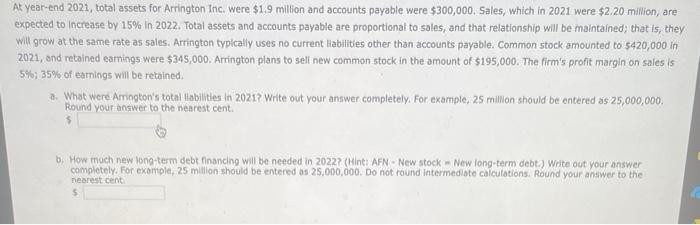

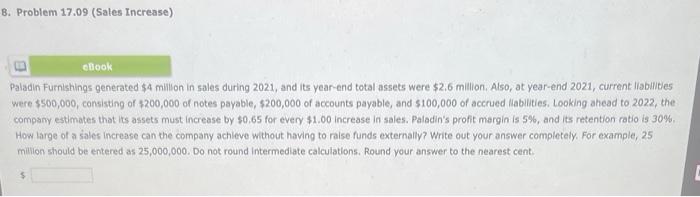

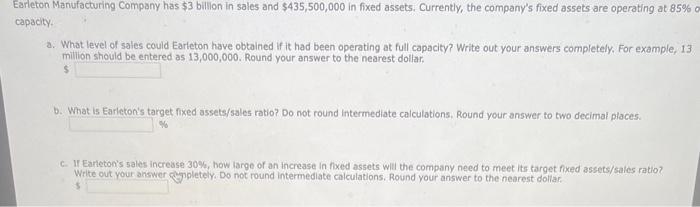

At year-end 2021, total assets for Arrington Inc. were $1.9 million and accounts payable were $300,000. Sales, which in 2021 were $2.20 million, are expected to increase by 15% in 2022 . Total assets and accounts payable are proportional to sales, and that relationship will be maintained; that is, they will grow at the same rate as sales. Arrington typically uses no current liabilities other than accounts payable. Common 5 tock amounted to $420,000 in 2021 , and retained eamings were $345,000. Arrington plans to sell new common stock in the amount of $195,000. The firm's profit margin on sales is 5%;35% of eamings will be retained. a. What were Amington's total liabilities in 2021? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Round vour answer to the nearest cent. s 6. How moch new long-term debt financing will be needed in 2022 ? (Hint: AFN - New stock - New long-term debt.) Write out your answer completely. For example, 25 millon should be entered as 25,000,000. Do not round intermediate coiculations. Round your answer to the nearest centi: Paladin Furnishings generated $4 million in sales during 2021, and its year-end total assets were $2.6 million, Also, at year-end 2021, current liabliltes were $500,000, consisting of $200,000 of notes payable, $200,000 of accounts payable, and $100,000 of accrued llabilities. Looking ahead to 2022, the company estimates that its assets must increase by $0.65 for every $1.00 increase in sales. Paladin's profit margin is 5%, and its retention ratio is 30%. How large of a sales increase can the company achieve without having to raise funds externally? Write out your answer completely. For example, 25 millon should be entered as 25,000,000. Do not round intermediate calculations. Round your answer to the nearest cent. Earleton Manufacturing Company has $3 billion in sales and $435,500,000 in fixed assets. Currently, the company's fixed assets are operating at 85% capacity. a. What level of sales could Earleton have obtained if it had been operating at full capacity? Write out your answers completely. For example, 13 million should be antared as 13,000,000. Round your answer to the nearest dollar, $ b. What is Earleton's target fixed assets/sales ratio? Do not round intermediate calculations. Round your answer to two decimal places. c. If Earieton's sales increase 30%, how targe of an increase in foxed assets will the company need to meet its target fixed assets/saies ratio