Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AthamSoft, a leading software producer in the mathematical field, is considering a set of capital projects to increase future income. The predicted costs and

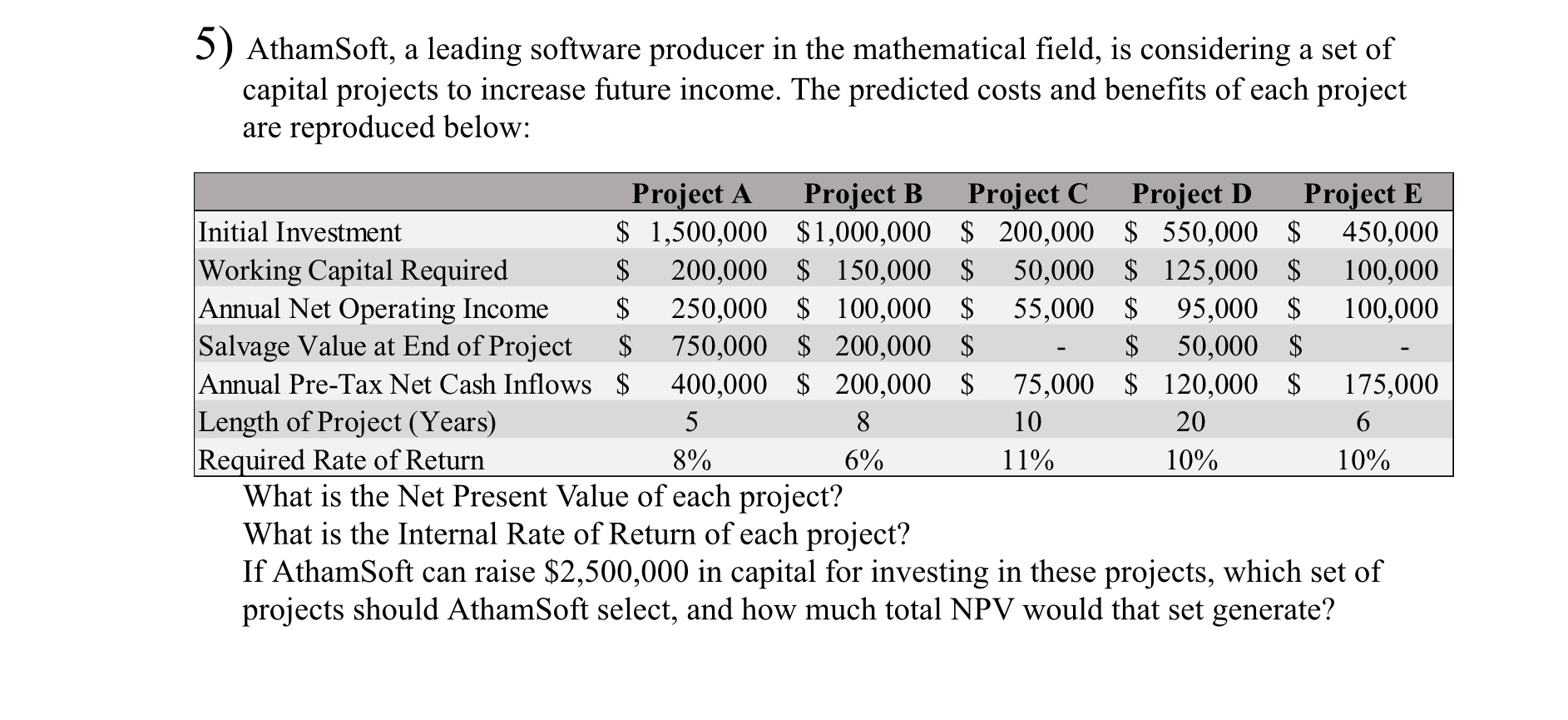

AthamSoft, a leading software producer in the mathematical field, is considering a set of capital projects to increase future income. The predicted costs and benefits of each project are reproduced below: Initial Investment Project A $ 1,500,000 Working Capital Required $ Project B $1,000,000 200,000 $ 150,000 $ $ Project C 200,000 50,000 Project D $ 550,000 Project E $ 450,000 $125,000 $ 100,000 Annual Net Operating Income $ 250,000 $ 100,000 $ 55,000 $ 95,000 $ 100,000 Salvage Value at End of Project $ 750,000 $200,000 $ $ 50,000 $ Annual Pre-Tax Net Cash Inflows $ Length of Project (Years) 5 8 400,000 $200,000 $ 75,000 10 $120,000 $ 175,000 20 6 Required Rate of Return 8% 6% 11% 10% 10% What is the Net Present Value of each project? What is the Internal Rate of Return of each project? If AthamSoft can raise $2,500,000 in capital for investing in these projects, which set of projects should AthamSoft select, and how much total NPV would that set generate?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started