At the last meeting of the executive committee of Kearins Ltd., the controller was severely criticized by both the president and vice-president of production about

At the last meeting of the executive committee of Kearins Ltd., the controller was severely criticized by both the president and vice-president of production about the recognition of periodic depreciation. The president was unhappy with the fact that what he referred to as “a fictitious item’’ was deducted, resulting in depressed profit. In his words, “Depreciation is a fiction when the assets being depreciated are worth far more than we paid for them. What the controller is doing is unduly understating our profit. This in turn is detrimental to our shareholders because it results in the undervaluation of our shares on the market.’’ The vice-president was equally adamant about the periodic depreciation charges; however, she presented a different argument. She said, “Our maintenance people tell me that the level of maintenance is such that our plant and equipment will last virtually forever.’’ She further stated that charging depreciation on top of maintenance expenses is double-counting—it seems reasonable to charge either maintenance or depreciation but not both. The time taken by other pressing matters did not permit the controller to answer; instead, you were asked to prepare a report to the executive committee to deal with the issues raised by the president and vice-president. Required As the controller’s assistant, prepare the required report.

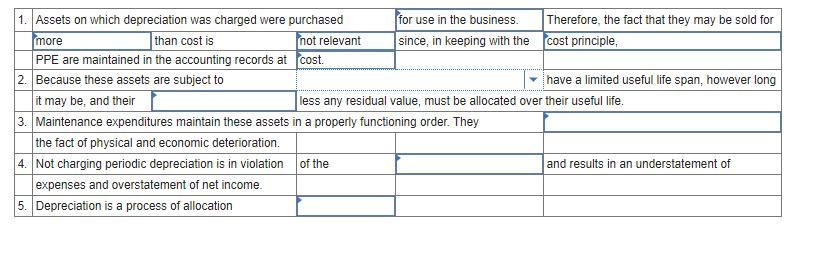

1. Assets on which depreciation was charged were purchased more for use in the business. Therefore, the fact that they may be sold for |than cost is not relevant since, in keeping with the cost principle, PPE are maintained in the accounting records at cost. 2. Because these assets are subject to it may be, and their 3. Maintenance expenditures maintain these assets in a properly functioning order. They the fact of physical and economic deterioration. 4. Not charging periodic depreciation is in violation of the expenses and overstatement of net income. 5. Depreciation is a process of allocation have a limited useful life span, however long less any residual value, must be allocated over their useful life. and results in an understatement of

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Assets on which depreciation was charged were purchased for use in business The...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started