Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Athar commenced business on I January 2012 trading as Athar Kitchen Cabinets, selling 3 - D kitchen furniture. He had opened a business bank account

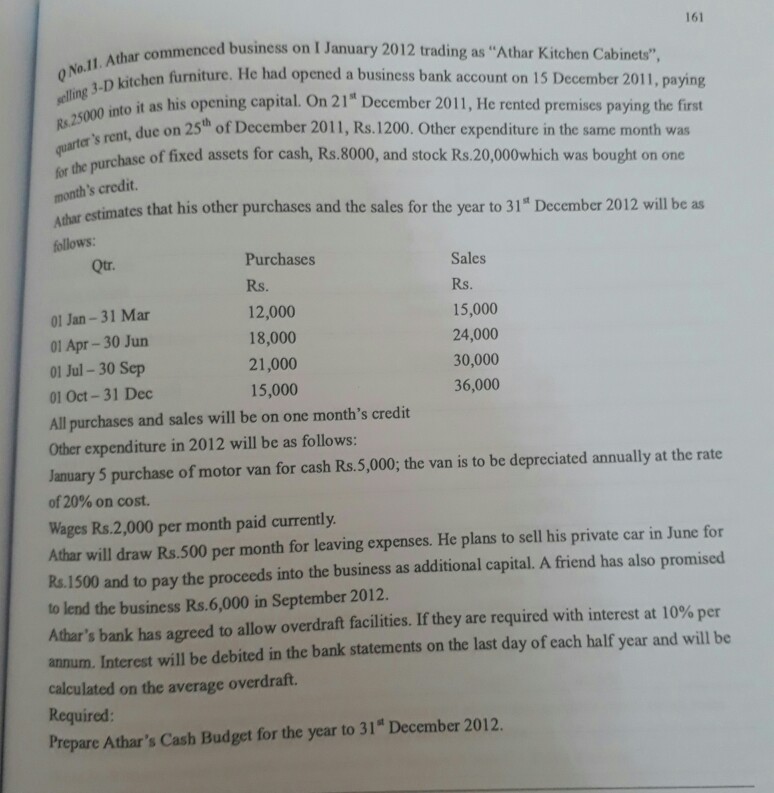

Athar commenced business on I January 2012 trading as "Athar Kitchen Cabinets", selling 3 - D kitchen furniture. He had opened a business bank account on 15 December 2011, paying Rs. 25000 into it as his opening capital on 21^th December 2011, Rs. 1200. Other expenditure in the same month was for the purchase of fixed assets for cash, Rs. 8000, and stock Rs. 20,000 which was bought on one month's credit. Athar estimates that his other purchases and the sales for the year to 31^st December 2012 will be as follows: All purchases and sales will be on one months credit Other expenditure in 2012 will be as follows. January 5 purchase of motor van for cash Rs. 5,000: the van is to be depreciated annually at the rate of 20% on cost. Wages Rs. 2,000 per month paid currently. Athar will draw Rs. 500 per month for leaving expenses. He plans to sell his private car in June for Rs. 1500 and to pay the proceeds into the business as additional capital. A friend has also promised to lend the business Rs. 6,000 in September 2012. Athars bank has agreed to allow overdraft facilities. If they are require with interest a, 10% per annum. Interest will be debited in the bank statements on the last day of each half year and will be calculated on the average overdraft. Required: Prepare Athar's Cash Budget for the year to 31^st December 2012

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started