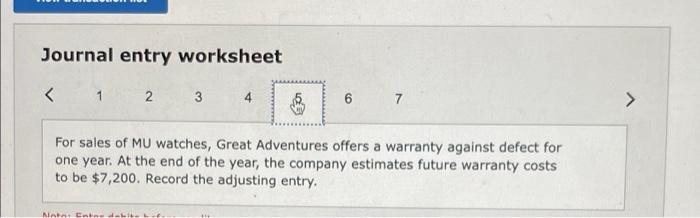

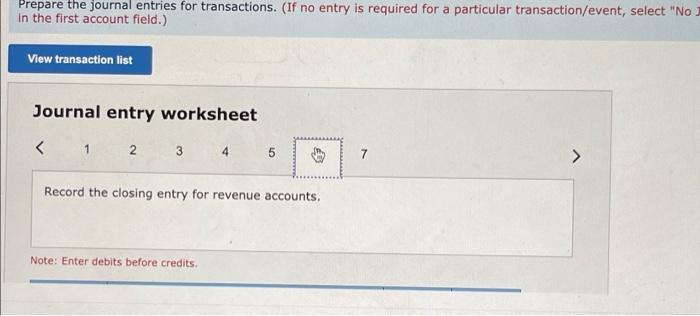

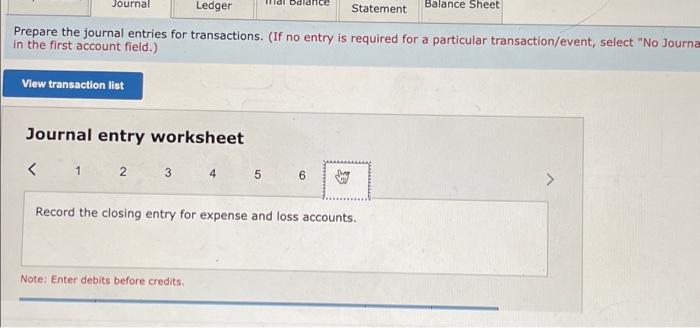

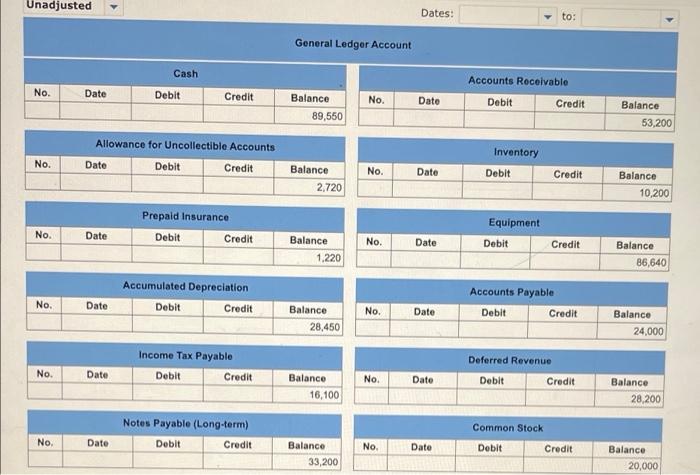

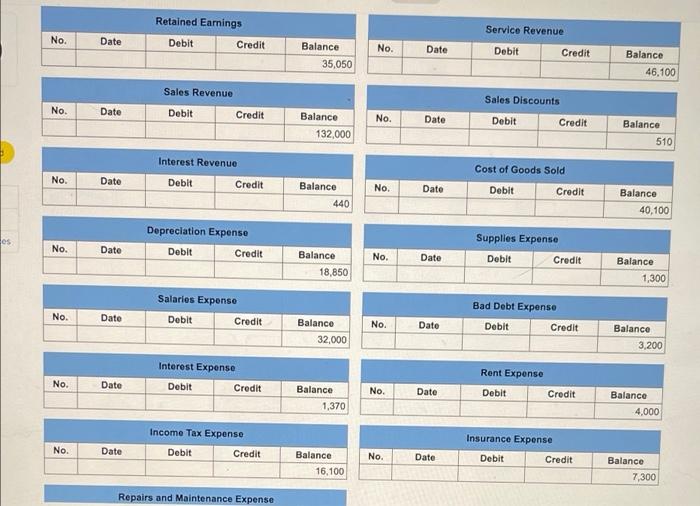

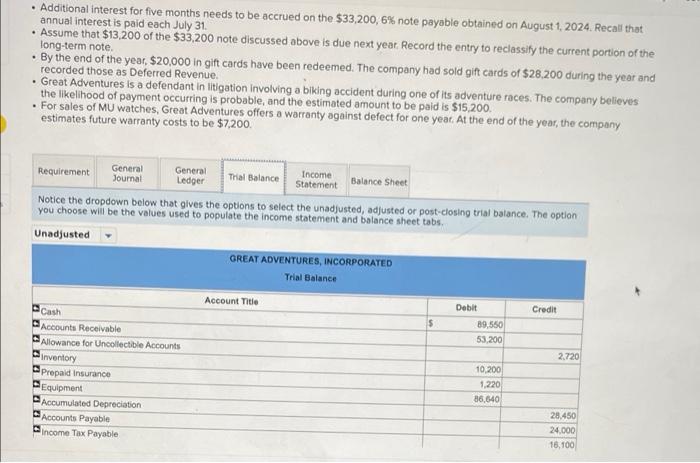

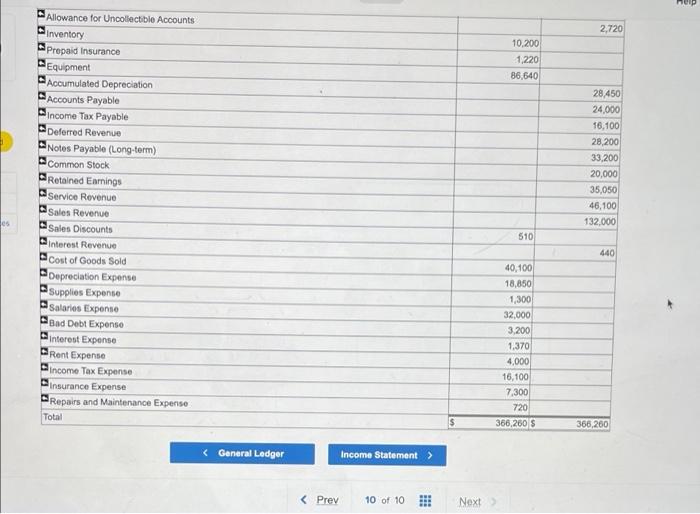

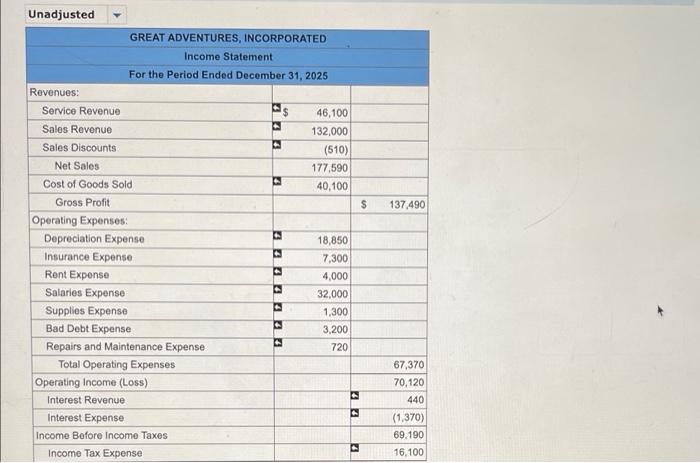

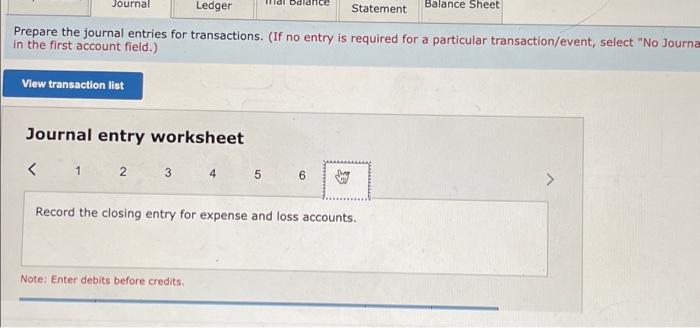

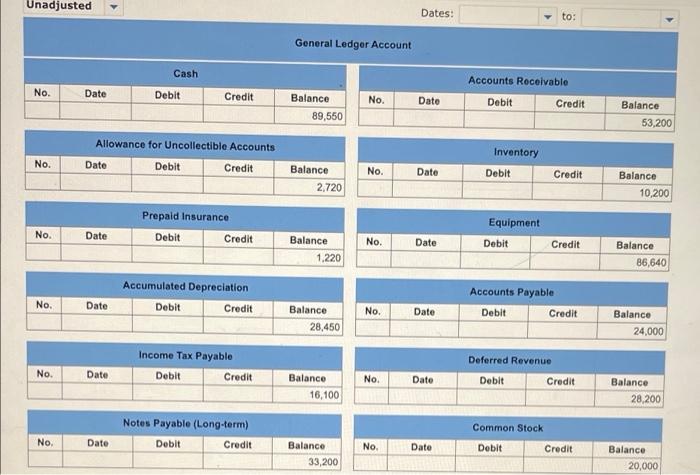

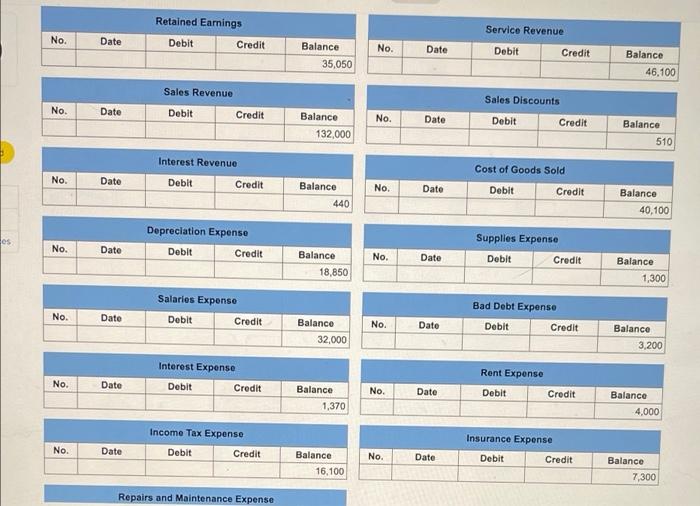

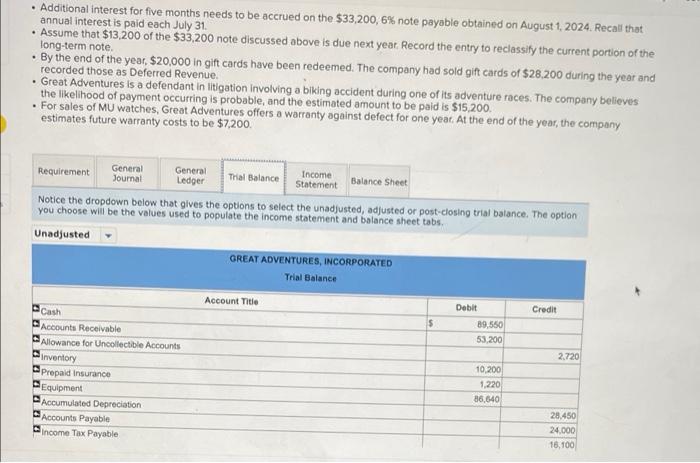

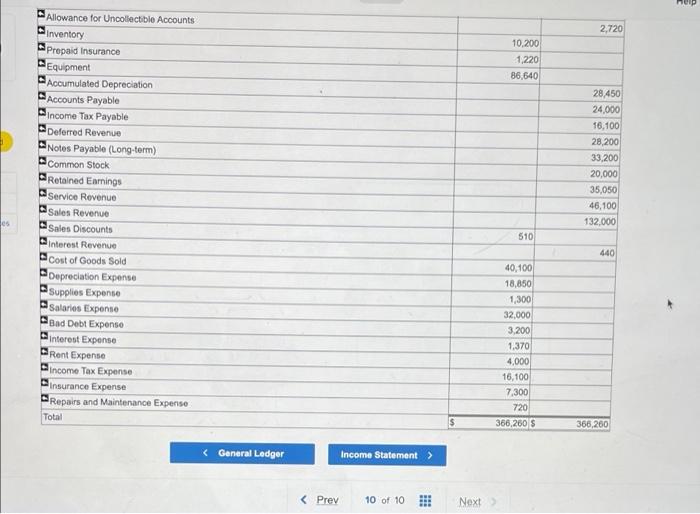

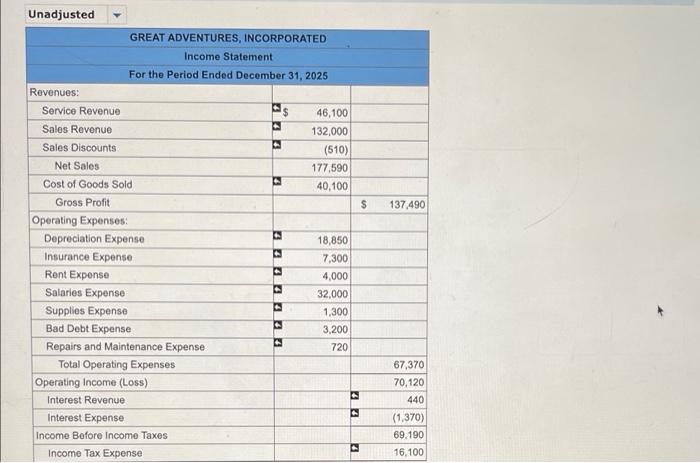

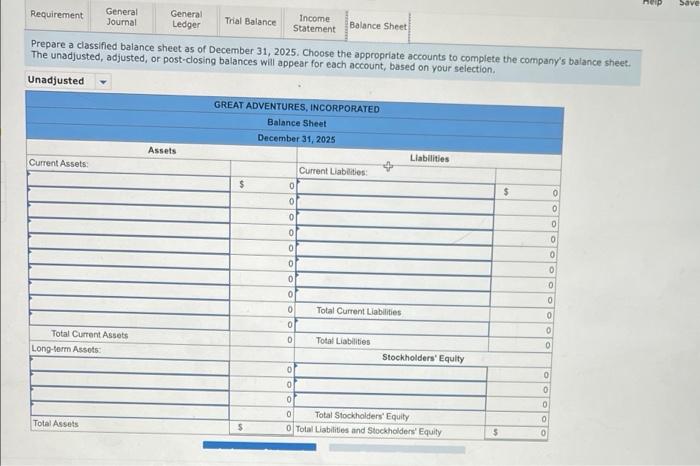

At the end of 2025 , the following information is available for Great Adventures. - Additional interest for five months needs to be accrued on the $33,200,6% note payable obtained on August 1, 2024. Recall that