Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the end of 2019, CeeNet, Inc., which uses the ASPE deferred tax method, had the following balances reported in its financial books: For the

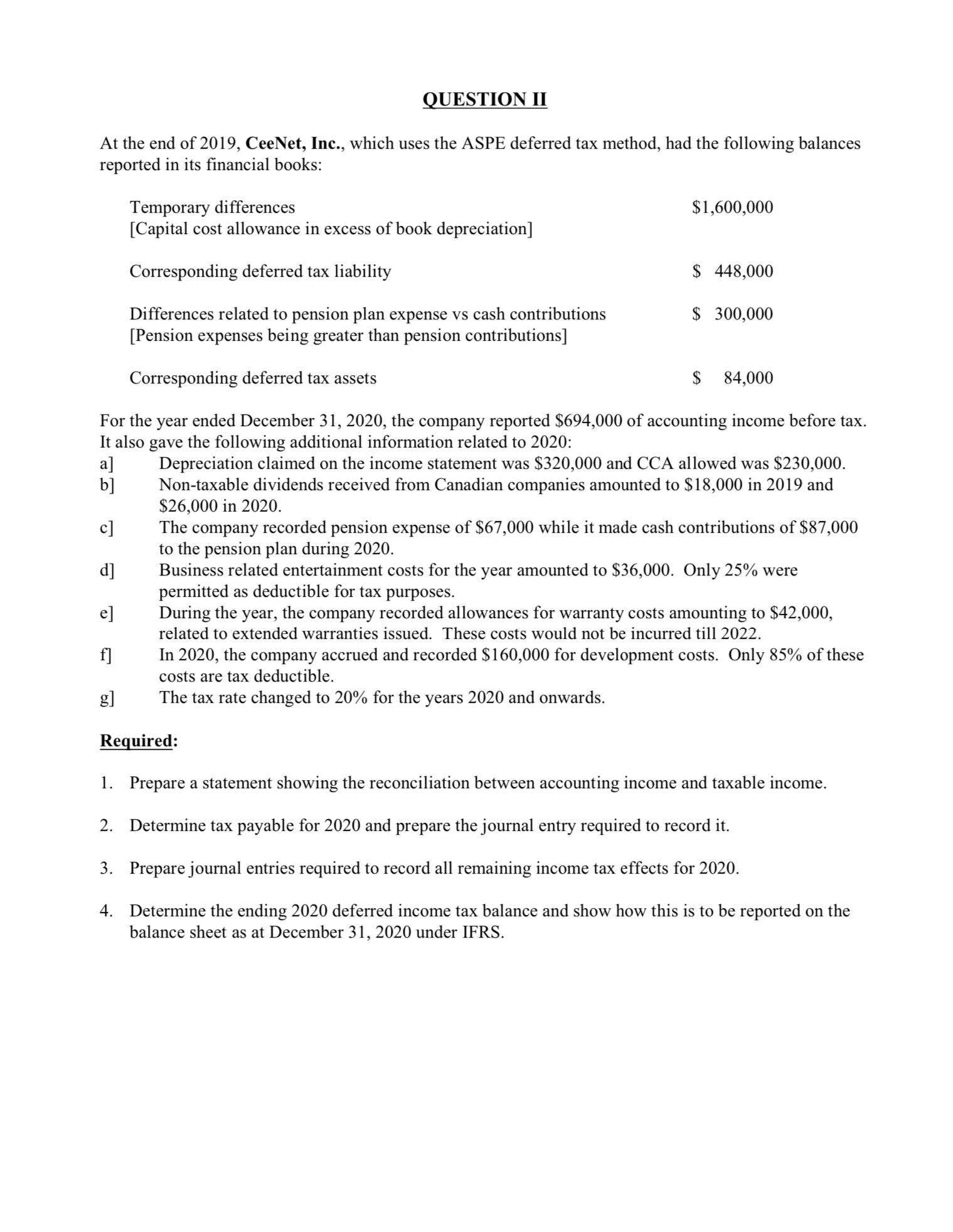

At the end of 2019, CeeNet, Inc., which uses the ASPE deferred tax method, had the following balances reported in its financial books: For the year ended December 31, 2020, the company reported $694,000 of accounting income before tax. It also gave the following additional information related to 2020 : a] Depreciation claimed on the income statement was $320,000 and CCA allowed was $230,000. b] Non-taxable dividends received from Canadian companies amounted to $18,000 in 2019 and $26,000 in 2020. c] The company recorded pension expense of $67,000 while it made cash contributions of $87,000 to the pension plan during 2020 . d] Business related entertainment costs for the year amounted to $36,000. Only 25% were permitted as deductible for tax purposes. e] During the year, the company recorded allowances for warranty costs amounting to $42,000, related to extended warranties issued. These costs would not be incurred till 2022. f] In 2020, the company accrued and recorded $160,000 for development costs. Only 85% of these costs are tax deductible. g] The tax rate changed to 20% for the years 2020 and onwards

At the end of 2019, CeeNet, Inc., which uses the ASPE deferred tax method, had the following balances reported in its financial books: For the year ended December 31, 2020, the company reported $694,000 of accounting income before tax. It also gave the following additional information related to 2020 : a] Depreciation claimed on the income statement was $320,000 and CCA allowed was $230,000. b] Non-taxable dividends received from Canadian companies amounted to $18,000 in 2019 and $26,000 in 2020. c] The company recorded pension expense of $67,000 while it made cash contributions of $87,000 to the pension plan during 2020 . d] Business related entertainment costs for the year amounted to $36,000. Only 25% were permitted as deductible for tax purposes. e] During the year, the company recorded allowances for warranty costs amounting to $42,000, related to extended warranties issued. These costs would not be incurred till 2022. f] In 2020, the company accrued and recorded $160,000 for development costs. Only 85% of these costs are tax deductible. g] The tax rate changed to 20% for the years 2020 and onwards Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started