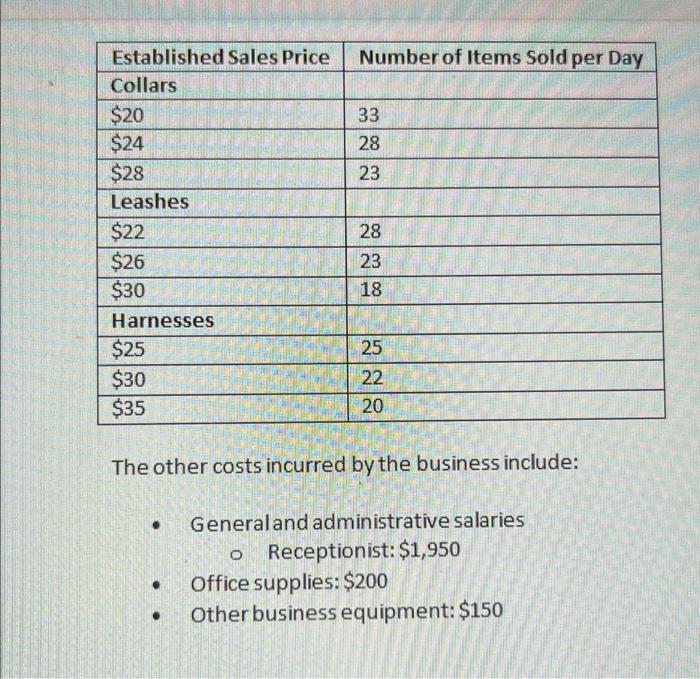

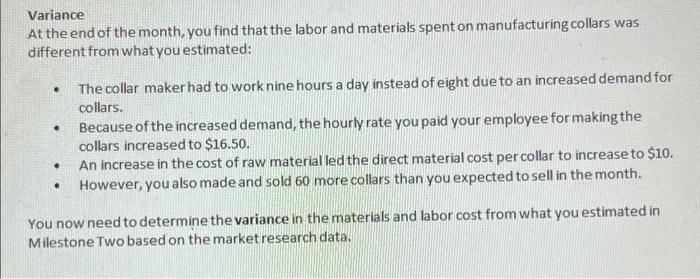

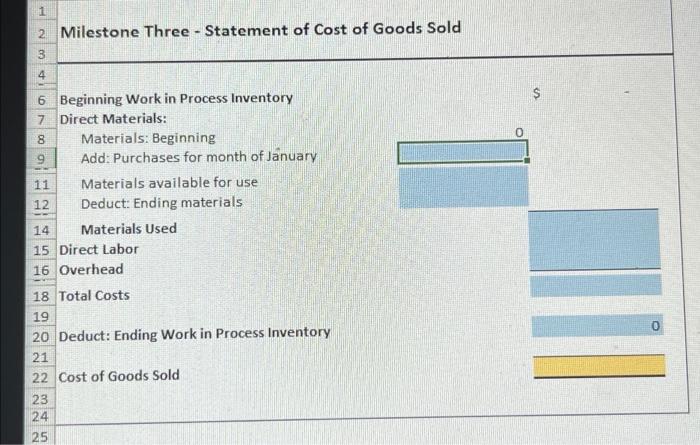

At the end of the first month ofopening your business, you calculate the actual operating costs of the business and the income you earned. You also notice and document the difference in what you budgeted for certain materials and labor against the actual amounts you spent on the same. For your statement of cost of goods sold, use the following data regarding the actual costs incurred by the business over the past month: . Materials purchased: $20,000 o Consumed 80% of the purchased materials Direct labor: $8,493 Overhead costs: $3,765 Note:Assume that the beginning materials and ending work in process are zero for the month. . . Use the following revenue and cost information for the income statement. Note that the revenue you use will depend on the pricing level options you chose in Milestone Two. Also, assume that after accounting for weekends and other holidays, there were 20 business days in the first month of operation. For example, if you chose a sales price of $20 percollar, the actual number of collars sold in the month was 33 per day or 33 x 20 = 660 per month Number of Items Sold per Day 33 28 23 Established Sales Price Collars $20 $24 $28 Leashes $22 $26 $30 Harnesses $25 $30 $35 28 23 18 25 22 20 The other costs incurred by the business include: . o Generaland administrative salaries Receptionist: $1,950 Office supplies: $200 Other business equipment: $150 . Variance At the end of the month, you find that the labor and materials spent on manufacturing collars was different from what you estimated: . . The collar maker had to work nine hours a day instead of eight due to an increased demand for collars. Because of the increased demand, the hourly rate you paid your employee for making the collars increased to $16.50. An increase in the cost of raw material led the direct material cost per collar to increase to $10. However, you also made and sold 60 more collars than you expected to sell in the month. . You now need to determine the variance in the materials and labor cost from what you estimated in Milestone Two based on the market research data. 1 2 Milestone Three - Statement of Cost of Goods Sold 3 4 $ 6 Beginning Work in Process Inventory 7 Direct Materials: 8 Materials: Beginning 9 Add: Purchases for month of January 11 Materials available for use 12 Deduct: Ending materials 14 Materials Used 15 Direct Labor 16 Overhead 18 Total Costs 19 20 Deduct: Ending Work in Process Inventory 21 22 Cost of Goods Sold 23 24 25 O NN NU