annual interest is paid each July 31. - Assume that $13,200 of the $33,200 note discussed above is due next year. Record the entry to reclassify the current portion of the long-term note. - By the end of the year, $20,000 in gift cards have been redeemed. The company had sold gift cards of $28,200 during the year and recorded those as Deferred Revenue. - Great Adventures is a defendant in litigation involving a biking accident during one of its adventure races. The company believes the likelihood of payment occurring is probable, and the estimated amount to be paid is $15,200. - For sales of MU watches, Great Adventures offers a warranty against defect for one year, At the end of the year, the company estimates future warranty costs to be $7,200. Prepare the journal entries for transactions. (If no entry is required for a particular transaction/event, select "No Joumal Entry Required" in the first account fleld.) Journal entry worksheet Additional interest for five months needs to be accrued on the $33,200,6% note payoble obtained on August 1,2024 . Recall that annual interest is paid each july 31 . Record the adjusting entry. Note: Eniter debits before credits. At the end of 2025 , the following information is avallable for Great Adventures. - Additional interest for five months needs to be accrued on the $33,200,6% note payable obtained on August 1, 2024. Recall that annual interest is paid each July 31. - Assume that $13,200 of the $33,200 note discussed above is due next year. Record the entry to reclassify the current portion of the long-term note. - By the end of the year, $20,000 in gift cards have been redeemed. The company had sold gift cards of $28,200 during the year and recorded those as Deferred Revenue. - Great Adventures is a defendant in litigation involving a biking accident during one of its adventure races. The company belleves the likelihood of payment occurring is probable, and the estimated amount to be paid is $15,200. - For sales of MU watches, Great Adventures offers a warranty against defect for one year. At the end of the year, the company estimates future warranty costs to be $7,200. Prepare the journal entries for transactions. (If no entry is required for a particular transaction/event, select "No Joumal Entry Required" in the first account field.) Journal entry worksheet Assume that $13,200 of the $33,200 note discussed above is due next year. Record the entry to reclassify the current portion of the long-term note. Notel Enter debits before credits worksheet