At the start of 2019, the Company has no non-capital loss carryforward or net capital loss carryforwards. At the end of 2018 the Company had an RDTOH balance of $52,000, a GRIP balance of $5,000, and paid a $80,000 non-eligible dividend in 2018, receiving the refund in 2019.

Assume the following provincial rates: BC - 2% for income eligible for the SBD and 12% on the remainder; Ontario 3.5% for income eligible for the SBD and 11.5% on the remainder

Required:

-

Calculate the Companys total taxes payable.

-

Calculate the Companys ending RDTOH balance.

-

Calculate the required dividend the Company would have to pay in order to receive the maximum refund.

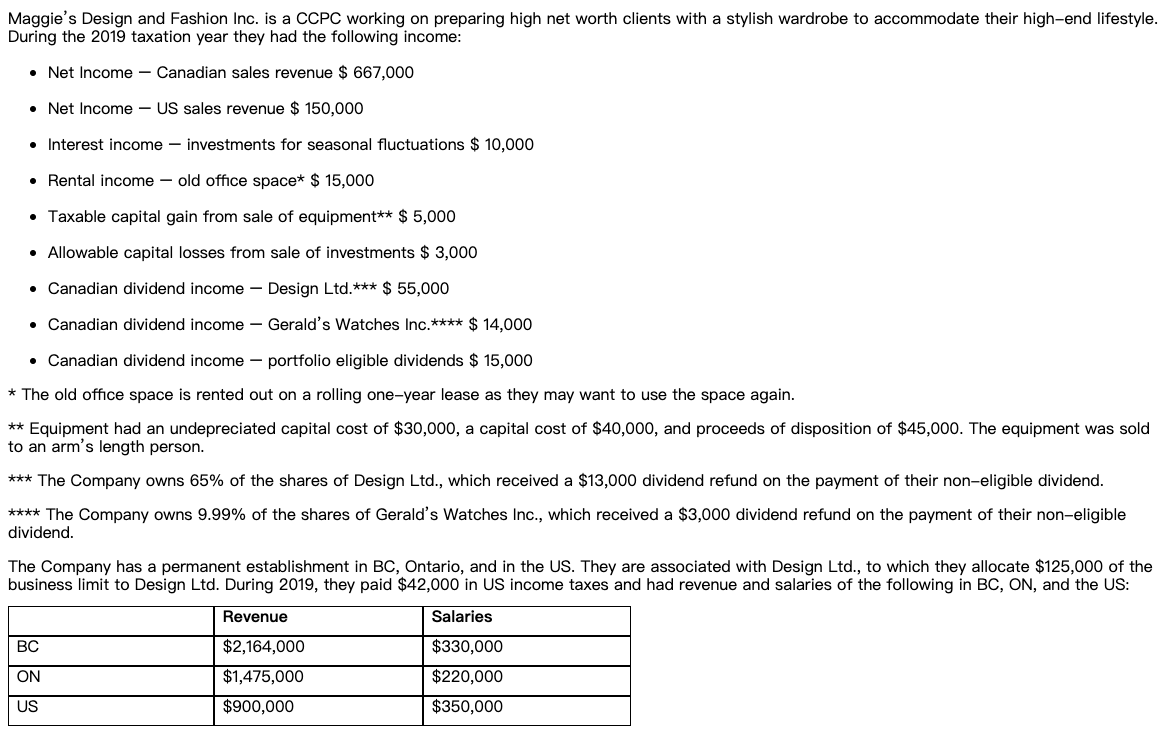

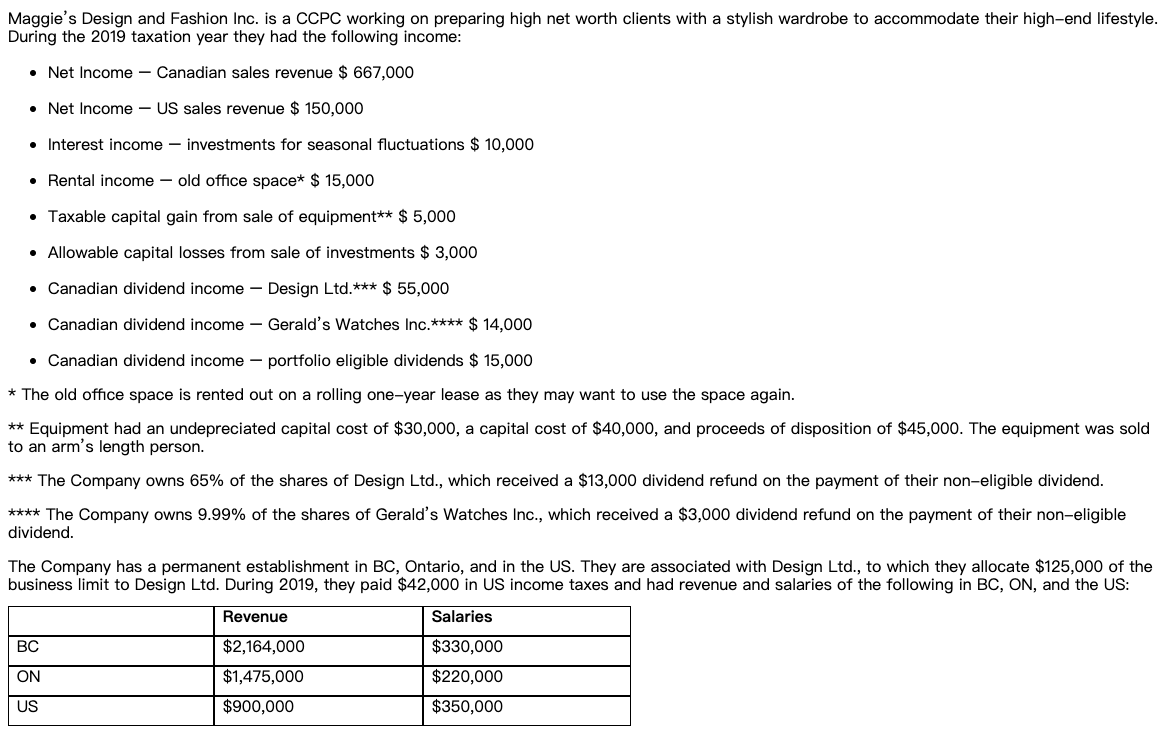

Maggie's Design and Fashion Inc. is a CCPC working on preparing high net worth clients with a stylish wardrobe to accommodate their high-end lifestyle. During the 2019 taxation year they had the following income: Net Income - Canadian sales revenue $ 667,000 Net Income US sales revenue $ 150,000 Interest income investments for seasonal fluctuations $ 10,000 Rental income - old office space* $ 15,000 Taxable capital gain from sale of equipment** $ 5,000 Allowable capital losses from sale of investments $3,000 Canadian dividend income Design Ltd.*** $ 55,000 Canadian dividend income Gerald's Watches Inc.**** $ 14,000 Canadian dividend income portfolio eligible dividends $ 15,000 * The old office space is rented out on a rolling one-year lease as they may want to use the space again. ** Equipment had an undepreciated capital cost of $30,000, a capital cost of $40,000, and proceeds of disposition of $45,000. The equipment was sold to an arm's length person. *** The Company owns 65% of the shares of Design Ltd., which received a $13,000 dividend refund on the payment of their non-eligible dividend. **** The Company owns 9.99% of the shares of Gerald's Watches Inc., which received a $3,000 dividend refund on the payment of their non-eligible dividend. The