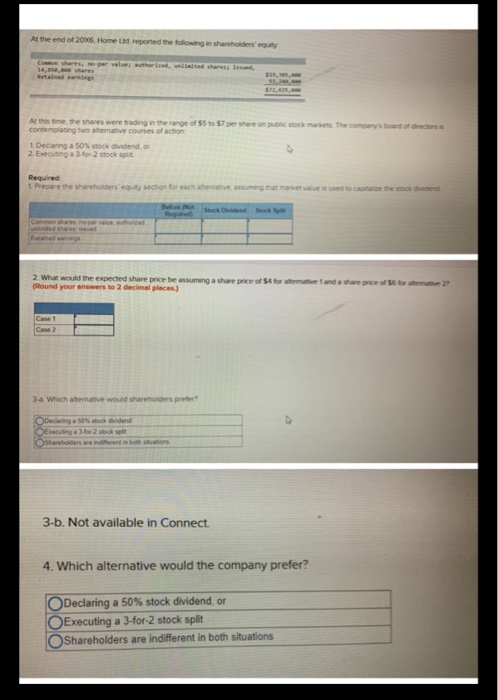

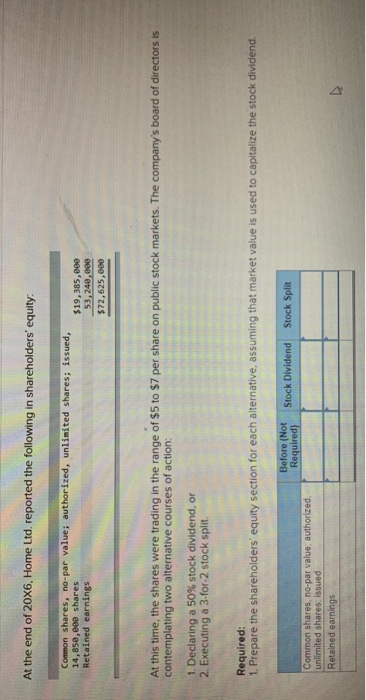

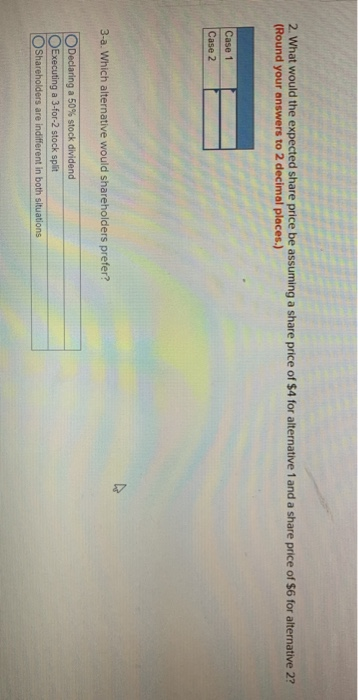

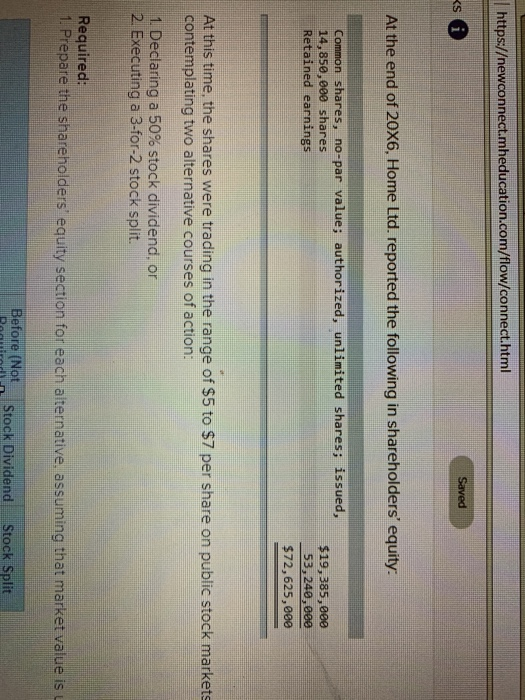

At the end of 20X6, Home dreported the following in shareholders' equity lated Shares; issued Retained in stock Theory's board s At the time the shares were trading in the range of 55 to 57 per share on contemplating two alternative courses of action t Declaring a 50 stock dividendo 2. Executing a for: 2 stock split Required: Prepare the shareholders' equity section for each antiveg eta i on one- 2. What would the expected share price be assuming a share price of $4 formative and the price of 55 (Round your answers to 2 decimal places) 2 3- Which alternative would shareholders prefer Declaring a son och vidend Exing or Shareholders are indiferent in bostons 3-b. Not available in Connect. 4. Which alternative would the company prefer? Declaring a 50% stock dividend, or O Executing a 3-for-2 stock split O Shareholders are indifferent in both situations At the end of 20X6, Home Ltd, reported the following in shareholders' equity: Common shares, no-par value; authorized, unlimited shares; issued, 14,850,000 shares Retained earnings $19,385,000 53,240, eee $72,625,000 At this time, the shares were trading in the range of $5 to $7 per share on public stock markets. The company's board of directors is contemplating two alternative courses of action: 1. Declaring a 50% stock dividend, or 2. Executing a 3-for-2 stock split Required: 1. Prepare the shareholders' equity section for each alternative, assuming that market value is used to capitalize the stock dividend Before (Not Required) Stock Dividend Stock Split Common shares, no-par value authorized unlimited shares: issued Retained earnings 2. What would the expected share price be assuming a share price of $4 for alternative 1 and a share price of $6 for alternative 2? (Round your answers to 2 decimal places.) Case 1 Case 2 3-a. Which alternative would shareholders prefer? Declaring a 50% stock dividend Executing a 3-for-2 stock split Shareholders are indifferent in both situations 3-a. Which alternative would shareholders prefer? Declaring a 50% stock dividend OExecuting a 3-for-2 stock split Shareholders are indifferent in both situations 3-b. Not available in Connect 4. Which alternative would the company prefer? Declaring a 50% stock dividend, or Executing a 3-for-2 stock split Shareholders are indifferent in both situations https:/ewconnect.mheducation.com/flow/connect.html ks Saved At the end of 20X6, Home Ltd. reported the following in shareholders' equity: Common shares, no-par value; authorized, unlimited shares; issued, 14,850,000 shares Retained earnings $19,385,000 53,240,000 $72,625,000 At this time, the shares were trading in the range of $5 to $7 per share on public stock markets contemplating two alternative courses of actioni 1. Declaring a 50% stock dividend, or 2. Executing a 3-for-2 stock split. Required: 1. Prepare the shareholders' equity section for