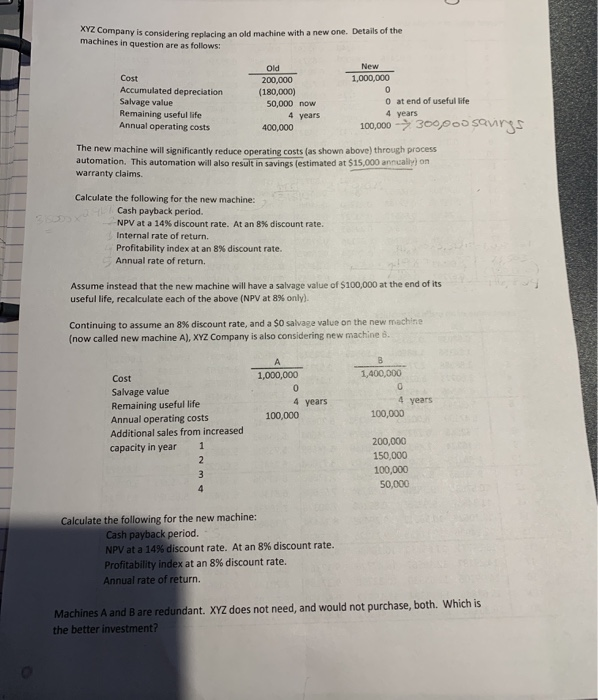

ATC Company is considering replacing an old machine with a new one. Details of the machines in question are as follows: Old Cost 200,000 1,000,000 Accumulated depreciation (180,000) Salvage value 50,000 now O at end of useful life Remaining useful life 4 years 4 years Annual operating costs 400,000 The new machine will significantly reduce operating costs (as shown above) through process automation. This automation will also result in savings (estimated at $15,000 annually on warranty claims 100,000 - 300poo savings Calculate the following for the new machine: Cash payback period. NPV at a 14% discount rate. At an 8% discount rate. Internal rate of return. Profitability index at an 8% discount rate. Annual rate of return. Assume instead that the new machine will have a salvage value of $100,000 at the end of its useful life, recalculate each of the above (NPV at 8% only) Continuing to assume an 8% discount rate, and a $0 salvage value on the new machine (now called new machine A), XYZ Company is also considering new machine B. 1,000,000 1,400,000 Cost Salvage value Remaining useful life Annual operating costs Additional sales from increased capacity in year 1 4 years 100,000 4 years 100,000 200,000 150,000 100,000 50,000 Calculate the following for the new machine: Cash payback period. NPV at a 14% discount rate. At an 8% discount rate. Profitability index at an 8% discount rate. Annual rate of return. Machines A and B are redundant. XYZ does not need, and would not purchase, both. Which is the better investment? ATC Company is considering replacing an old machine with a new one. Details of the machines in question are as follows: Old Cost 200,000 1,000,000 Accumulated depreciation (180,000) Salvage value 50,000 now O at end of useful life Remaining useful life 4 years 4 years Annual operating costs 400,000 The new machine will significantly reduce operating costs (as shown above) through process automation. This automation will also result in savings (estimated at $15,000 annually on warranty claims 100,000 - 300poo savings Calculate the following for the new machine: Cash payback period. NPV at a 14% discount rate. At an 8% discount rate. Internal rate of return. Profitability index at an 8% discount rate. Annual rate of return. Assume instead that the new machine will have a salvage value of $100,000 at the end of its useful life, recalculate each of the above (NPV at 8% only) Continuing to assume an 8% discount rate, and a $0 salvage value on the new machine (now called new machine A), XYZ Company is also considering new machine B. 1,000,000 1,400,000 Cost Salvage value Remaining useful life Annual operating costs Additional sales from increased capacity in year 1 4 years 100,000 4 years 100,000 200,000 150,000 100,000 50,000 Calculate the following for the new machine: Cash payback period. NPV at a 14% discount rate. At an 8% discount rate. Profitability index at an 8% discount rate. Annual rate of return. Machines A and B are redundant. XYZ does not need, and would not purchase, both. Which is the better investment