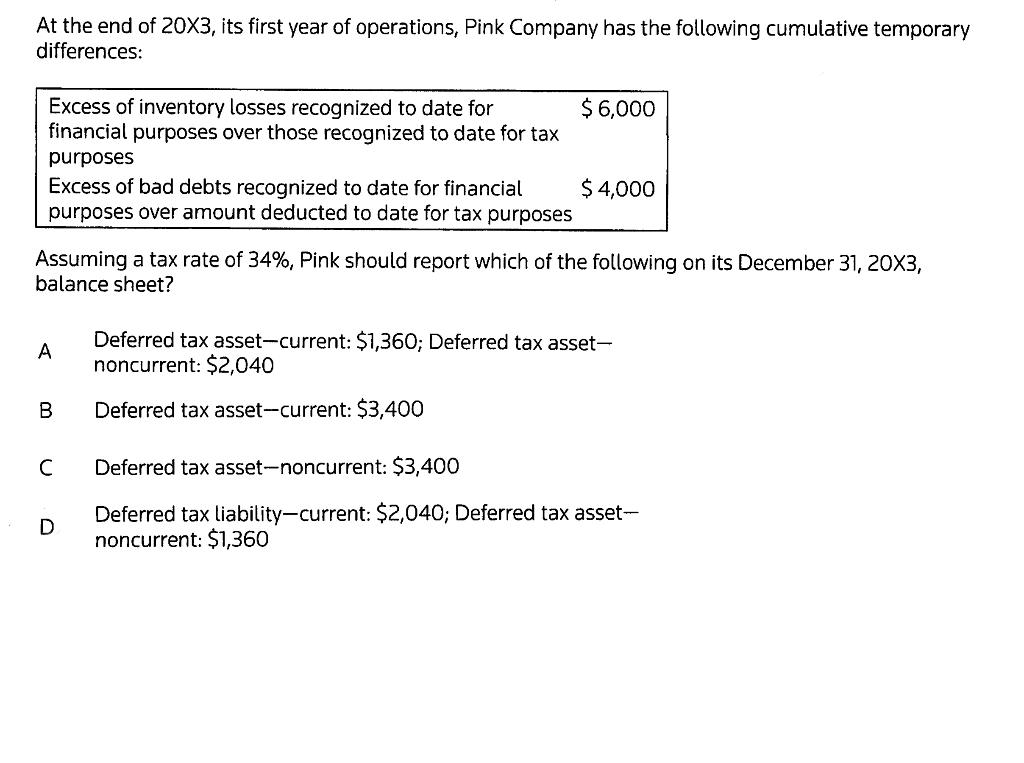

At the end of 20X3, its first year of operations, Pink Company has the following cumulative temporary differences: Excess of inventory losses recognized to

At the end of 20X3, its first year of operations, Pink Company has the following cumulative temporary differences: Excess of inventory losses recognized to date for financial purposes over those recognized to date for tax $ 6,000 purposes Excess of bad debts recognized to date for financial purposes over amount deducted to date for tax purposes $ 4,000 Assuming a tax rate of 34%, Pink should report which of the following on its December 31, 20X3, balane sheet? Deferred tax asset-current: $1,360; Deferred tax asset- noncurrent: $2,040 A Deferred tax asset-current: $3,400 Deferred tax asset-noncurrent: $3,400 Deferred tax liability-current: $2,040; Deferred tax asset- D noncurrent: $1,360 At the end of 20X3, its first year of operations, Pink Company has the following cumulative temporary differences: Excess of inventory losses recognized to date for financial purposes over those recognized to date for tax $ 6,000 purposes Excess of bad debts recognized to date for financial purposes over amount deducted to date for tax purposes $ 4,000 Assuming a tax rate of 34%, Pink should report which of the following on its December 31, 20X3, balane sheet? Deferred tax asset-current: $1,360; Deferred tax asset- noncurrent: $2,040 A Deferred tax asset-current: $3,400 Deferred tax asset-noncurrent: $3,400 Deferred tax liability-current: $2,040; Deferred tax asset- D noncurrent: $1,360

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Option C Deferred tax asset non current 3400 C...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started