Answered step by step

Verified Expert Solution

Question

1 Approved Answer

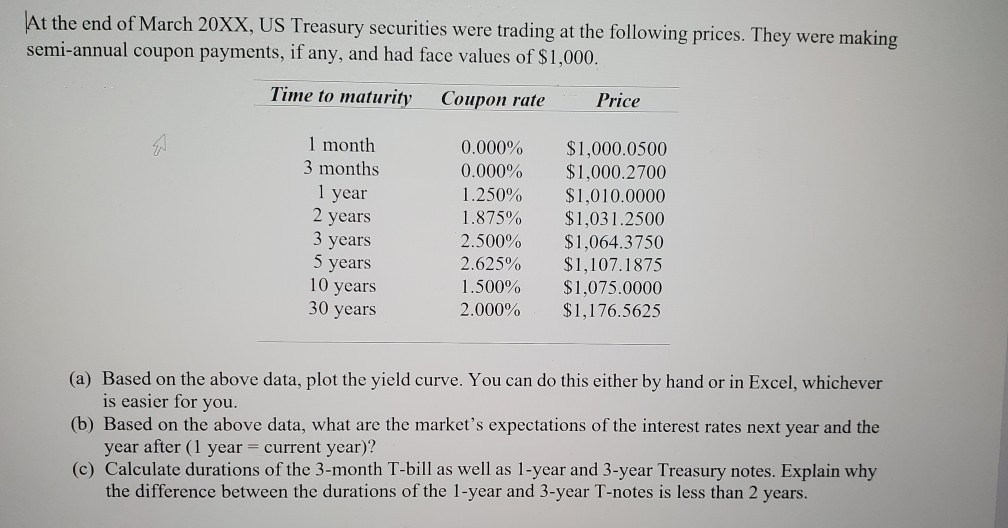

At the end of March 20XX, US Treasury securities were trading at the following prices. They were making semi-annual coupon payments, if any, and had

At the end of March 20XX, US Treasury securities were trading at the following prices. They were making semi-annual coupon payments, if any, and had face values of $1,000. Time to maturity Coupon rate Price 1 month 3 months 1 year 2 years 3 years 5 years 10 years 30 years 0.000% 0.000% 1.250% 1.875% 2.500% 2.625% 1.500% 2.000% $1,000.0500 $1,000.2700 $1,010.0000 $1,031.2500 $1,064.3750 $1,107.1875 $1,075.0000 $1,176.5625 (a) Based on the above data, plot the yield curve. You can do this either by hand or in Excel, whichever is easier for you. (b) Based on the above data, what are the market's expectations of the interest rates next year and the year after (1 year = current year)? (c) Calculate durations of the 3-month T-bill as well as 1-year and 3-year Treasury notes. Explain why the difference between the durations of the 1-year and 3-year T-notes is less than 2 years. At the end of March 20XX, US Treasury securities were trading at the following prices. They were making semi-annual coupon payments, if any, and had face values of $1,000. Time to maturity Coupon rate Price 1 month 3 months 1 year 2 years 3 years 5 years 10 years 30 years 0.000% 0.000% 1.250% 1.875% 2.500% 2.625% 1.500% 2.000% $1,000.0500 $1,000.2700 $1,010.0000 $1,031.2500 $1,064.3750 $1,107.1875 $1,075.0000 $1,176.5625 (a) Based on the above data, plot the yield curve. You can do this either by hand or in Excel, whichever is easier for you. (b) Based on the above data, what are the market's expectations of the interest rates next year and the year after (1 year = current year)? (c) Calculate durations of the 3-month T-bill as well as 1-year and 3-year Treasury notes. Explain why the difference between the durations of the 1-year and 3-year T-notes is less than 2 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started