Question

At the end of the current year (before adjusting entries), Gorilla Guitars had an accounts receivable balance of $76,000. The allowance for doubtful accounts has

At the end of the current year (before adjusting entries), Gorilla Guitars had an accounts receivable balance of $76,000.

The allowance for doubtful accounts has a credit balance of $11,000. Revenue (all credit sales) for the year totaled $490,000.

Consider each of the following two independent situations:

1) Using the percentage of sales method, calculate the amount of Uncollectible-Account (Bad debt) Expense if Gorilla Guitars estimates its uncollectible account expense using a rate of 2% of credit sales. What is the ending balance of the Allowance for Doubtful Accounts under this scenario? What is the net accounts receivable under this scenario?

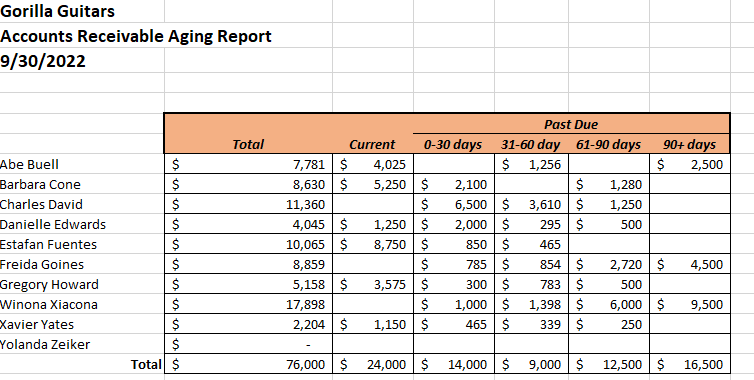

2) Now assume that Gorilla Guitars uses the aging of receivables method. Gorilla Guitars estimates current accounts have an uncollectible rate of 2%, past due 0-30 days have an uncollectible rate of 18%, past due 31-60 days have an uncollectible rate of 28%, past due 61-90 days have an uncollectible rate of 46%, and past due greater than 90 days have an uncollectible rate of 59%. Calculate the amount of Uncollectible-Account (Bad debt) Expense for Gorilla Guitars. What is the ending balance of the Allowance for Doubtful Accounts under this scenario? What is the net accounts receivable under this scenario?

Gorilla Guitars Accounts Receivable Aging Report 9/30/2022 Abe Buell Barbara Cone Charles David Danielle Edwards Estafan Fuentes Freida Goines Gregory Howard Winona Xiacona Xavier Yates Yolanda ZeikerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started