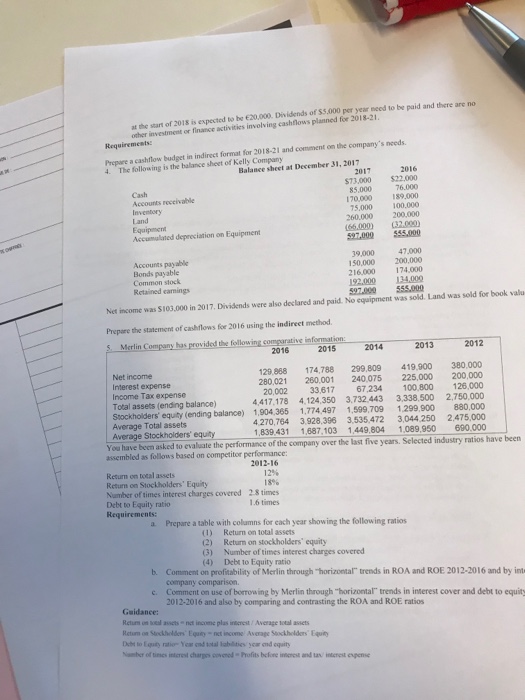

at the start of 2018 is expected to be 620,000. Dividends of $5,000 per year need to be paid and there are no other investment or finance activities involving cashflows planned for 2018-21 Prepare a cashflow budget in indirect format for 2018-21 and comment on the 4. The following is the halance sheet of Kelly Company company's needs Balance sheet at December 31, 2017 2016 2017 $73,000 $22,000 85,000 76.000 70,000 189,000 75,000 100,000 260,000 200,000 Cash Accounts receivalble Accumalated depreciation on Equipment 597,000 555.000 Accounts payable Bonds payable Common slock Retained carnings 39,000 47.000 50,000 200,000 216.000 174,000 192.000 134,00 597.000 555.000 Net imcome was 5103,000 in 2017. Dividends were also declared and paid. No equipment was sold. Land was sold for book valu Prepare the statement of cashflows foe 2016 using the indirect method S. Merlin C the t 2016 2015 2014 2013 2012 29,888 174,788 299,809 419,900 380,000 280,021 260,001 240,075 225,000 200,000 20,002 33,617 67,234 100,800 126,000 4,417,178 4,124,350 3,732443 3,338,500 2,750,000 880,000 4270,764 3.928,396 3,535,472 3,044.250 2.475,000 1839.431 1,687.103 1,449.804 1.089950 690.000 Net income Interest expense Income Tax expense Total assets (ending balance) Stockholders equity (ending balance) 1,904,365 1,774,497 1,599,709 1,299,900 Average Total assets Average Stockholders equity You have been asked to evaluate the performance assembled as follows based on competitor performance of the company over the last five years. Selected industry ratios have been Return on total assets Return on Stockholders Equity Namber of times interest charges covered Debt to Equity ratio Requirements: 2012-16 12% 8% 2 8 times 1.6 times a Prepare a table with colamns for each year showing the following ratios (1) (2) (3) (4) Return on total assets Returm on stockholders" equity Number of times interest charges covered Debt to Equity ratio b. Comment on profitability of Merlin through "horizontal" trends in ROA and ROE 2012-2016 and by int c Comment on use of borrow ing by Merlin through "horizontal" trends in interest cover and debt to equity 2012-2016 and also by comparing and contrasting the ROA and ROE ratios Rcturs on ocal assets net income plas inrest Average otal assets Retum on Steckholders Equity-nt income Average Stockhelders Equity y of ines interet charps cov enod " Profits bcfre rest and tae: interest egeme