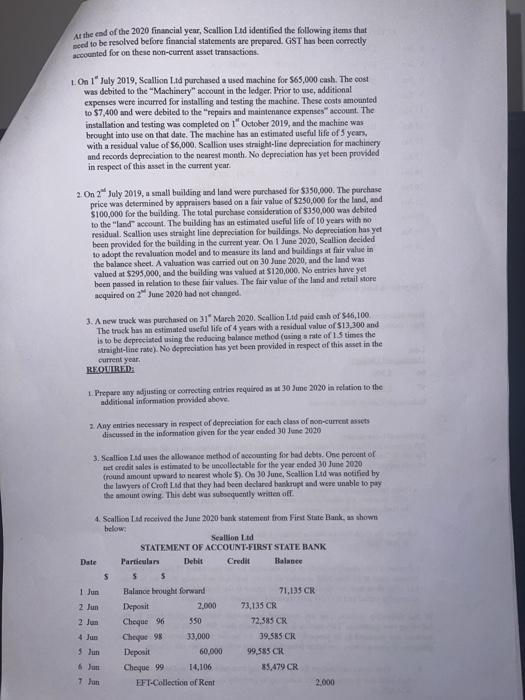

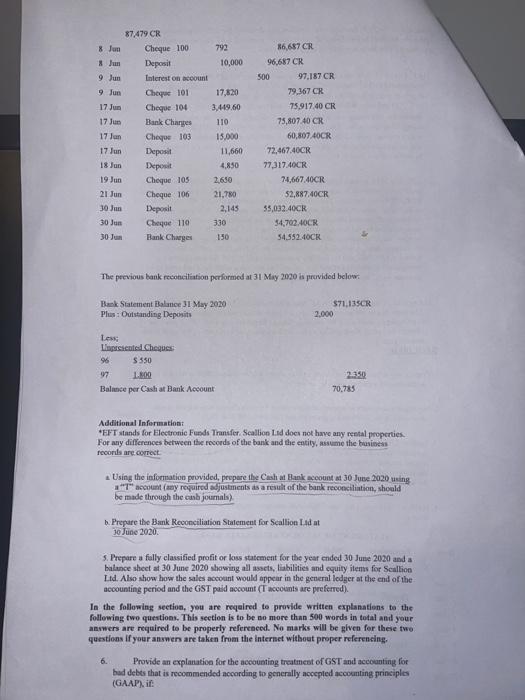

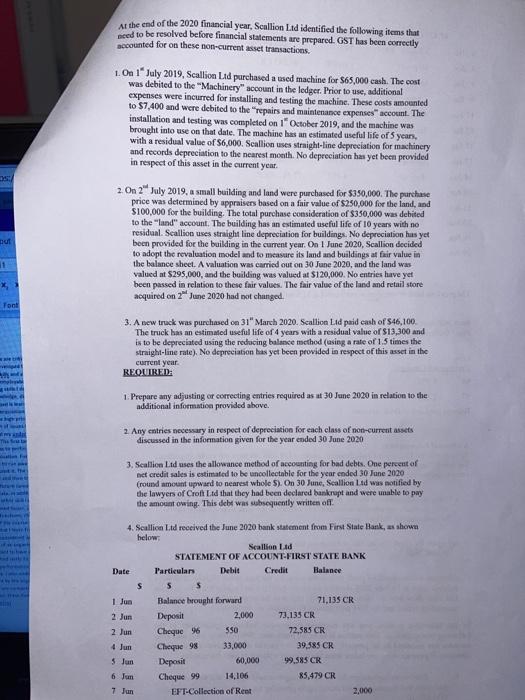

At the end of the 2020 financial year, Scullion Iad identified the following items that need to be resolved before financial statements are prepared. GST has been correctly accounted for on these non-current asset transactions L.On 1 July 2019, Scallion Lid purchased a used machine for $65,000 cash. The cost was debited to the "Machinery account in the ledger. Prior to use, additional expenses were incurred for installing and testing the machine. These costs amounted to $7,400 and were debited to the repairs and maintenance expenses" account. The installation and testing was completed on 19 October 2019, and the machine was brought into use on that date. The machine has an estimated useful life of 5 years, with a residual value of $6,000. Scallion uses straight-line depreciation for machinery and records depreciation to the nearest month. No depreciation has yet been provided in respect of this asset in the current year. 2. On 2 July 2019, a small building and land were purchased for $350,000. The purchase price was determined by appraisers based on a fair value of $250,000 for the land, and $100,000 for the building. The total purchase consideration of $350,000 was debited to the land account. The building has an estimated useful life of 10 years with to residual. Scallion uses straight line depreciation for buildings. No depreciation has yet been provided for the building in the current year. On 1 June 2020, Scallion decided to adopt the revaluation model and to measure its land and buildings at finir value in the balance sheet. A valuation was carried out on 30 June 2020, and the land was valued at $295,000, and the building was valued at $120,000. No entries have yet been passed in relation to these finir values. The fair value of the land and retail store acquired on 2 June 2020 had not changed 3. A new truck was purchased on 31 March 2020. Scallion Lad paid cash of $46,100 The track has an estimated useful life of 4 years with a residual value of $13.300 and is to be depreciated using the reducing balance method (using a rate of 15 times the straight-line rate). No depreciation has yet been provided in respect of this asset in the current year REQUIRED 1. Prepare any adjusting or correcting entries required as at 30 June 2020 in relation to the additional information provided above 2. Any entries necessary in respect of depreciation for each class of non-current Assets discussed in the information given for the year ended 30 June 2020 3. Scallio Lad mes the allowance method of accounting for had debts. One percent of et credit sales is estimated to be uncollectable for the year ended 30 June 2020 (round amount upward to nearest whole 5). On 30 June, Salli Lid was notified by the lawyers of Croft Led that they had been declared bankrupt and were unable to pay the amount owing. This debt was subsequently written oft 4. Scallion received the June 2020 bank statement from First State Bank, as shown below: Seallion Ltd STATEMENT OF ACCOUNT-FIRST STATE BANK Date Particular Debit Credit Balance $ 5 5 1 Jun Balance brought forward 71.135 CR 2 Jun Deposit 2,000 73,135 CR 2 Jun Cheque 96 550 72,585 CR 33,000 39,585 CR 3 Jun Deposit 60.000 99,585 CR 6 Juni Cheque 99 14,106 85.479 CR 7 Jun EFT-Collection of Rent 2,000 Cheque 98 87.479 CR 8 Jun Cheque 100 792 X Jun Deposit 10,000 9 Jun Interest on account 9 Jun Cheque 101 17,820 17 Jun Cheque 104 3,449.60 17 Jun Bank Charges 110 17 Jun Cheque 103 15.000 17 Jun Deposit 