Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At year end 2017, Alpha Technologies' balance sheet showed gross plant, property and equipment amount of $5,000,000 and accumulated depreciation of $2,700,000. During 2018, Alpha

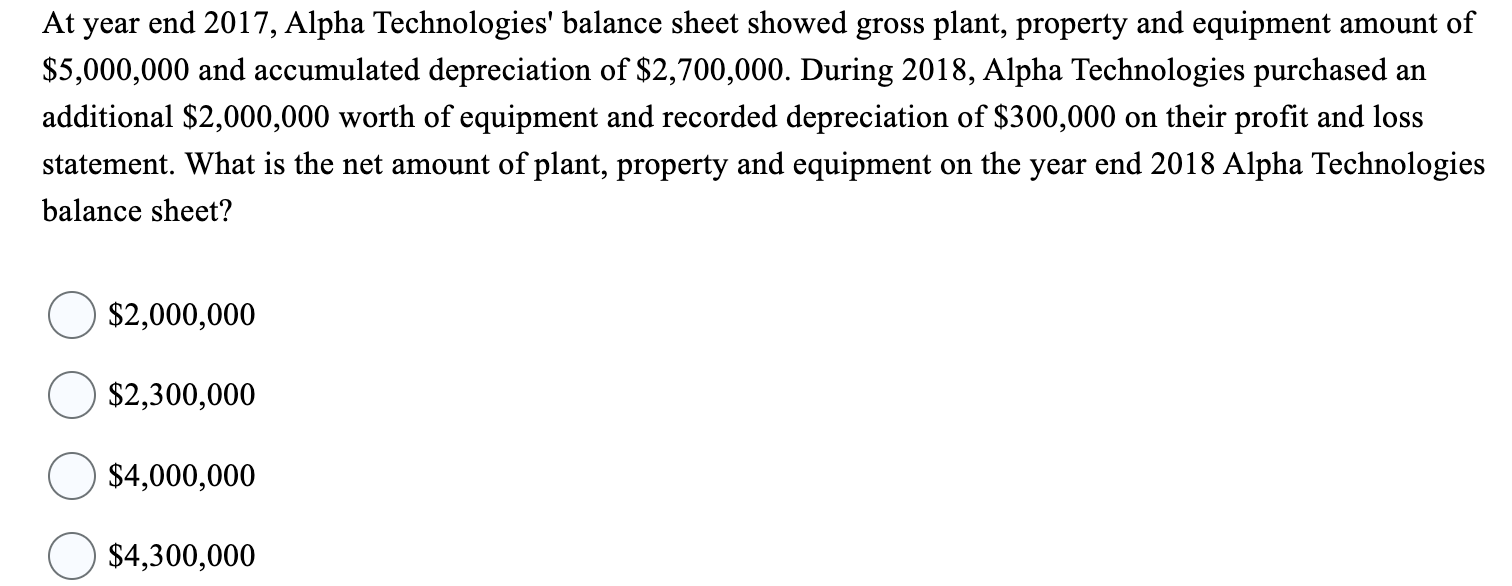

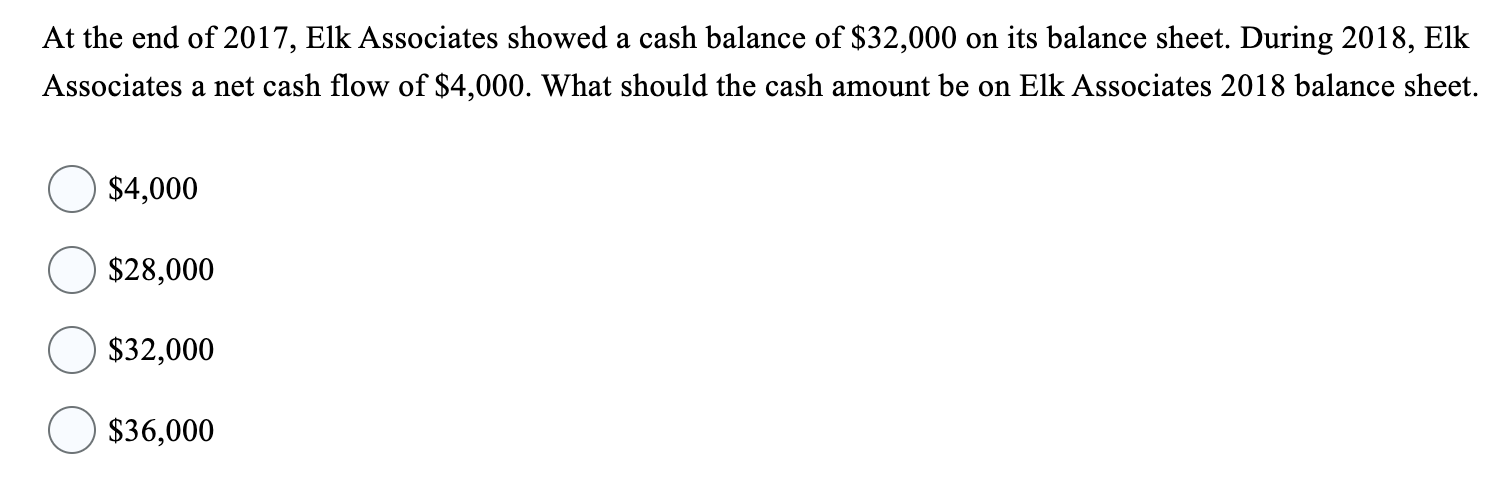

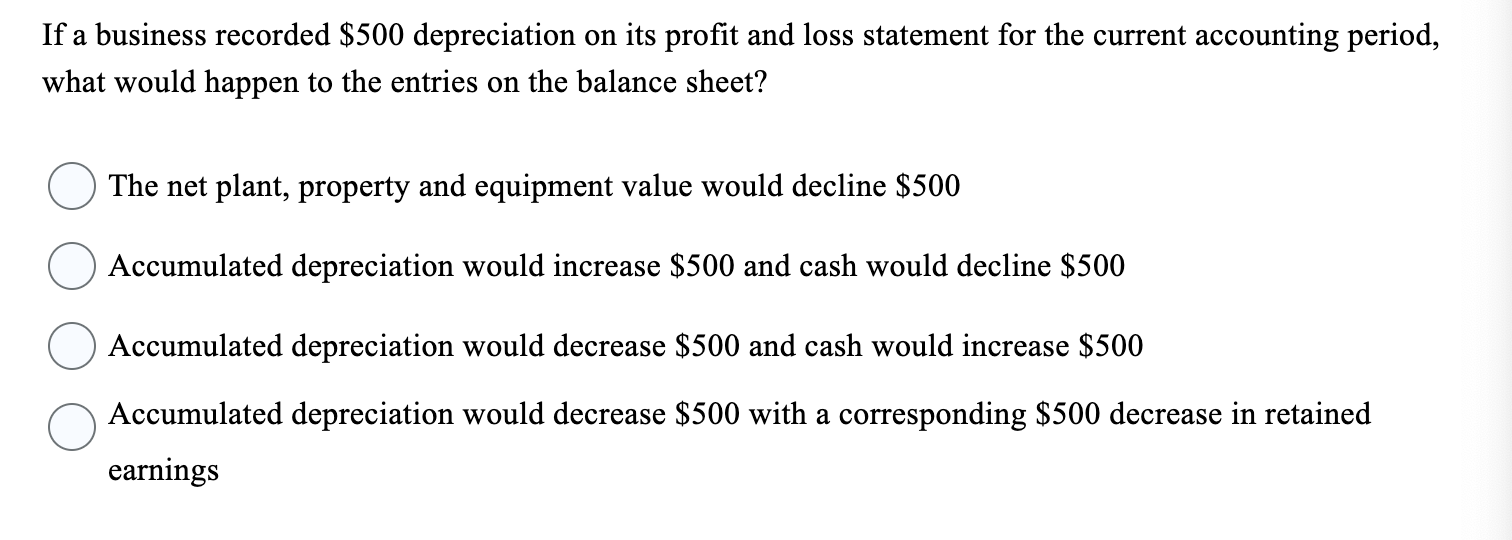

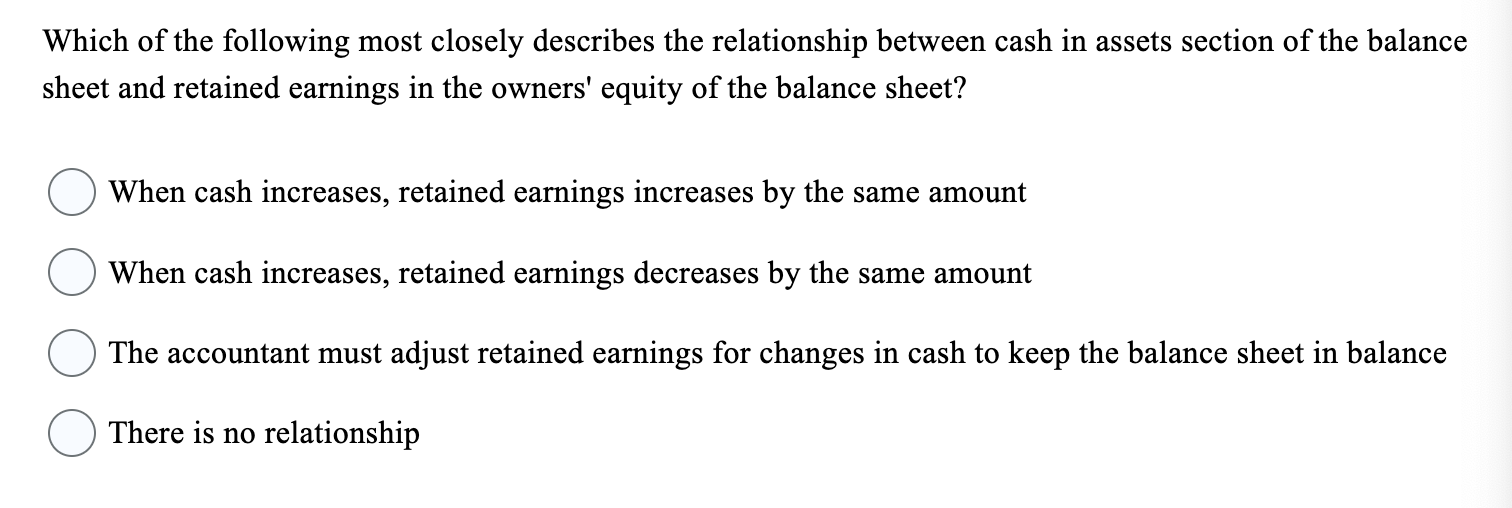

At year end 2017, Alpha Technologies' balance sheet showed gross plant, property and equipment amount of $5,000,000 and accumulated depreciation of $2,700,000. During 2018, Alpha Technologies purchased an additional $2,000,000 worth of equipment and recorded depreciation of $300,000 on their profit and loss statement. What is the net amount of plant, property and equipment on the year end 2018 Alpha Technologies balance sheet? $2,000,000$2,300,000$4,000,000$4,300,000 At the end of 2017, Elk Associates showed a cash balance of $32,000 on its balance sheet. During 2018, Elk Associates a net cash flow of $4,000. What should the cash amount be on Elk Associates 2018 balance sheet. $4,000 $28,000 $32,000 $36,000 If a business recorded $500 depreciation on its profit and loss statement for the current accounting period, what would happen to the entries on the balance sheet? The net plant, property and equipment value would decline $500 Accumulated depreciation would increase $500 and cash would decline $500 Accumulated