Answered step by step

Verified Expert Solution

Question

1 Approved Answer

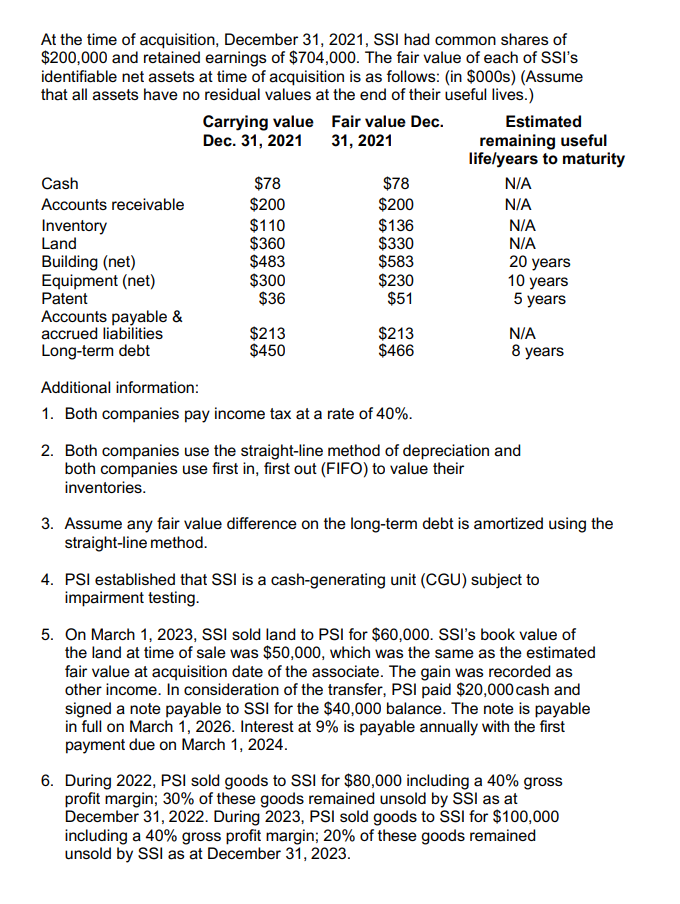

At the time of acquisition, December 31, 2021, SSI had common shares of $200,000 and retained earnings of $704,000. The fair value of each

