Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the end of the year, before distributions, Bombay (an S corporation) has an accumulated adjustments account balance of $15,400 and accumulated Earnings and profit

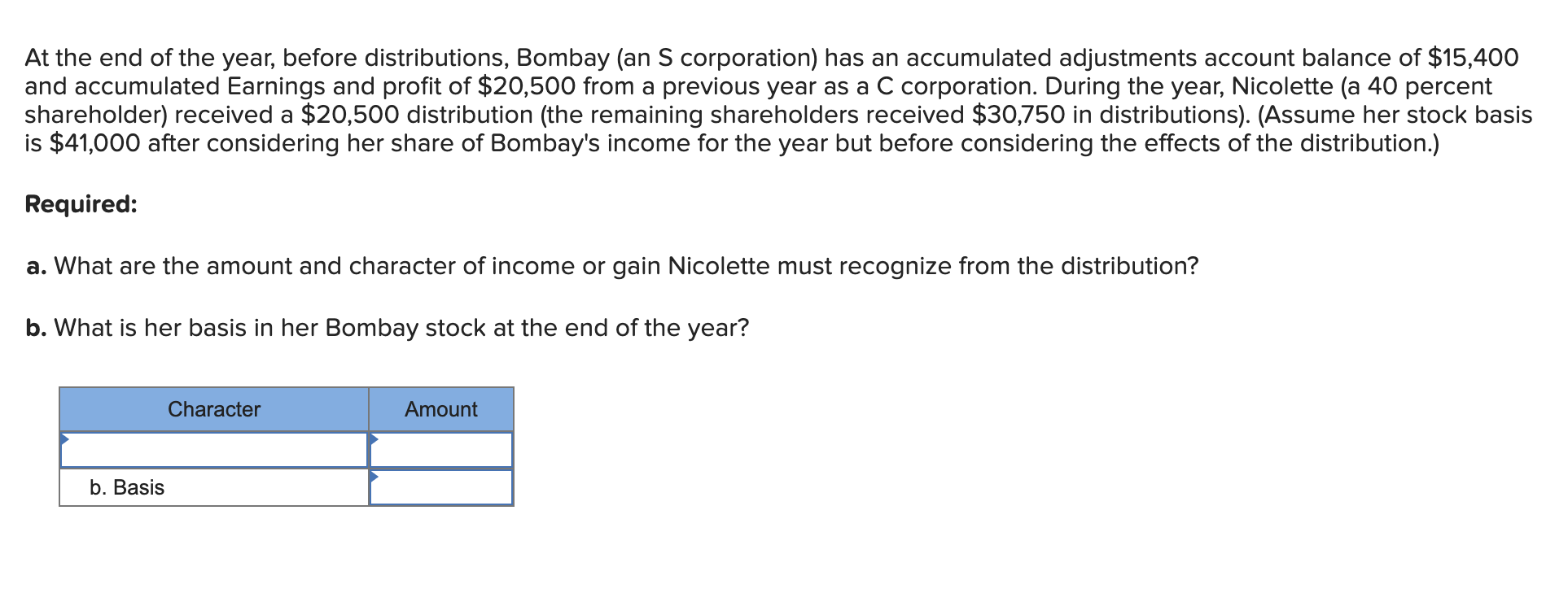

At the end of the year, before distributions, Bombay (an S corporation) has an accumulated adjustments account balance of $15,400 and accumulated Earnings and profit of $20,500 from a previous year as a C corporation. During the year, Nicolette (a 40 percent shareholder) received a $20,500 distribution (the remaining shareholders received $30,750 in distributions). (Assume her stock basis is $41,000 after considering her share of Bombay's income for the year but before considering the effects of the distribution.) Required: a. What are the amount and character of income or gain Nicolette must recognize from the distribution? b. What is her basis in her Bombay stock at the end of the year

At the end of the year, before distributions, Bombay (an S corporation) has an accumulated adjustments account balance of $15,400 and accumulated Earnings and profit of $20,500 from a previous year as a C corporation. During the year, Nicolette (a 40 percent shareholder) received a $20,500 distribution (the remaining shareholders received $30,750 in distributions). (Assume her stock basis is $41,000 after considering her share of Bombay's income for the year but before considering the effects of the distribution.) Required: a. What are the amount and character of income or gain Nicolette must recognize from the distribution? b. What is her basis in her Bombay stock at the end of the year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started