Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the end of March, 2020, our retained earning was $3,150, with capital of $5,000. The cost of our opening stock was $950 with a

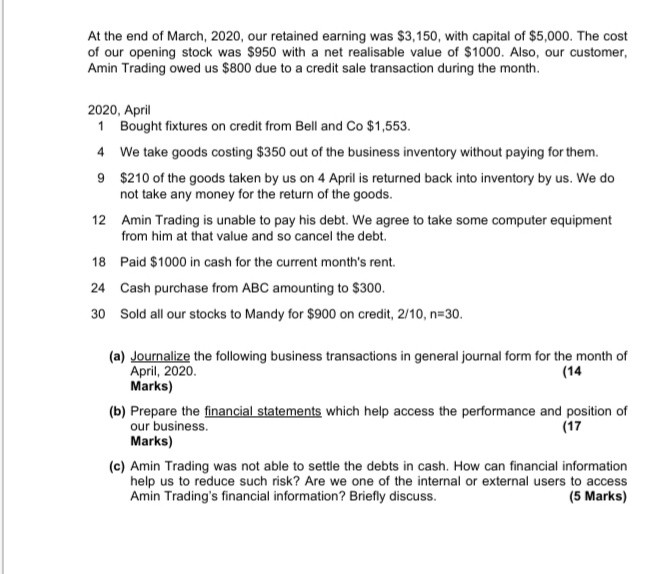

At the end of March, 2020, our retained earning was $3,150, with capital of $5,000. The cost of our opening stock was $950 with a net realisable value of $1000. Also, our customer, Amin Trading owed us $800 due to a credit sale transaction during the month. 2020, April 1 Bought fixtures on credit from Bell and Co $1,553. 4 We take goods costing $350 out of the business inventory without paying for them. 9 $210 of the goods taken by us on 4 April is returned back into inventory by us. We do not take any money for the return of the goods. 12 Amin Trading is unable to pay his debt. We agree to take some computer equipment from him at that value and so cancel the debt. 18 Paid $1000 in cash for the current month's rent. 24 Cash purchase from ABC amounting to $300. 30 Sold all our stocks to Mandy for $900 on credit, 2/10, n=30. (a) Journalize the following business transactions in general journal form for the month of April, 2020 (14 Marks) (b) Prepare the financial statements which help access the performance and position of our business. (17 Marks) (c) Amin Trading was not able to settle the debts in cash. How can financial information help us to reduce such risk? Are we one of the internal or external users to access Amin Trading's financial information? Briefly discuss. (5 Marks) At the end of March, 2020, our retained earning was $3,150, with capital of $5,000. The cost of our opening stock was $950 with a net realisable value of $1000. Also, our customer, Amin Trading owed us $800 due to a credit sale transaction during the month. 2020, April 1 Bought fixtures on credit from Bell and Co $1,553. 4 We take goods costing $350 out of the business inventory without paying for them. 9 $210 of the goods taken by us on 4 April is returned back into inventory by us. We do not take any money for the return of the goods. 12 Amin Trading is unable to pay his debt. We agree to take some computer equipment from him at that value and so cancel the debt. 18 Paid $1000 in cash for the current month's rent. 24 Cash purchase from ABC amounting to $300. 30 Sold all our stocks to Mandy for $900 on credit, 2/10, n=30. (a) Journalize the following business transactions in general journal form for the month of April, 2020 (14 Marks) (b) Prepare the financial statements which help access the performance and position of our business. (17 Marks) (c) Amin Trading was not able to settle the debts in cash. How can financial information help us to reduce such risk? Are we one of the internal or external users to access Amin Trading's financial information? Briefly discuss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started