11,660 18 Jun Deposit 4,850 19 Jun Cheque 105 2.630 21 Jun Cheque 106 21.780 30 Jun Deposit 2.145 30 Jun Cheque 110 330 30 J Bank Charges 150 86,687 CR 96,687 CR 500 97,187 CR 79.367 CR 75.917.40 CR 75,807 40 CR 60,807.40CR 72,467.40CR 77,317.40CR 74,667.40CR 52,887,40CR 55,032.40CR 54,702 AOCR 54.552.4OCK The previous bank reconciliation performed at 31 May 2020 la provided below. Bank Statement Balance 31 May 2020 Plus: Outstanding Deposit $71.135CR 2.000 Los LingestedCheques 96 $550 97 L.10 Balance per Cash at Bank Account 2350 70.785 Additional Information "EFT stands for Electronic Funds Transfer Scallion Lind does not have any rental properties For any differences between the records of the bank and the entity, assume the business records are correct Using the information provided, peepare the Cash at Bank account at 30 June 2020 using am account (ay required adjustments as a result of the bank reconciliation should be made through the usb journals) b. Prepare the Bank Reconciliation Statement for Scallion Iad at 30 June 2020 5. Prepare a fully classified profit or loss statement for the year ended 30 June 2020 and a bulance sheet at 30 June 2020 showing all assets, liabilities and equity items for Scallion Itd. Also show how the sales account would appear in the general ledger at the end of the accounting period and the GST paid account (Taccounts are preferred). In the following section, you are required to provide written explanations to the following two questions. This section to be no more than 500 words in total and your answers are required to be properly referenced. No marks will be given for these two questions if your answers are taken from the Internet without proper referencing, 6. Provide an explanation for the accounting treatment of GST and accounting for had debts that is recommended according to generally accepted accounting principles (GAAP) if: You were required to write off the balance of a customer's account 1) You had to estimate bad debts expense using the allowance method for the year end accounts 7. Explain the income taxation implications for Scallion Lid for the year ended 30 June 2020. At the end of the 2020 financial year, Scullion Lid identified the following items that need to be resolved before financial statements are prepared. GST has been correctly accounted for on these non-current asset transactions 1. On 1 July 2019, Scallion Lad purchased a used machine for $65,000 cash. The cost was debited to the "Machinery account in the ledger. Prior to use, additional expenses were incurred for installing and testing the machine. These costs amounted to $7,400 and were debited to the repairs and maintenance expenses account. The installation and testing was completed on 19 October 2019, and the machine was brought into use on that date. The machine has an estimated useful life of years, with a residual value of $6,000. Scallion uses straight-line depreciation for machinery and records depreciation to the nearest month. No depreciation has yet been provided in respect of this asset in the current year. but 2 2. On 2 July 2019, a small building and land were purchased for $350,000. The purchase price was determined by appraisers based on a fair value of $250,000 for the land, and $100,000 for the building. The total purchase consideration of $350,000 was debited to the "land" account. The building has an estimated useful life of 10 years with no residan. Scallion uses straight line depreciation for buildings. No depreciation has yet been provided for the building in the current year. On I June 2020, Scallion