Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the time of his death, Barney owned 60 percent of Orange Corporation, a closely held corporation. His interest in Orange was valued at

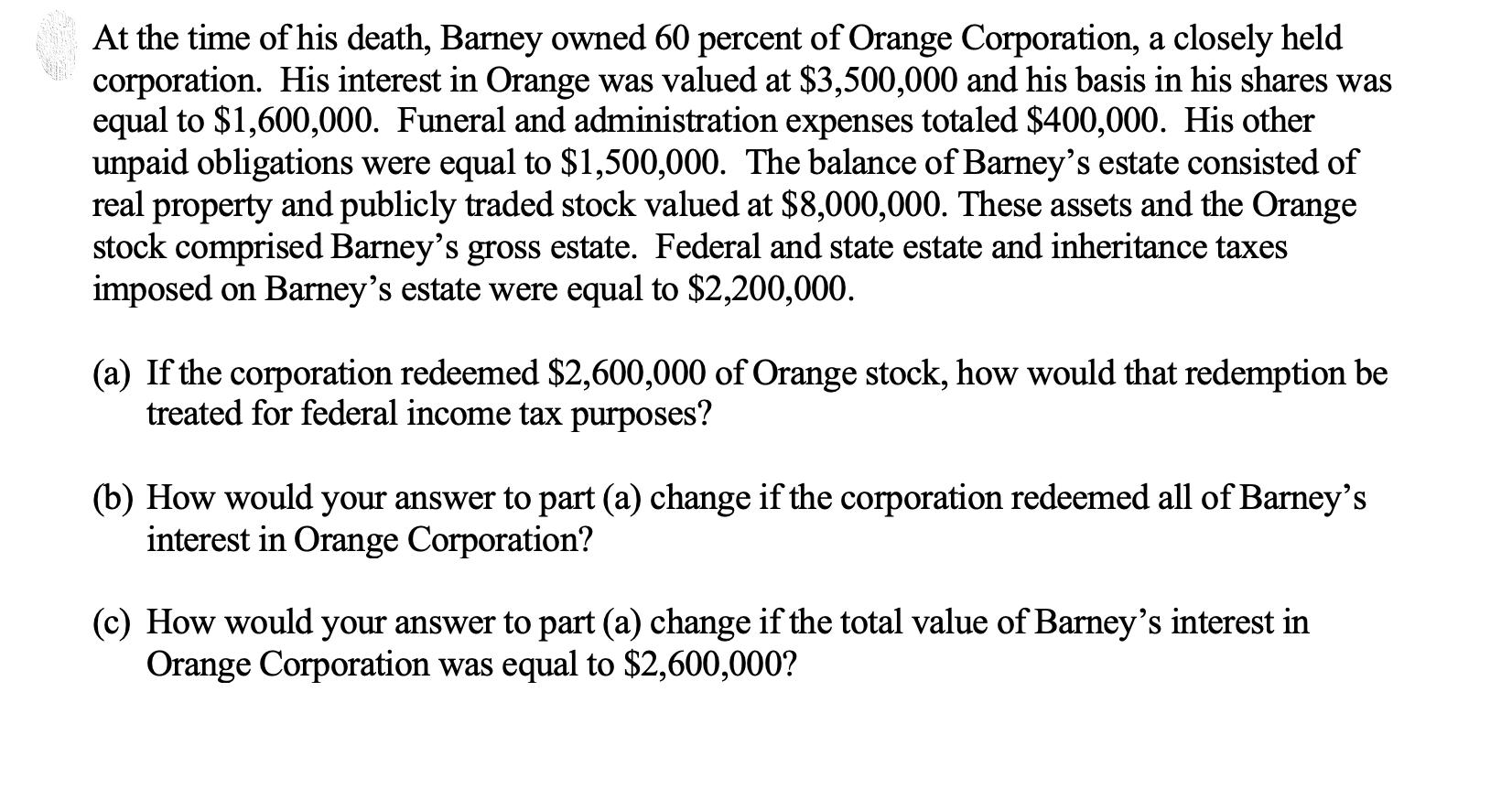

At the time of his death, Barney owned 60 percent of Orange Corporation, a closely held corporation. His interest in Orange was valued at $3,500,000 and his basis in his shares was equal to $1,600,000. Funeral and administration expenses totaled $400,000. His other unpaid obligations were equal to $1,500,000. The balance of Barney's estate consisted of real property and publicly traded stock valued at $8,000,000. These assets and the Orange stock comprised Barney's gross estate. Federal and state estate and inheritance taxes imposed on Barney's estate were equal to $2,200,000. (a) If the corporation redeemed $2,600,000 of Orange stock, how would that redemption be treated for federal income tax purposes? (b) How would your answer to part (a) change if the corporation redeemed all of Barney's interest in Orange Corporation? (c) How would your answer to part (a) change if the total value of Barney's interest in Orange Corporation was equal to $2,600,000?

Step by Step Solution

★★★★★

3.35 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

If the corporation redeemed 2600000 of Orange stock Barneys estate would recognize a gain on the dif...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started