Answered step by step

Verified Expert Solution

Question

1 Approved Answer

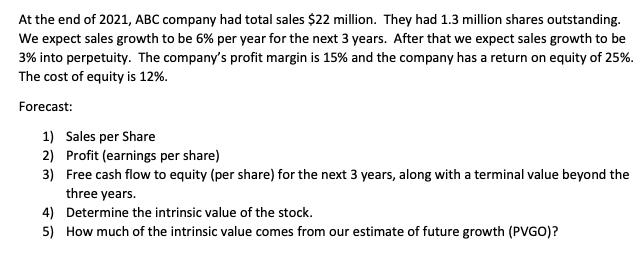

At the end of 2021, ABC company had total sales $22 million. They had 1.3 million shares outstanding. We expect sales growth to be

At the end of 2021, ABC company had total sales $22 million. They had 1.3 million shares outstanding. We expect sales growth to be 6% per year for the next 3 years. After that we expect sales growth to be 3% into perpetuity. The company's profit margin is 15% and the company has a return on equity of 25%. The cost of equity is 12%. Forecast: 1) Sales per Share 2) Profit (earnings per share) 3) Free cash flow to equity (per share) for the next 3 years, along with a terminal value beyond the three years. 4) Determine the intrinsic value of the stock. 5) How much of the intrinsic value comes from our estimate of future growth (PVGO)?

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Sales per Share Sales per Share Total Sales Number of Shares Outstanding Sales per Share 22000000 1300000 Sales per Share 1692 Profit Earnings per Sha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started