Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the end of the year, Mary's supervisor asked her to record sales transactions for products that would not ship until the following year, and

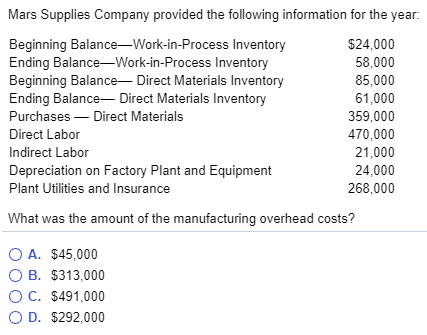

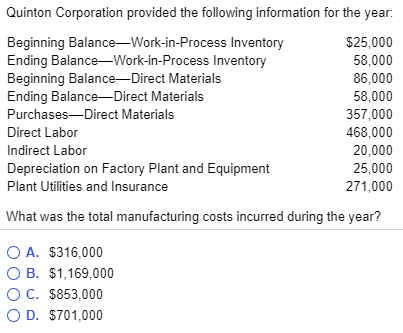

At the end of the year, Mary's supervisor asked her to record sales transactions for products that would not ship until the following year, and she complied. Mary has violated IMA ethical standards True False O O Which of the following would be included as indirect manufacturing costs for a manufacturing company? O A. fuel and maintenance for delivery vehicles B. wages of the assembly line workers C. wages of the factory manager D. sales commissions Indirect labor costs might include the salary of the production manager. O True OFalse Supplies Company provided the following information for the year Beginning Balance-Work-in-Process Inventory Ending Balance Work-in-Process Inventory Beginning Balance Direct Materials Inventory Ending Balance Direct Materials Inventory Purchases Direct Materials Direct Labor $24,000 58,000 85,000 61,000 359,000 470,000 21,000 24,000 268,000 Indirect Labor Depreciation on Factory Plant and Equipment Plant Utilities and Insurance What was the amount of the manufacturing overhead costs? O A. $45,000 O B. $313,000 O C. $491,000 O D. $292,000 Quinton Corporation provided the following information for the year Beginning Balance-Work-in-Process Inventory Ending Balance-Work-in-Process Inventory Beginning Balance-Direct Materials Ending Balance Direct Materials Purchases-Direct Materials Direct Labor Indirect Labor $25,000 58,000 86,000 58,000 357,000 468,000 20,000 25,000 271,000 Depreciation on Factory Plant and Equipment Plant Utilities and Insurance What was the total manufacturing costs incurred during the year? O A. $316,000 O B. $1,169,000 O C. $853,000 O D. $701,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started