Question

At the start of 2020, a resident of the City of LaVerada donated $2.5 million to the LaVerada School District. The donor specified that the

At the start of 2020, a resident of the City of LaVerada donated $2.5 million to the LaVerada School District. The donor specified that the entire $2.5 million be invested, and the investment income was used to provide tutoring services for high school students. Investments were made, and the 2020 investment income was $100,000. Administrative costs related to investing activities were $2,000. The school district started a tutoring program, and spent $15,000 on supplies, $25,000 for facilities rent, and $35,000 on tutoring. The investments are worth $2,580,000 at the end of 2020.

Required

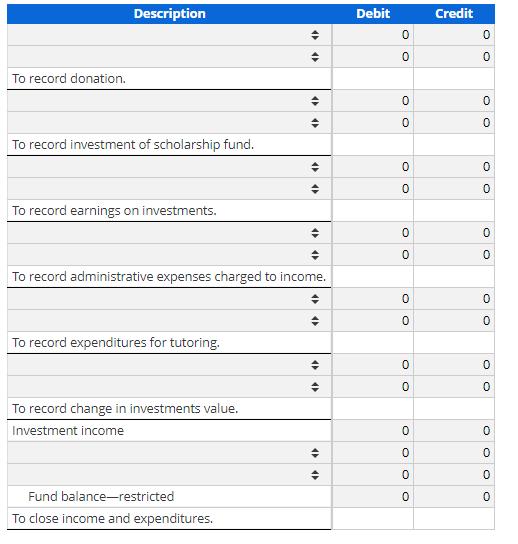

The drop-down options are as follows: Cash-principal, Fund balance-non spendable, Investments-principal, Cash-income, Investment income, Investments-income, Expenditures, Unrealized gain on investment, and Unrealized loss on investment.

Record the events described above in a permanent fund. Include closing entries.

Description To record donation. To record investment of scholarship fund. To record earnings on investments. To record administrative expenses charged to income. To record expenditures for tutoring. To record change in investments value. Investment income Fund balance-restricted To close income and expenditures. 45 + AP 45 (7 + 46 45 4 + 4 Debit 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Credit 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Cash Ac dr 25 million To Donation Ac 25 million Investments Ac dr 25 million To Cash Ac 25 million ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started