Question

At the end of each year, you plan to deposit $2,500 in a savings account. The account will earn 7% annual interest, which will be

At the end of each year, you plan to deposit $2,500 in a savings account. The account will earn 7% annual interest, which will be added to the fund balance at year-end. The first deposit will be made at the end of Year 1. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided.)

Required:

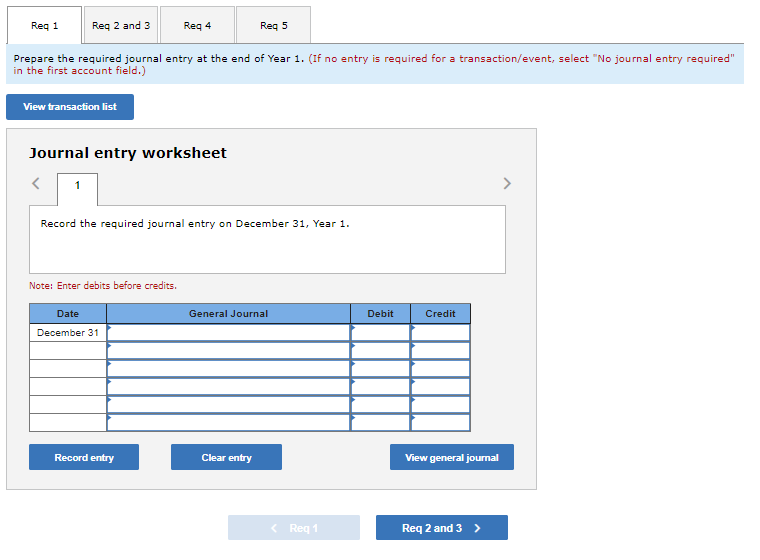

1. Assume you follow GAAP. Prepare the required journal entry at the end of Year 1.

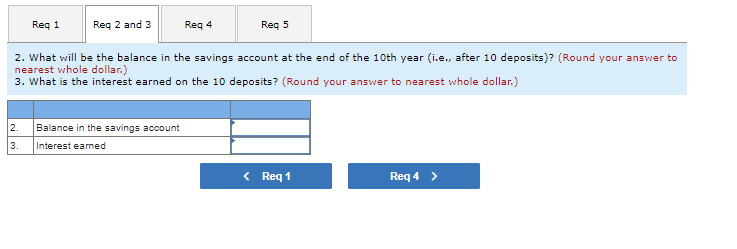

2. What will be the balance in the savings account at the end of the 10th year (i.e., after 10 deposits)?

3. What is the interest earned on the 10 deposits?

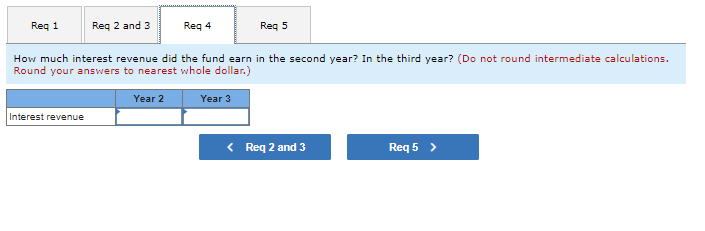

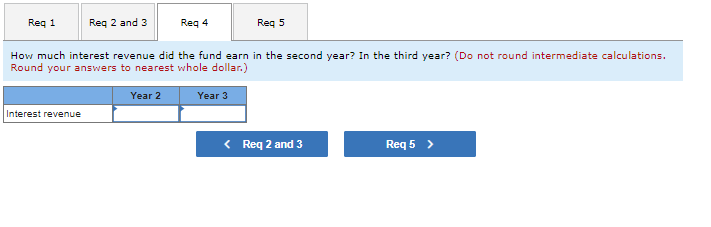

4. How much interest revenue did the fund earn in the second year? In the third year?

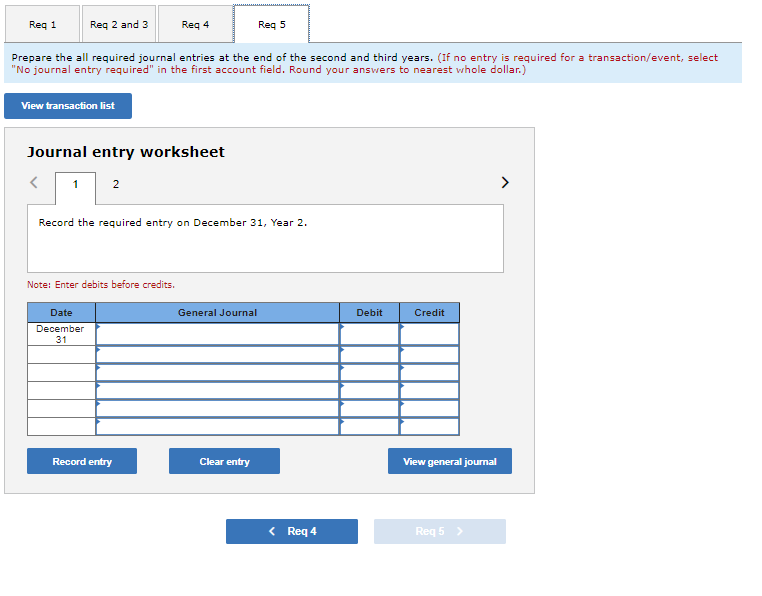

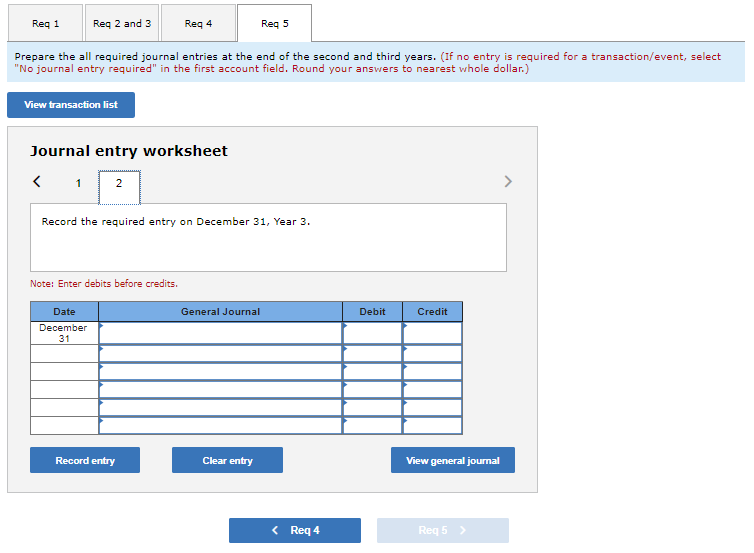

5. Assume you follow GAAP. Prepare the all required journal entries at the end of the second and third years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started