decided to adopt the revaluation model and to measure its land and buildings at fair value in the balance sheet. A valuation was carried out on 30 June 2020, and the land was valued at $295,000, and the building was valued at $120,000. No entries have yet been passed in relation to these fair values. The fair value of the land and retail store acquired on 2 June 2020 had not changed 11 Tont 3. A new truck was purchased on 31" March 2020. Scallion Lid paid cash of $46,100 The truck has an estimated useful life of 4 years with a residual value of $13,300 and is to be depreciated using the reducing balance method (using a rate of 1.5 times the straight-line rate). No depreciation has yet been provided in respect of this asset in the current year REQUIRED: 1. Prepare any adjusting or correcting entries required as at 30 June 2020 in relation to the additional information provided above. 2. Any entries necessary in respect of depreciation for each class of non-current assets discussed in the information given for the year ended 30 June 2020 3. Scallion Ltd uses the allowance method of accounting for bad debts. One percent of net credit sales is estimated to be uncollectable for the year ended 30 June 2020 (round amount upward to nearest whole 5). On 30 June, Scallion Lad was notified by the lawyers of Croft Led that they had been declared bankrupt and were able to pay the amount owing. This debt was subsequently written of 4. Scullion Ltd received the June 2020 bank statement from First State Bank, as shown helow Scallion 10 STATEMENT OF ACCOUNT-FIRST STATE BANK Date Particular Debit Credit Halance s s 5 1 Jun Balance brought forward 71,135 CR 2 Jun Deposit 2,000 73.135 CR 2 Jun Cheque 46 550 72,585 CR 4 Jun Cheque 98 33,000 39,585 CR Deposit 60,000 99.585 CR 6 Jun Cheque 99 14,106 85,479 CR EFT-Collection of Rent 2,000 5 Jun 7 Jun At the end of the 2020 financial year, Scullion Iad identified the following items that need to be resolved before financial statements are prepared. GST has been correctly accounted for on these non-current asset transactions L.On 1 July 2019, Scallion Lid purchased a used machine for $65,000 cash. The cost was debited to the "Machinery account in the ledger. Prior to use, additional expenses were incurred for installing and testing the machine. These costs amounted to $7,400 and were debited to the repairs and maintenance expenses" account. The installation and testing was completed on 19 October 2019, and the machine was brought into use on that date. The machine has an estimated useful life of 5 years, with a residual value of $6,000. Scallion uses straight-line depreciation for machinery and records depreciation to the nearest month. No depreciation has yet been provided in respect of this asset in the current year. 2. On 2 July 2019, a small building and land were purchased for $350,000. The purchase price was determined by appraisers based on a fair value of $250,000 for the land, and $100,000 for the building. The total purchase consideration of $350,000 was debited to the land account. The building has an estimated useful life of 10 years with to residual. Scallion uses straight line depreciation for buildings. No depreciation has yet been provided for the building in the current year. On 1 June 2020, Scallion decided to adopt the revaluation model and to measure its land and buildings at finir value in the balance sheet. A valuation was carried out on 30 June 2020, and the land was valued at $295,000, and the building was valued at $120,000. No entries have yet been passed in relation to these finir