Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the end of the year, the Chief Financial Officer (CFO) of Major Industries has been asked by the company's president to prepare financial statements.

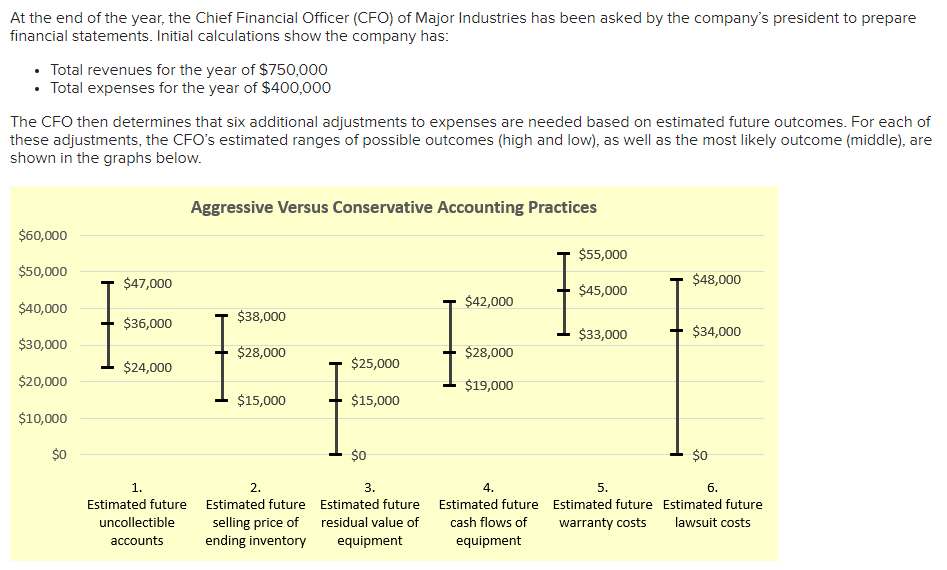

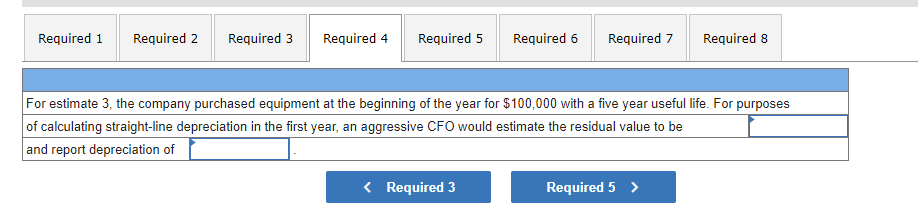

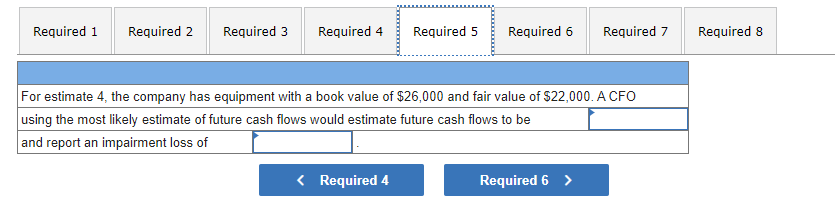

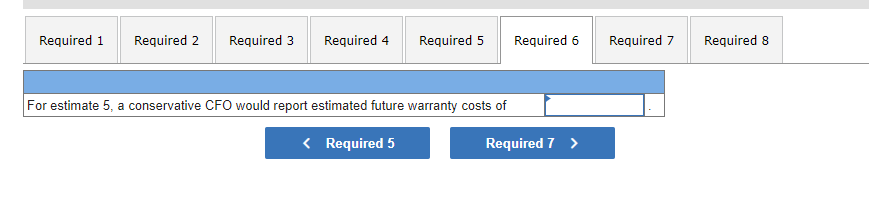

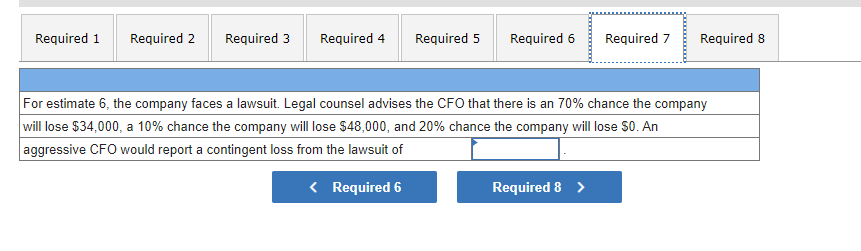

At the end of the year, the Chief Financial Officer (CFO) of Major Industries has been asked by the company's president to prepare financial statements. Initial calculations show the company has: - Total revenues for the year of $750,000 - Total expenses for the year of $400,000 The CFO then determines that six additional adjustments to expenses are needed based on estimated future outcomes. For each of these adjustments, the CFO's estimated ranges of possible outcomes (high and low), as well as the most likely outcome (middle), are shown in the graphs below. What is the reported amount of net income prior to any of the five adjustments? For estimate 1, an aggressive CFO would report estimated future uncollectible accounts of For estimate 3 , the company purchased equipment at the beginning of the year for $100,000 with a five year useful life. For purposes of calculating straight-line depreciation in the first year, an aggressive CFO would estimate the residual value to be and report depreciation of or estimate 4 , the company has equipment with a book value of $26,000 and fair value of $22,000. A CFO sing the most likely estimate of future cash flows would estimate future cash flows to be For estimate 5 , a conservative CFO would report estimated future warranty costs of For estimate 6 , the company faces a lawsuit. Legal counsel advises the CFO that there is an 70% chance the company will lose $34,000, a 10% chance the company will lose $48,000, and 20% chance the company will lose $0. An aggressive CFO would report a contingent loss from the lawsuit of

At the end of the year, the Chief Financial Officer (CFO) of Major Industries has been asked by the company's president to prepare financial statements. Initial calculations show the company has: - Total revenues for the year of $750,000 - Total expenses for the year of $400,000 The CFO then determines that six additional adjustments to expenses are needed based on estimated future outcomes. For each of these adjustments, the CFO's estimated ranges of possible outcomes (high and low), as well as the most likely outcome (middle), are shown in the graphs below. What is the reported amount of net income prior to any of the five adjustments? For estimate 1, an aggressive CFO would report estimated future uncollectible accounts of For estimate 3 , the company purchased equipment at the beginning of the year for $100,000 with a five year useful life. For purposes of calculating straight-line depreciation in the first year, an aggressive CFO would estimate the residual value to be and report depreciation of or estimate 4 , the company has equipment with a book value of $26,000 and fair value of $22,000. A CFO sing the most likely estimate of future cash flows would estimate future cash flows to be For estimate 5 , a conservative CFO would report estimated future warranty costs of For estimate 6 , the company faces a lawsuit. Legal counsel advises the CFO that there is an 70% chance the company will lose $34,000, a 10% chance the company will lose $48,000, and 20% chance the company will lose $0. An aggressive CFO would report a contingent loss from the lawsuit of Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started