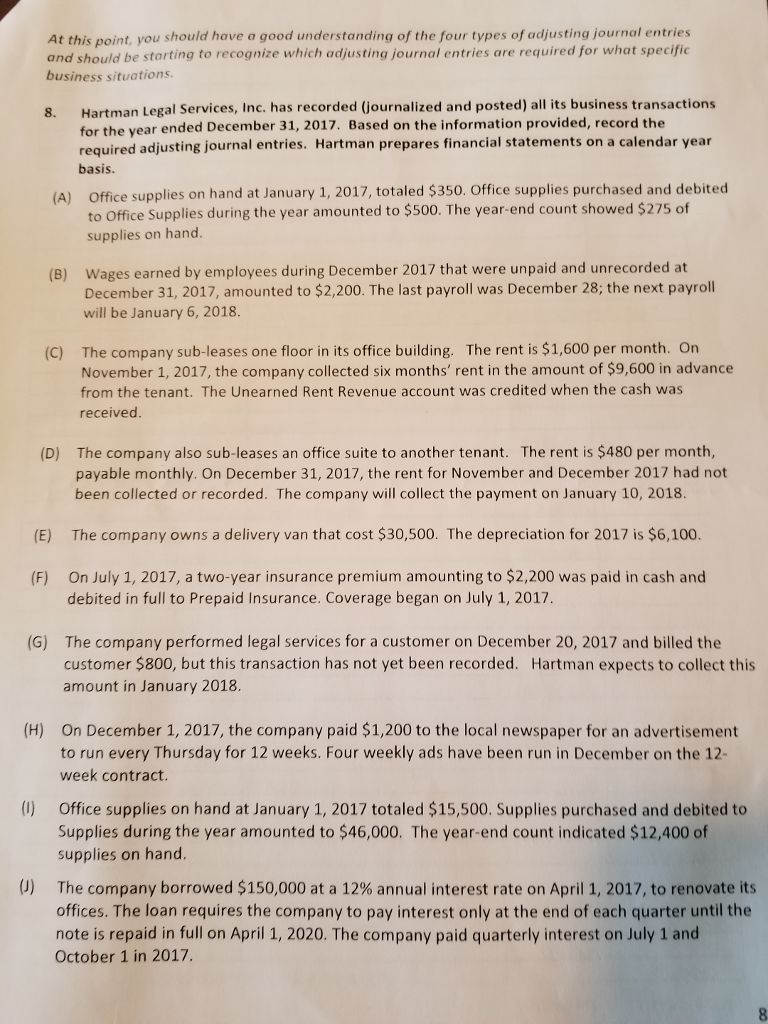

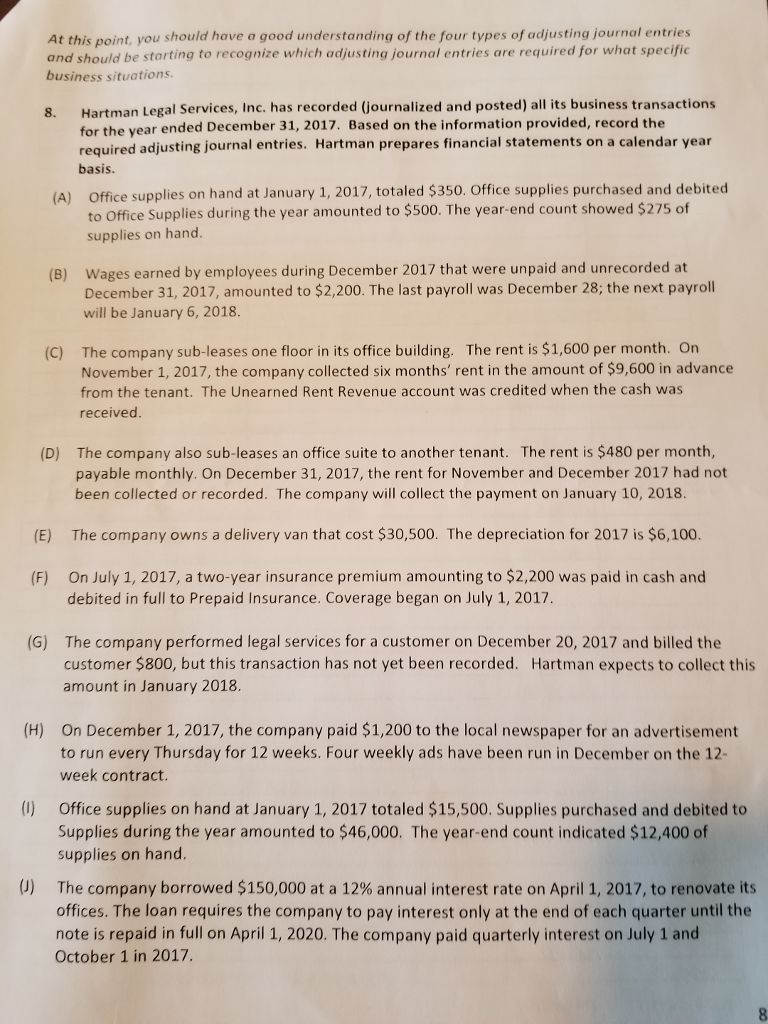

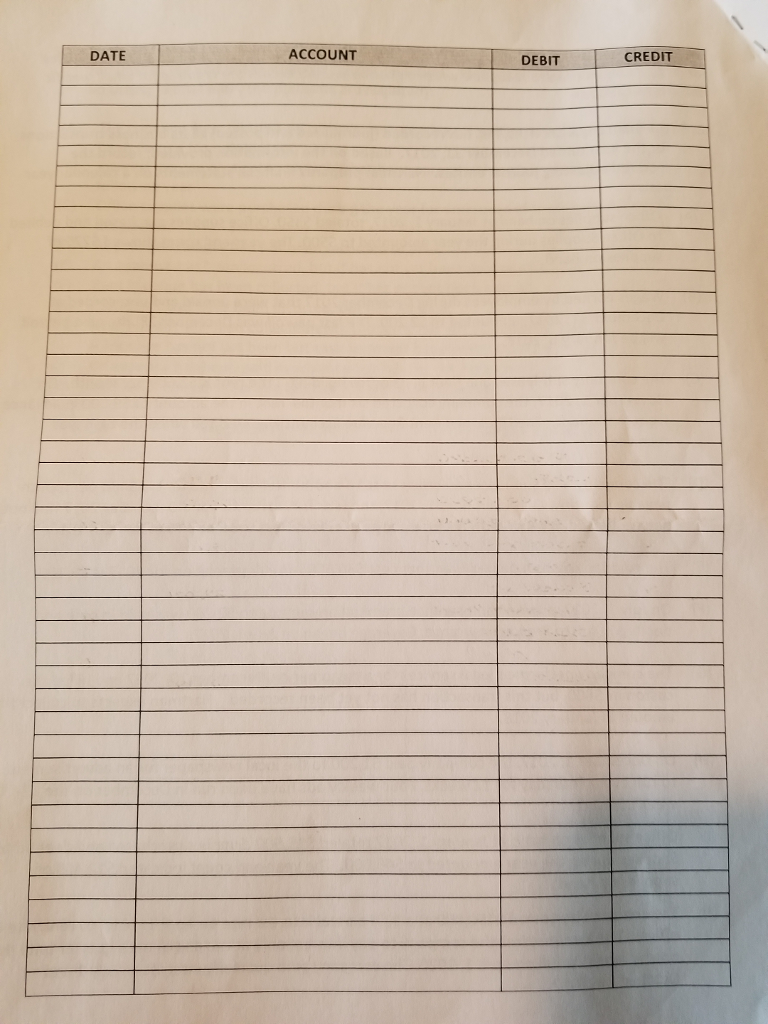

At this point, you should have a good understanding of the four types of adjusting journal entries and should be starting to recognize which adjusting journal entries are required for what specific business situations. 8. Hartman Legal Services, Inc, has recorded (journalized and posted) all its business transactions for the year ended December 31, 2017. Based on the information provided, record the required adjusting journal entries. Hartman prepares financial statements on a calendar year basis. Office supplies on hand at January 1, 2017, totaled $350. Office supplies purchased and debited to Office Supplies during the year amounted to $500. The year-end count showed $275 of supplies on hand. (A) (B) Wages earned by employees during December 2017 that were unpaid and unrecorded at December 31, 2017, amounted to $2,200. The last payroll was December 28; the next payroll will be January 6, 2018. (C) The company sub-leases one floor in its office building. The rent is $1,600 per month. On November 1, 2017, the company collected six months' rent in the amount of $9,600 in advance from the tenant. The Unearned Rent Revenue account was credited when the cash was received. (D) The company also sub-leases an office suite to another tenant. The rent is $480 per month, payable monthly. On December 31, 2017, the rent for November and December 2017 had not been collected or recorded. The company will collect the payment on January 10, 2018. (E) The company owns a delivery van that cost $30,500. The depreciation for 2017 is $6,100. (F) On July 1, 2017, a two-year insurance premium amounting to $2,200 was paid in cash and debited in full to Prepaid Insurance. Coverage began on July 1, 2017 (G) The company performed legal services for a customer on December 20, 2017 and billed the customer $800, but this transaction has not yet been recorded. Hartman expects to collect this amount in January 2018. (H) On December 1, 2017, the company paid $1,200 to the local newspaper for an advertisement to run every Thursday for 12 weeks. Four weekly ads have been run in December on the 12- week contract. Office supplies on hand at January 1, 2017 totaled $15,500. Supplies purchased and debited to Supplies during the year amounted to $46,000. The year-end count indicated $12,400 of supplies on hand. The company borrowed $150,000 at a 12% annual interest rate on April 1, 2017, to renovate its offices. The loan requires the company to pay interest only at the end of each quarter until the note is repaid in full on April 1, 2020. The company paid quarterly interest on July 1 and October 1 in 2017. (0)