values. The fair value of the land and retail store acquired on 2 June 2020 had not changed 3. A new truck was purchased on 31 March 2020. Scallion Lad paid cash of $46,100 The track has an estimated useful life of 4 years with a residual value of $13.300 and is to be depreciated using the reducing balance method (using a rate of 15 times the straight-line rate). No depreciation has yet been provided in respect of this asset in the current year REQUIRED 1. Prepare any adjusting or correcting entries required as at 30 June 2020 in relation to the additional information provided above 2. Any entries necessary in respect of depreciation for each class of non-current Assets discussed in the information given for the year ended 30 June 2020 3. Scallio Lad mes the allowance method of accounting for had debts. One percent of et credit sales is estimated to be uncollectable for the year ended 30 June 2020 (round amount upward to nearest whole 5). On 30 June, Salli Lid was notified by the lawyers of Croft Led that they had been declared bankrupt and were unable to pay the amount owing. This debt was subsequently written oft 4. Scallion received the June 2020 bank statement from First State Bank, as shown below: Seallion Ltd STATEMENT OF ACCOUNT-FIRST STATE BANK Date Particular Debit Credit Balance $ 5 5 1 Jun Balance brought forward 71.135 CR 2 Jun Deposit 2,000 73,135 CR 2 Jun Cheque 96 550 72,585 CR 33,000 39,585 CR 3 Jun Deposit 60.000 99,585 CR 6 Juni Cheque 99 14,106 85.479 CR 7 Jun EFT-Collection of Rent 2,000 Cheque 98 87.479 CR 8 Jun Cheque 100 792 X Jun Deposit 10,000 9 Jun Interest on account 9 Jun Cheque 101 17,820 17 Jun Cheque 104 3,449.60 17 Jun Bank Charges 110 17 Jun Cheque 103 15.000 17 Jun Deposit 11,660 18 Jun Deposit 4,850 19 Jun Cheque 105 2.630 21 Jun Cheque 106 21.780 30 Jun Deposit 2.145 30 Jun Cheque 110 330 30 J Bank Charges 150 86,687 CR 96,687 CR 500 97,187 CR 79.367 CR 75.917.40 CR 75,807 40 CR 60,807.40CR 72,467.40CR 77,317.40CR 74,667.40CR 52,887,40CR 55,032.40CR 54,702 AOCR 54.552.4OCK The previous bank reconciliation performed at 31 May 2020 la provided below. Bank Statement Balance 31 May 2020 Plus: Outstanding Deposit $71.135CR 2.000 Los LingestedCheques 96 $550 97 L.10 Balance per Cash at Bank Account 2350 70.785 Additional Information "EFT stands for Electronic Funds Transfer Scallion Lind does not have any rental properties For any differences between the records of the bank and the entity, assume the business records are correct Using the information provided, peepare the Cash at Bank account at 30 June 2020 using am account (ay required adjustments as a result of the bank reconciliation should be made through the usb journals) b. Prepare the Bank Reconciliation Statement for Scallion Iad at 30 June 2020 5. Prepare a fully classified profit or loss statement for the year ended 30 June 2020 and a bulance sheet at 30 June 2020 showing all assets, liabilities and equity items for Scallion Itd. Also show how the sales account would appear in the general ledger at the end of the accounting period and the GST paid account (Taccounts are preferred). In the following section, you are required to provide written explanations to the following two questions. This section to be no more than 500 words in total and your answers are required to be properly referenced. No marks will be given for these two questions if your answers are taken from the Internet without proper referencing, 6. Provide an explanation for the accounting treatment of GST and accounting for had debts that is recommended according to generally