each alternative, assuming that market value is Before (Not Stock Dividend Stock sp At the end of 20X6, Home dreported the following in shareholders' equity lated Shares; issued Retained in stock Theory's board s At the time the shares were trading in the range of 55 to 57 per share on contemplating two alternative courses of action t Declaring a 50 stock dividendo 2. Executing a for: 2 stock split Required: Prepare the shareholders' equity section for each antiveg eta i on one- 2. What would the expected share price be assuming a share price of $4 formative and the price of 55 (Round your answers to 2 decimal places) 2 3- Which alternative would shareholders prefer Declaring a son och vidend Exing or Shareholders are indiferent in bostons 3-b. Not available in Connect. 4. Which alternative would the company prefer? Declaring a 50% stock dividend, or O Executing a 3-for-2 stock split O Shareholders are indifferent in both situations At the end of 20X6, Home Ltd, reported the following in shareholders' equity: Common shares, no-par value; authorized, unlimited shares; issued, 14,850,000 shares Retained earnings $19,385,000 53,240, eee $72,625,000 At this time, the shares were trading in the range of $5 to $7 per share on public stock markets. The company's board of directors is contemplating two alternative courses of action: 1. Declaring a 50% stock dividend, or 2. Executing a 3-for-2 stock split Required: 1. Prepare the shareholders' equity section for each alternative, assuming that market value is used to capitalize the stock dividend Before (Not Required) Stock Dividend Stock Split Common shares, no-par value authorized unlimited shares: issued Retained earnings 2. What would the expected share price be assuming a share price of $4 for alternative 1 and a share price of $6 for alternative 2? (Round your answers to 2 decimal places.) Case 1 Case 2 3-a. Which alternative would shareholders prefer? Declaring a 50% stock dividend Executing a 3-for-2 stock split Shareholders are indifferent in both situations 3-a. Which alternative would shareholders prefer? Declaring a 50% stock dividend OExecuting a 3-for-2 stock split Shareholders are indifferent in both situations 3-b. Not available in Connect 4. Which alternative would the company prefer? Declaring a 50% stock dividend, or Executing a 3-for-2 stock split Shareholders are indifferent in both situations https:/ewconnect.mheducation.com/flow/connect.html ks Saved At the end of 20X6, Home Ltd. reported the following in shareholders' equity: Common shares, no-par value; authorized, unlimited shares; issued, 14,850,000 shares Retained earnings $19,385,000 53,240,000 $72,625,000 At this time, the shares were trading in the range of $5 to $7 per share on public stock markets contemplating two alternative courses of actioni 1. Declaring a 50% stock dividend, or 2. Executing a 3-for-2 stock split. Required: 1. Prepare the shareholders' equity section for each alternative, assuming that market value is Before (Not Stock Dividend Stock sp