Answered step by step

Verified Expert Solution

Question

1 Approved Answer

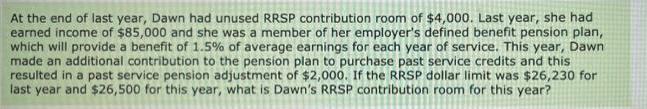

At the end of last year, Dawn had unused RRSP contribution room of $4,000. Last year, she had earned income of $85,000 and she

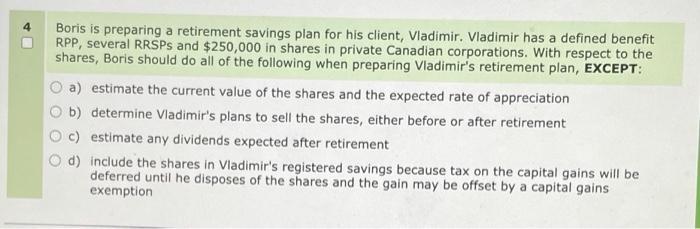

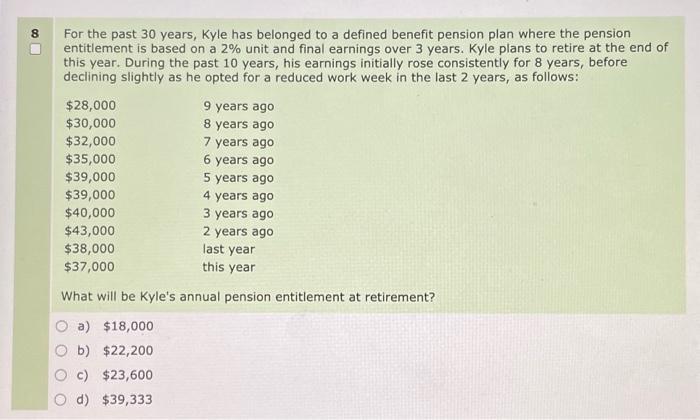

At the end of last year, Dawn had unused RRSP contribution room of $4,000. Last year, she had earned income of $85,000 and she was a member of her employer's defined benefit pension plan, which will provide a benefit of 1.5% of average earnings for each year of service. This year, Dawn made an additional contribution to the pension plan to purchase past service credits and this resulted in a past service pension adjustment of $2,000. If the RRSP dollar limit was $26,230 for last year and $26,500 for this year, what is Dawn's RRSP contribution room for this year? Boris is preparing a retirement savings plan for his client, Vladimir. Vladimir has a defined benefit RPP, several RRSPs and $250,000 in shares in private Canadian corporations. With respect to the shares, Boris should do all of the following when preparing Vladimir's retirement plan, EXCEPT: a) estimate the current value of the shares and the expected rate of appreciation b) determine Vladimir's plans to sell the shares, either before or after retirement c) estimate any dividends expected after retirement d) include the shares in Vladimir's registered savings because tax on the capital gains will be deferred until he disposes of the shares and the gain may be offset by a capital gains exemption 8 For the past 30 years, Kyle has belonged to a defined benefit pension plan where the pension entitlement is based on a 2% unit and final earnings over 3 years. Kyle plans to retire at the end of this year. During the past 10 years, his earnings initially rose consistently for 8 years, before declining slightly as he opted for a reduced work week in the last 2 years, as follows: $28,000 $30,000 $32,000 $35,000 $39,000 $39,000 $40,000 43,000 $38,000 $37,000 9 years ago 8 years ago 7 years ago 6 years ago 5 years ago 4 years ago 3 years ago 2 years ago last year this year What will be Kyle's annual pension entitlement at retirement? a) $18,000 b) $22,200 c) $23,600 d) $39,333

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION 3 To calculate Dawns RRSP contribution room for this year we need to consider her earned income pension adjustments and the RRSP dollar limits for both years First lets calculate Dawns pensio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started