Answered step by step

Verified Expert Solution

Question

1 Approved Answer

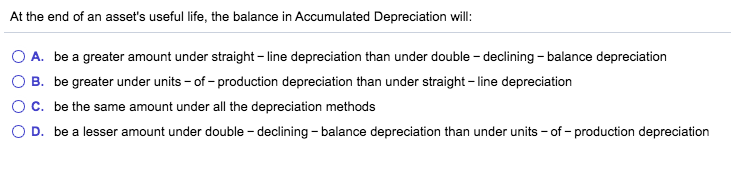

At the end of an asset's useful life, the balance in Accumulated Depreciation will: A. be a greater amount under straight - line depreciation than

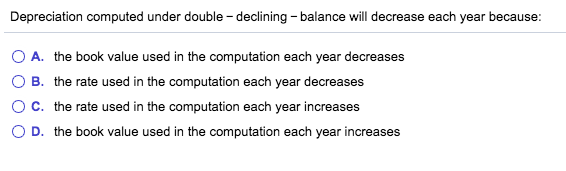

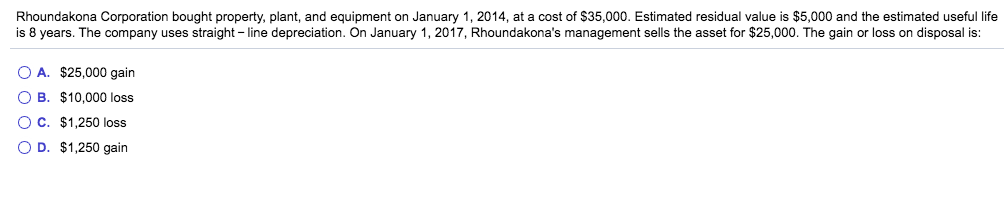

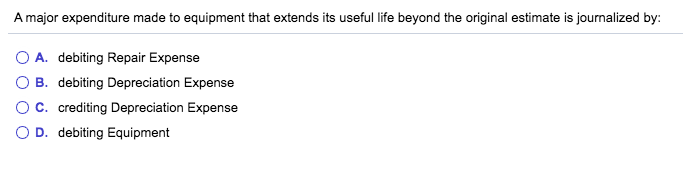

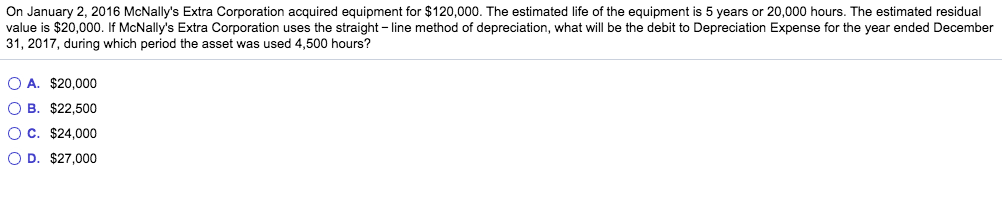

At the end of an asset's useful life, the balance in Accumulated Depreciation will: A. be a greater amount under straight - line depreciation than under double declining -balance depreciation B. be greater under units - of - production depreciation than under straight - line depreciation C. be the same amount under all the depreciation methods D. be a lesser amount under double -declining -balance depreciation than under units of - production depreciation Depreciation computed under double - declining balance will decrease each year because: A. the book value used in the computation each year decreases B. the rate used in the computation each year decreases C. the rate used in the computation each year increases D. the book value used in the computation each year increases Rhoundakona Corporation bought property, plant, and equipment on January 1, 2014, at a cost of $35,000. Estimated residual value is $5,000 and the estimated useful life is 8 years. The company uses straight - line depreciation. On January 1, 2017, Rhoundakona's management sells the asset for $25,000. The gain or loss on disposal is: O A. $25,000 gain O B. $10,000 loss O c. $1,250 loss O D. $1,250 gain A major expenditure made to equipment that extends its useful life beyond the original estimate is journalized by A. debiting Repair Expense B. debiting Depreciation Expense C. crediting Depreciation Expense D. debiting Equipment On January 2, 2016 McNally's Extra Corporation acquired equipment for $120,000. The estimated life of the equipment is 5 years or 20,000 hours. The estimated residual value is $20,000. If McNally's Extra Corporation uses the straight - line method of depreciation, what will be the debit to Depreciation Expense for the year ended December 31, 2017, during which period the asset was used 4,500 hours? O A. $20,000 O B. $22,500 O C. $24,000 O D. $27,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started