Question

At what underlying stock price for SPY is the option at-the-money? What is the premium of the call option using the European Black-Scholes option pricing

At what underlying stock price for SPY is the option at-the-money?

What is the premium of the call option using the European Black-Scholes option pricing model?

What would be the expected premium of the call option if the underlying stock price for SPY increased to $490 per share (Hint: adjust the input S in your B-S model)?

What would be your dollar return had you purchased a single contract at the call premium when the SPY price was $464.72 and sold at the expected call premium if the underlying SPY price increased to $490 (do not round the forecasted premium)?

What would be your percent return had you purchased a single contract at the call premium when the SPY price was $464.72 and sold at the expected call premium if the underlying SPY price increased to $490 (do not round the forecasted premium)?

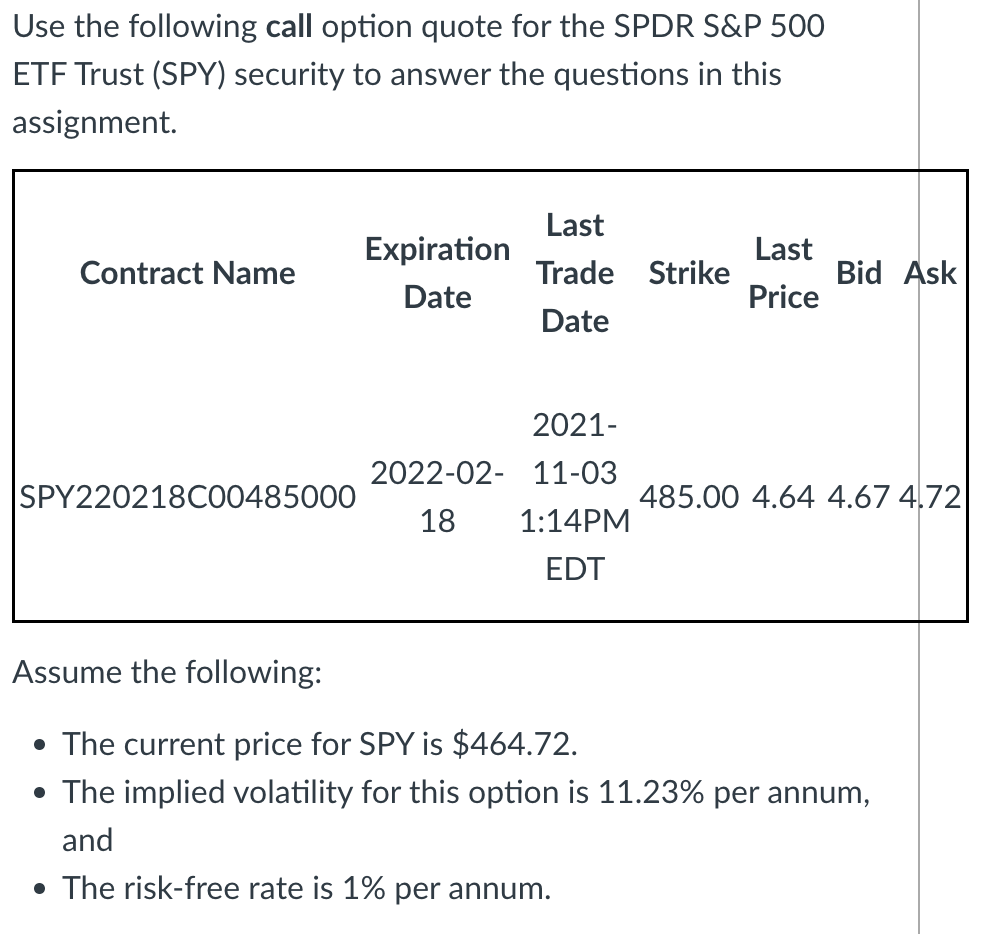

Use the following call option quote for the SPDR S&P 500 ETF Trust (SPY) security to answer the questions in this assignment. Contract Name Expiration Date Last Trade Strike Date Last Price Bid Ask 2021- 2022-02- 11-03 SPY220218C00485000 485.00 4.64 4.67 4.72 18 1:14PM EDT Assume the following: The current price for SPY is $464.72. The implied volatility for this option is 11.23% per annum, and The risk-free rate is 1% per annum. Use the following call option quote for the SPDR S&P 500 ETF Trust (SPY) security to answer the questions in this assignment. Contract Name Expiration Date Last Trade Strike Date Last Price Bid Ask 2021- 2022-02- 11-03 SPY220218C00485000 485.00 4.64 4.67 4.72 18 1:14PM EDT Assume the following: The current price for SPY is $464.72. The implied volatility for this option is 11.23% per annum, and The risk-free rate is 1% per annumStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started