labor cost. Required 1. Determine the following. a. Predetermined overhead rate for 2017. b. Total overhead cost applied to each of the six jobs during 2017 c. Over- or underapplied overhead at year-end 2017. 2. Assuming that any over or underapplied overhead is not material, prepare the adjusting entry to allocate any over or underapplied overhead to Cost of Goods Sold at the end of he following information applies to the questions displayed below/ e following data is provided for Garcon Company and Pepper Company. Garcon eppe Company Company Beginning finished goods S 13,50017,350 20, 700 12,600 25, 600 inventory Beginning work in process inventory Beginning raw materials inventory Rental cost on factory equipment Direct labor Ending finished goods inventory Ending work in process inventory Ending raw materials inventory Factory utilities Factory supplies used 15, 500 8, 400 33,250 20, 600 20,150 27,100 6, 900 39,000 13,200 19,800 8, 600 1 000 4, 300 48,000 8,440 2,100 14, 400 12,100 General and administrative 27,500 expenses Indirect labor Repairs-Factory equipment Raw materials purchases 1,600 6,860 33,500 55, 600 196, 530 23,000 277, 500 15, 400 60, 500 selling expenses Sales Cash Factory equipment, net Accounts receivable, net 53, 500 317, 510 17,200 139, 825s 20,200 Prev , a of 7