depreciation would decrease $500 and cash would increase $500 Accumulated depreciation would decrease $500 with a corresponding $500 decrease in retained earnings Which of the following most closely describes the relationship between cash in assets section of the balance sheet and retained earnings in the owners' equity of the balance sheet? When cash increases, retained earnings increases by the same amount When cash increases, retained earnings decreases by the same amount The accountant must adjust retained earnings for changes in cash to keep the balance sheet in balance There is no relationship When preparing quarterly financial statements, an accountant must prepare all three of the main financial statements - the profit and loss statement, the balance sheet, and the cash flow statement - as the values on one financial statement affect the values on the others. True False

At year end 2017, Alpha Technologies' balance sheet showed gross plant, property and equipment amount of $5,000,000 and accumulated depreciation of $2,700,000. During 2018, Alpha Technologies purchased an additional $2,000,000 worth of equipment and recorded depreciation of $300,000 on their profit and loss statement. What is the net amount of plant, property and equipment on the year end 2018 Alpha Technologies balance sheet? $2,000,000$2,300,000$4,000,000$4,300,000 At the end of 2017, Elk Associates showed a cash balance of $32,000 on its balance sheet. During 2018, Elk Associates a net cash flow of $4,000. What should the cash amount be on Elk Associates 2018 balance sheet. $4,000 $28,000 $32,000 $36,000 If a business recorded $500 depreciation on its profit and loss statement for the current accounting period, what would happen to the entries on the balance sheet? The net plant, property and equipment value would decline $500 Accumulated depreciation would increase $500 and cash would decline $500 Accumulated depreciation would decrease $500 and cash would increase $500 Accumulated depreciation would decrease $500 with a corresponding $500 decrease in retained earnings Which of the following most closely describes the relationship between cash in assets section of the balance sheet and retained earnings in the owners' equity of the balance sheet? When cash increases, retained earnings increases by the same amount When cash increases, retained earnings decreases by the same amount The accountant must adjust retained earnings for changes in cash to keep the balance sheet in balance There is no relationship When preparing quarterly financial statements, an accountant must prepare all three of the main financial statements - the profit and loss statement, the balance sheet, and the cash flow statement - as the values on one financial statement affect the values on the others. True False Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started