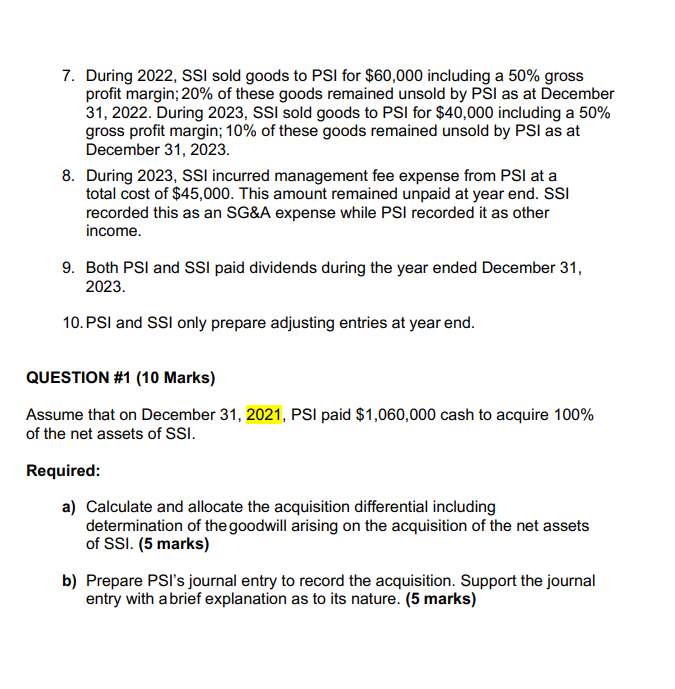

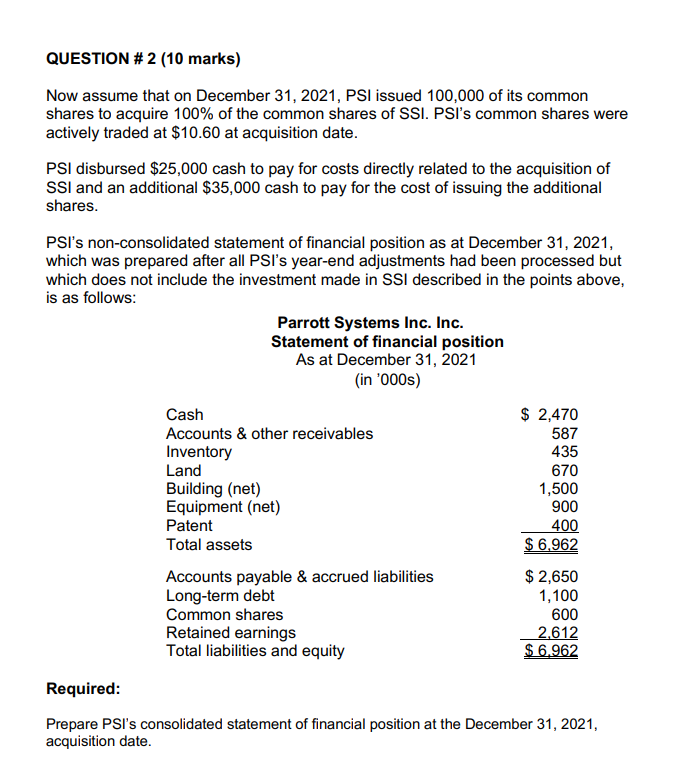

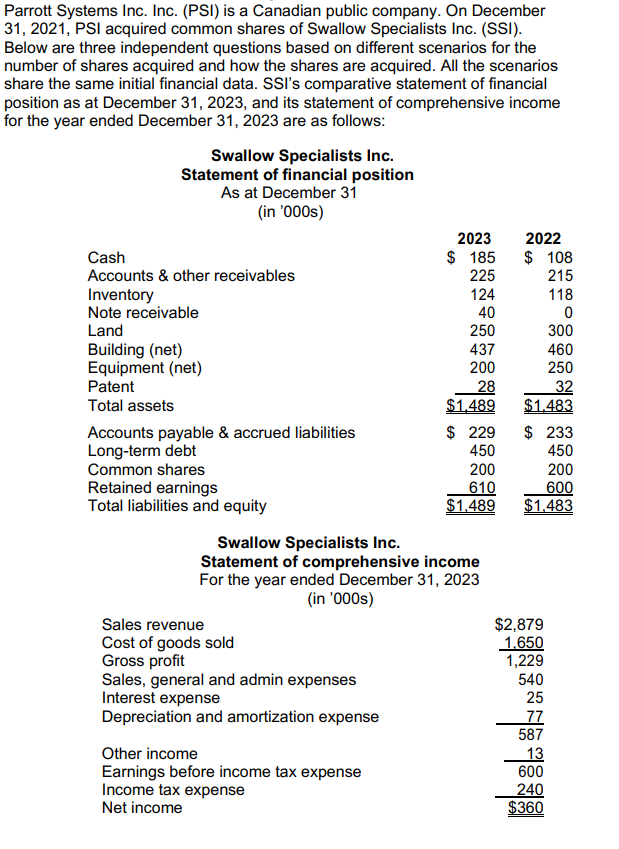

At the time of acquisition, December 31, 2021, SSI had common shares of $200,000 and retained earnings of $704,000. The fair value of each of SSI's identifiable net assets at time of acquisition is as follows: (in $000s) (Assume that all assets have no residual values at the end of their useful lives.) Cash Accounts receivable Inventory Land Building (net) Equipment (net) Patent Accounts payable & accrued liabilities Long-term debt Carrying value Fair value Dec. Dec. 31, 2021 31, 2021 $78 $200 $110 $360 $483 $300 $36 $213 $450 $78 $200 $136 $330 $583 $230 $51 $213 $466 Additional information: 1. Both companies pay income tax at a rate of 40%. Estimated remaining useful life/years to maturity N/A N/A N/A N/A 20 years 10 years 5 years N/A 8 years 2. Both companies use the straight-line method of depreciation and both companies use first in, first out (FIFO) to value their inventories. 3. Assume any fair value difference on the long-term debt is amortized using the straight-line method. 4. PSI established that SSI is a cash-generating unit (CGU) subject to impairment testing. 5. On March 1, 2023, SSI sold land to PSI for $60,000. SSI's book value of the land at time of sale was $50,000, which was the same as the estimated fair value at acquisition date of the associate. The gain was recorded as other income. In consideration of the transfer, PSI paid $20,000 cash and signed a note payable to SSI for the $40,000 balance. The note is payable in full on March 1, 2026. Interest at 9% is payable annually with the first payment due on March 1, 2024. 6. During 2022, PSI sold goods to SSI for $80,000 including a 40% gross profit margin; 30% of these goods remained unsold by SSI as at December 31, 2022. During 2023, PSI sold goods to SSI for $100,000 including a 40% gross profit margin; 20% of these goods remained unsold by SSI as at December 31, 2023. 7. During 2022, SSI sold goods to PSI for $60,000 including a 50% gross profit margin; 20% of these goods remained unsold by PSI as at December 31, 2022. During 2023, SSI sold goods to PSI for $40,000 including a 50% gross profit margin; 10% of these goods remained unsold by PSI as at December 31, 2023. 8. During 2023, SSI incurred management fee expense from PSI at a total cost of $45,000. This amount remained unpaid at year end. SSI recorded this as an SG&A expense while PSI recorded it as other income. 9. Both PSI and SSI paid dividends during the year ended December 31, 2023. 