Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. At time t=0 three bonds are available for the same price. The first bond will give the investor five equal payments of P,

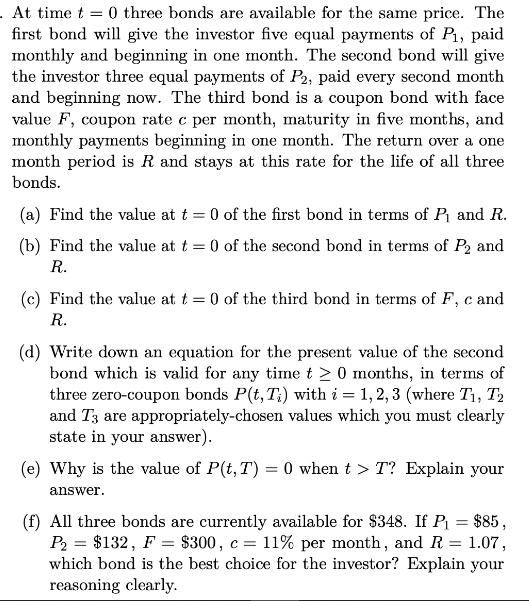

. At time t=0 three bonds are available for the same price. The first bond will give the investor five equal payments of P, paid monthly and beginning in one month. The second bond will give the investor three equal payments of P2, paid every second month and beginning now. The third bond is a coupon bond with face value F, coupon rate c per month, maturity in five months, and monthly payments beginning in one month. The return over a one month period is R and stays at this rate for the life of all three bonds. (a) Find the value at t = 0 of the first bond in terms of P and R. (b) Find the value at t = 0 of the second bond in terms of P2 and R. and (c) Find the value at t = 0 of the third bond in terms of F, C R. (d) Write down an equation for the present value of the second bond which is valid for any time t 0 months, in terms of three zero-coupon bonds P(t, T;) with i = 1,2,3 (where T, T2 and T3 are appropriately-chosen values which you must clearly state in your answer). (e) Why is the value of P(t, T) = 0 when t > T? Explain your answer. (f) All three bonds are currently available for $348. If P = $85, P = $132, F = $300, c = 11% per month, and R = 1.07, which bond is the best choice for the investor? Explain your reasoning clearly.

Step by Step Solution

★★★★★

3.42 Rating (133 Votes )

There are 3 Steps involved in it

Step: 1

Lets break this down step by step a The first bond pays five equal monthly payments starting in one month To find its value at t 0 we can calculate th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started