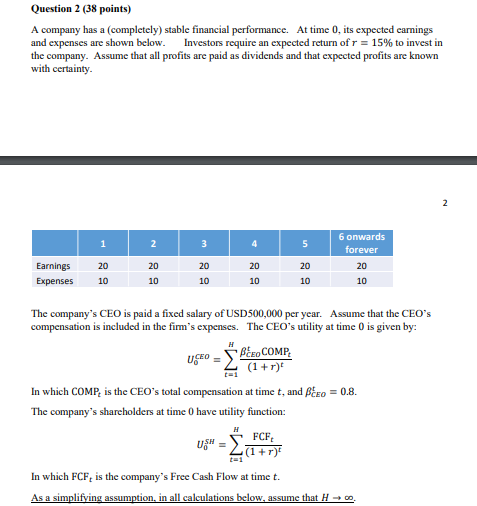

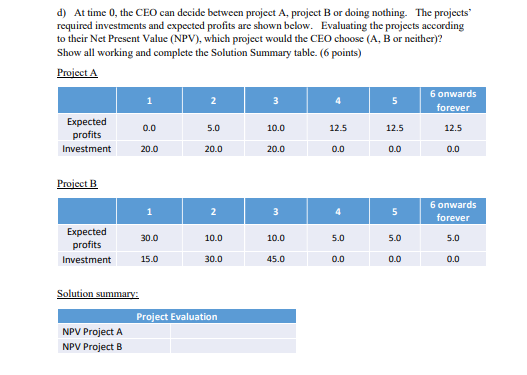

At time 0, the CEO can decide between project A, project B or doing nothing. The projects required investments and expected profits are shown below. Evaluating the projects according to their Net Present Value (NPV), which project would the CEO choose (A, B or neither)? Show all working and complete the Solution Summary table. (6 points)

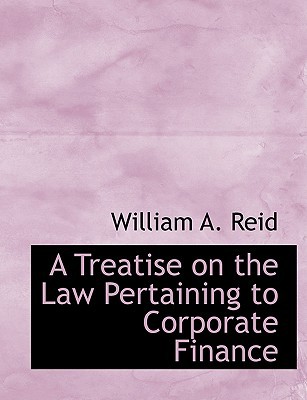

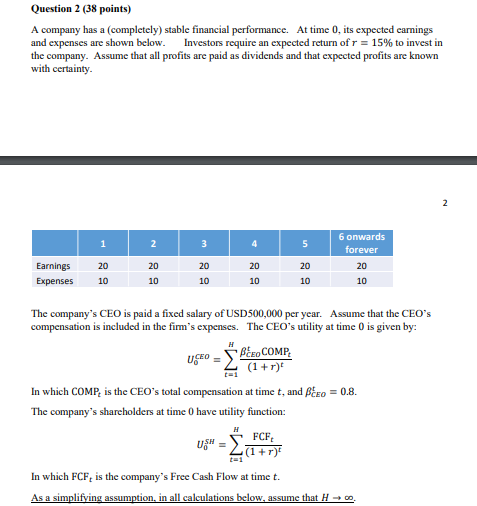

Question 2 (38 points) A company has a completely) stable financial performance. At time 0, its expected earnings and expenses are shown below. Investors require an expected return of r = 15% to invest in the company. Assume that all profits are paid as dividends and that expected profits are known with certainty. 2 1 2 3 4 5 6 onwards forever 20 10 20 20 Earnings Expenses 20 10 20 10 20 10 10 10 The company's CEO is paid a fixed salary of USD 500,000 per year. Assume that the CEO's compensation is included in the fim's expenses. The CEO's utility at time is given by: H Ug = PEROCOMP (1+r) In which COMP, is the CEO's total compensation at time t, and BEEO = 0.8. The company's shareholders at time have utility function: H FCF USH (1 + r) In which FCF, is the company's Free Cash Flow at time t. As a simplifying assumption, in all calculations below, assume that H. d) At time 0, the CEO can decide between project A, project Bor doing nothing. The projects required investments and expected profits are shown below. Evaluating the projects according to their Net Present Value (NPV), which project would the CEO choose (A, B or neither)? Show all working and complete the solution Summary table. (6 points) Project A 6 onwards 2 forever Expected profits Investment 5 0.0 5.0 10.0 12.5 12.5 12.5 20.0 20.0 20.0 0.0 0.0 0.0 Project B 1 2 3 5 6 onwards forever 30.0 10.0 10.0 5.0 5.0 5.0 Expected profits Investment 15.0 30.0 45.0 0.0 0.0 0.0 Solution summary: Project Evaluation NPV Project A NPV Project B Question 2 (38 points) A company has a completely) stable financial performance. At time 0, its expected earnings and expenses are shown below. Investors require an expected return of r = 15% to invest in the company. Assume that all profits are paid as dividends and that expected profits are known with certainty. 2 1 2 3 4 5 6 onwards forever 20 10 20 20 Earnings Expenses 20 10 20 10 20 10 10 10 The company's CEO is paid a fixed salary of USD 500,000 per year. Assume that the CEO's compensation is included in the fim's expenses. The CEO's utility at time is given by: H Ug = PEROCOMP (1+r) In which COMP, is the CEO's total compensation at time t, and BEEO = 0.8. The company's shareholders at time have utility function: H FCF USH (1 + r) In which FCF, is the company's Free Cash Flow at time t. As a simplifying assumption, in all calculations below, assume that H. d) At time 0, the CEO can decide between project A, project Bor doing nothing. The projects required investments and expected profits are shown below. Evaluating the projects according to their Net Present Value (NPV), which project would the CEO choose (A, B or neither)? Show all working and complete the solution Summary table. (6 points) Project A 6 onwards 2 forever Expected profits Investment 5 0.0 5.0 10.0 12.5 12.5 12.5 20.0 20.0 20.0 0.0 0.0 0.0 Project B 1 2 3 5 6 onwards forever 30.0 10.0 10.0 5.0 5.0 5.0 Expected profits Investment 15.0 30.0 45.0 0.0 0.0 0.0 Solution summary: Project Evaluation NPV Project A NPV Project B