Answered step by step

Verified Expert Solution

Question

1 Approved Answer

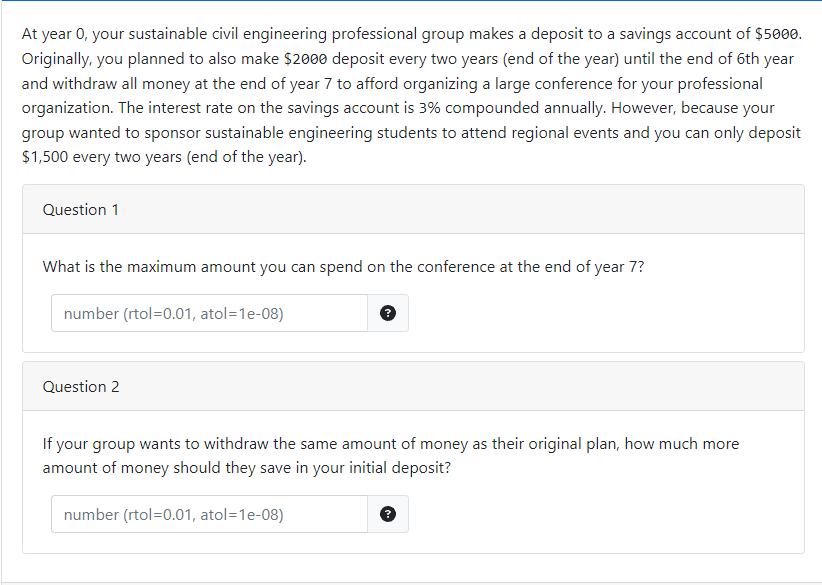

At year 0, your sustainable civil engineering professional group makes a deposit to a savings account of $5000. Originally, you planned to also make

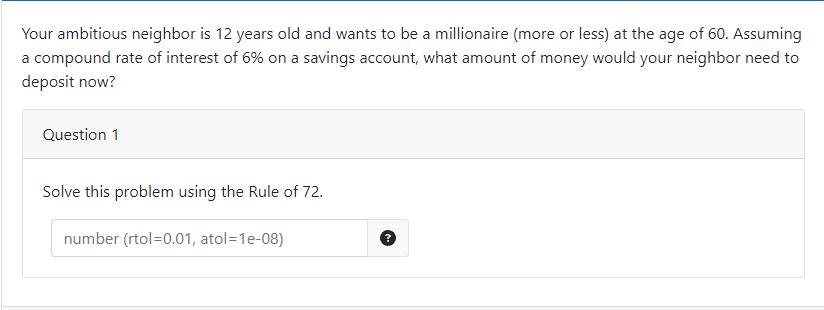

At year 0, your sustainable civil engineering professional group makes a deposit to a savings account of $5000. Originally, you planned to also make $2000 deposit every two years (end of the year) until the end of 6th year and withdraw all money at the end of year 7 to afford organizing a large conference for your professional organization. The interest rate on the savings account is 3% compounded annually. However, because your group wanted to sponsor sustainable engineering students to attend regional events and you can only deposit $1,500 every two years (end of the year). Question 1 What is the maximum amount you can spend on the conference at the end of year 7? number (rtol=0.01, atol=1e-08) Question 2 If your group wants to withdraw the same amount of money as their original plan, how much more amount of money should they save in your initial deposit? number (rtol=0.01, atol=1e-08) Your ambitious neighbor is 12 years old and wants to be a millionaire (more or less) at the age of 60. Assuming a compound rate of interest of 6% on a savings account, what amount of money would your neighbor need to deposit now? Question 1 Solve this problem using the Rule of 72. number (rtol=0.01, atol=1e-08)

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer To answer your questions lets break them down one by one Question 1 To calculate the maximum amount you can spend on the conference at the end of year 7 we need to consider the deposits made an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started