Company has a permanent establishment in BC, Ontario, and in the US. They are associated with Design Ltd., which they allocate $125,000 of the business limit to Design Ltd. During 2019, they paid $42,000 in US income taxes and had revenue and salaries of the following in BC, ON, and the US: Revenue Salaries BC ON $2,164,000 $1,475,000 $900,000 $330,000 $220,000 $350,000 US Maggie's Design and Fashion Inc. is a CCPC working on preparing high net worth clients with a stylish wardrobe to accommodate their high-end lifestyle. During the 2019 taxation year they had the following income: Net Income - Canadian sales revenue $ 667,000 Net Income US sales revenue $ 150,000 Interest income investments for seasonal fluctuations $ 10,000 Rental income - old office space* $ 15,000 Taxable capital gain from sale of equipment** $ 5,000 Allowable capital losses from sale of investments $3,000 Canadian dividend income Design Ltd.*** $ 55,000 Canadian dividend income Gerald's Watches Inc.**** $ 14,000 Canadian dividend income portfolio eligible dividends $ 15,000 * The old office space is rented out on a rolling one-year lease as they may want to use the space again. ** Equipment had an undepreciated capital cost of $30,000, a capital cost of $40,000, and proceeds of disposition of $45,000. The equipment was sold to an arm's length person. *** The Company owns 65% of the shares of Design Ltd., which received a $13,000 dividend refund on the payment of their non-eligible dividend. **** The Company owns 9.99% of the shares of Gerald's Watches Inc., which received a $3,000 dividend refund on the payment of their non-eligible dividend. The Company has a permanent establishment in BC, Ontario, and in the US. They are associated with Design Ltd., which they allocate $125,000 of the business limit to Design Ltd. During 2019, they paid $42,000 in US income taxes and had revenue and salaries of the following in BC, ON, and the US: Revenue Salaries BC ON $2,164,000 $1,475,000 $900,000 $330,000 $220,000 $350,000 US