accepted accounting principles (GAAP) if: You were required to write off the balance of a customer's account 1) You had to estimate bad debts expense using the allowance method for the year end accounts 7. Explain the income taxation implications for Scallion Lid for the year ended 30 June 2020. At the end of the 2020 financial year, Scullion Lid identified the following items that need to be resolved before financial statements are prepared. GST has been correctly accounted for on these non-current asset transactions 1. On 1 July 2019, Scallion Lad purchased a used machine for $65,000 cash. The cost was debited to the "Machinery account in the ledger. Prior to use, additional expenses were incurred for installing and testing the machine. These costs amounted to $7,400 and were debited to the repairs and maintenance expenses account. The installation and testing was completed on 19 October 2019, and the machine was brought into use on that date. The machine has an estimated useful life of years, with a residual value of $6,000. Scallion uses straight-line depreciation for machinery and records depreciation to the nearest month. No depreciation has yet been provided in respect of this asset in the current year. but 2 2. On 2 July 2019, a small building and land were purchased for $350,000. The purchase price was determined by appraisers based on a fair value of $250,000 for the land, and $100,000 for the building. The total purchase consideration of $350,000 was debited to the "land" account. The building has an estimated useful life of 10 years with no residan. Scallion uses straight line depreciation for buildings. No depreciation has yet been provided for the building in the current year. On I June 2020, Scallion decided to adopt the revaluation model and to measure its land and buildings at fair value in the balance sheet. A valuation was carried out on 30 June 2020, and the land was valued at $295,000, and the building was valued at $120,000. No entries have yet been passed in relation to these fair values. The fair value of the land and retail store acquired on 2 June 2020 had not changed 11 Tont 3. A new truck was purchased on 31" March 2020. Scallion Lid paid cash of $46,100 The truck has an estimated useful life of 4 years with a residual value of $13,300 and is to be depreciated using the reducing balance method (using a rate of 1.5 times the straight-line rate). No depreciation has yet been provided in respect of this asset in the current year REQUIRED: 1. Prepare any adjusting or correcting entries required as at 30 June 2020 in relation to the additional information provided above. 2. Any entries necessary in respect of depreciation for each class of non-current assets discussed in the information given for the year ended 30 June 2020 3. Scallion Ltd uses the allowance method of accounting for bad debts. One percent of net credit sales is estimated to be uncollectable for the year ended 30 June 2020 (round amount upward to nearest whole 5). On 30 June, Scallion Lad was notified by the lawyers of Croft Led that they had been declared bankrupt and were able to pay the amount owing. This debt was subsequently written of 4. Scullion Ltd received the June 2020 bank statement from First State Bank, as shown helow Scallion 10 STATEMENT OF ACCOUNT-FIRST STATE BANK Date Particular Debit Credit Halance s s 5 1 Jun Balance brought forward 71,135 CR 2 Jun Deposit 2,000 73.135 CR 2 Jun Cheque 46 550 72,585 CR 4 Jun Cheque 98 33,000 39,585 CR Deposit 60,000 99.585 CR 6 Jun Cheque 99 14,106 85,479 CR EFT-Collection of Rent 2,000 5 Jun 7 Jun