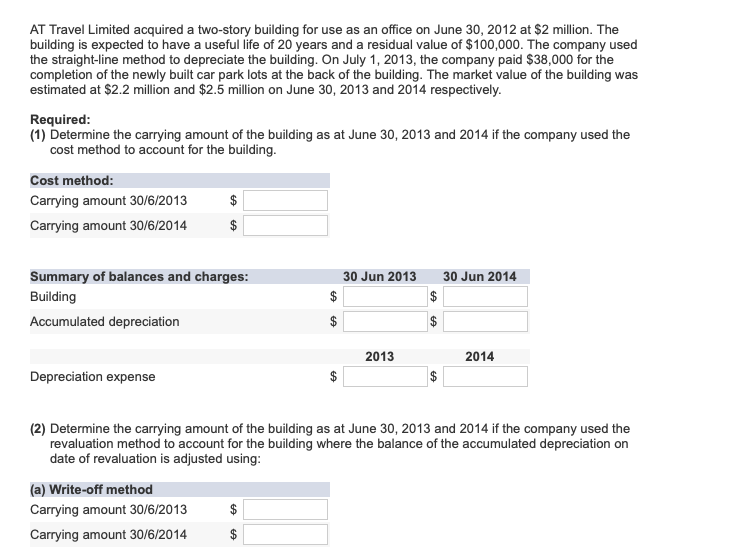

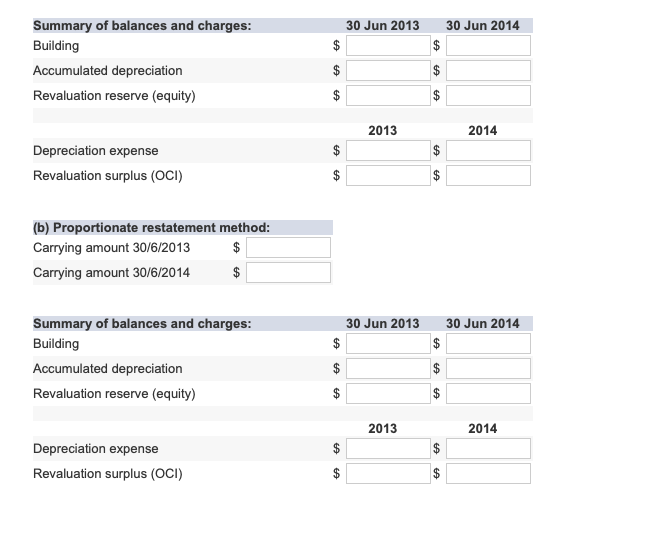

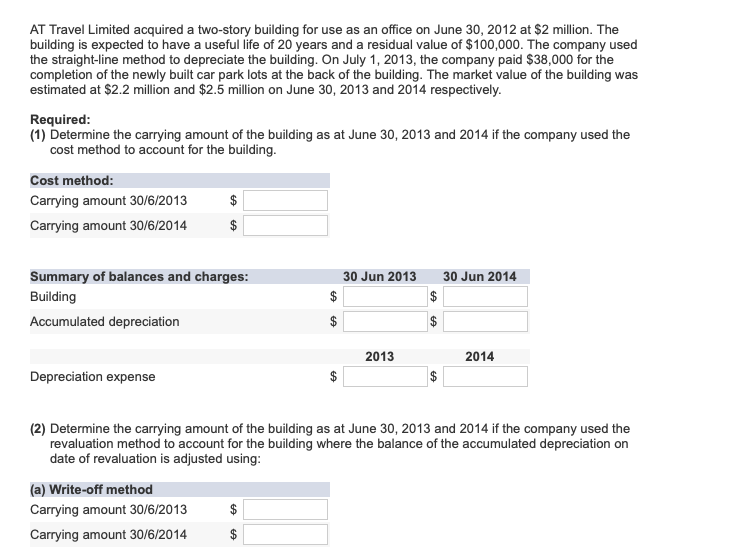

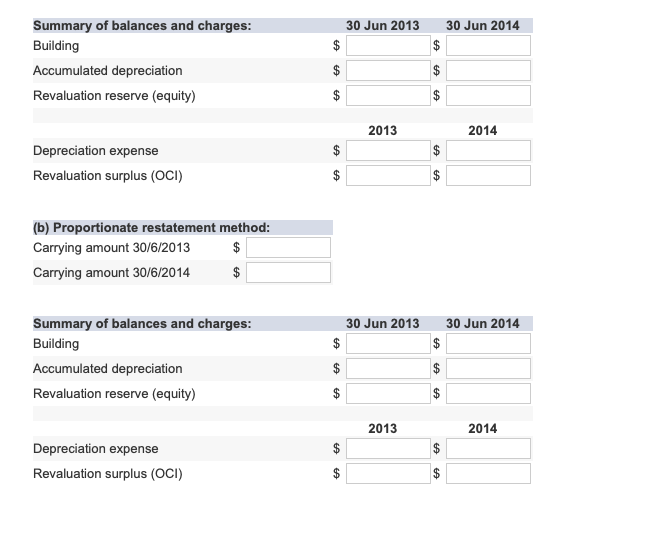

AT Travel Limited acquired a two-story building for use as an office on June 30, 2012 at $2 million. The building is expected to have a useful life of 20 years and a residual value of $100,000. The company used the straight-line method to depreciate the building. On July 1, 2013, the company paid $38,000 for the completion of the newly built car park lots at the back of the building. The market value of the building was estimated at $2.2 million and $2.5 million on June 30, 2013 and 2014 respectively Required (1) Determine the carrying amount of the building as at June 30, 2013 and 2014 if the company used the cost method to account for the building Cost method Carrying amount 30/6/2013 Carrying amount 30/6/2014 Summary of balances and charges Building Acc 30 Jun 2013 30 Jun 2014 umulated depreciation 2013 2014 Depreciation expense (2) Determine the carrying amount of the building as at June 30, 2013 and 2014 if the company used the revaluation method to account for the building where the balance of the accumulated depreciation on date of revaluation is adjusted using (a) Write-off method Carrying amount 30/6/2013 Carrying amount 30/6/2014 Summary of balances and charges 30 Jun 2013 30 Jun 2014 Building Accumulated depreciation Revaluation reserve (equity) 2013 2014 Depreciation expense Revaluation surplus (OCI) (b) Proportionate restatement method Carrying amount 30/6/2013 Carrying amount 30/6/2014 Summary of balances and charges 30 Jun 2013 30 Jun 2014 Building Accumulated depreciation