10. PSI and SSI only prepare adjusting entries at year end. QUESTION #1 (10 Marks) Assume that on December 31, 2021, PSI paid $1,060,000 cash to acquire 100% of the net assets of SSI. Required: a) Calculate and allocate the acquisition differential including determination of the goodwill arising on the acquisition of the net assets of SSI. (5 marks) b) Prepare PSI's journal entry to record the acquisition. Support the journal entry with a brief explanation as to its nature. (5 marks) QUESTION # 2 (10 marks) Now assume that on December 31, 2021, PSI issued 100,000 of its common shares to acquire 100% of the common shares of SSI. PSI's common shares were actively traded at $10.60 at acquisition date. PSI disbursed $25,000 cash to pay for costs directly related to the acquisition of SSI and an additional $35,000 cash to pay for the cost of issuing the additional shares. PSI's non-consolidated statement of financial position as at December 31, 2021, which was prepared after all PSI's year-end adjustments had been processed but which does not include the investment made in SSI described in the points above, is as follows: Parrott Systems Inc. Inc. Statement of financial position As at December 31, 2021 (in '000s) Cash Accounts & other receivables Inventory Land Building (net) Equipment (net) Patent Total assets Accounts payable & accrued liabilities Long-term debt Common shares Retained earnings Total liabilities and equity $ 2,470 587 435 670 1,500 900 400 $6,962 $ 2,650 1,100 600 2,612 $6.962 Required: Prepare PSI's consolidated statement of financial position at the December 31, 2021, acquisition date. Parrott Systems Inc. Inc. (PSI) is a Canadian public company. On December 31, 2021, PSI acquired common shares of Swallow Specialists Inc. (SSI). Below are three independent questions based on different scenarios for the number of shares acquired and how the shares are acquired. All the scenarios share the same initial financial data. SSI's comparative statement of financial position as at December 31, 2023, and its statement of comprehensive income for the year ended December 31, 2023 are as follows: Swallow Specialists Inc. Statement of financial position As at December 31 (in '000s) Cash Accounts & other receivables Inventory Note receivable Land Building (net) Equipment (net) Patent Total assets Accounts payable & accrued liabilities Long-term debt Common shares Retained earnings Total liabilities and equity Sales revenue Cost of goods sold Gross profit Sales, general and admin expenses Interest expense Depreciation and amortization expense 2023 $ 185 225 124 40 250 Other income Earnings before income tax expense Income tax expense Net income 437 200 28 $1,489 Swallow Specialists Inc. Statement of comprehensive income For the year ended December 31, 2023 (in '000s) 2022 $ 108 215 118 0 300 460 250 32 $1,483 $ 229 450 200 200 610 600 $1,489 $1.483 $ 233 450 $2,879 1.650 1,229 540 25 77 587 13 600 240 $360

Step by Step Solution

★★★★★

3.35 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Answer To analyze the acquisition of SSI by PSI we need to calculate the following Calculate the goodwill or bargain purchase gain Allocate the fair v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started