Revaluation reserve (equity) 2013 2014 Depreciation expense Revaluation surplus (OCI) AT Travel Limited acquired a two-story building for use as an office on June 30, 2012 at $2 million. The building is expected to have a useful life of 20 years and a residual value of $100,000. The company used the straight-line method to depreciate the building. On July 1, 2013, the company paid $38,000 for the completion of the newly built car park lots at the back of the building. The market value of the building was estimated at $2.2 million and $2.5 million on June 30, 2013 and 2014 respectively Required (1) Determine the carrying amount of the building as at June 30, 2013 and 2014 if the company used the cost method to account for the building Cost method Carrying amount 30/6/2013 Carrying amount 30/6/2014 Summary of balances and charges Building Acc 30 Jun 2013 30 Jun 2014 umulated depreciation 2013 2014 Depreciation expense (2) Determine the carrying amount of the building as at June 30, 2013 and 2014 if the company used the revaluation method to account for the building where the balance of the accumulated depreciation on date of revaluation is adjusted using (a) Write-off method Carrying amount 30/6/2013 Carrying amount 30/6/2014 Summary of balances and charges 30 Jun 2013 30 Jun 2014 Building Accumulated depreciation Revaluation reserve (equity) 2013 2014 Depreciation expense Revaluation surplus (OCI) (b) Proportionate restatement method Carrying amount 30/6/2013 Carrying amount 30/6/2014 Summary of balances and charges 30 Jun 2013 30 Jun 2014 Building Accumulated depreciation Revaluation reserve (equity) 2013 2014 Depreciation expense Revaluation surplus (OCI)