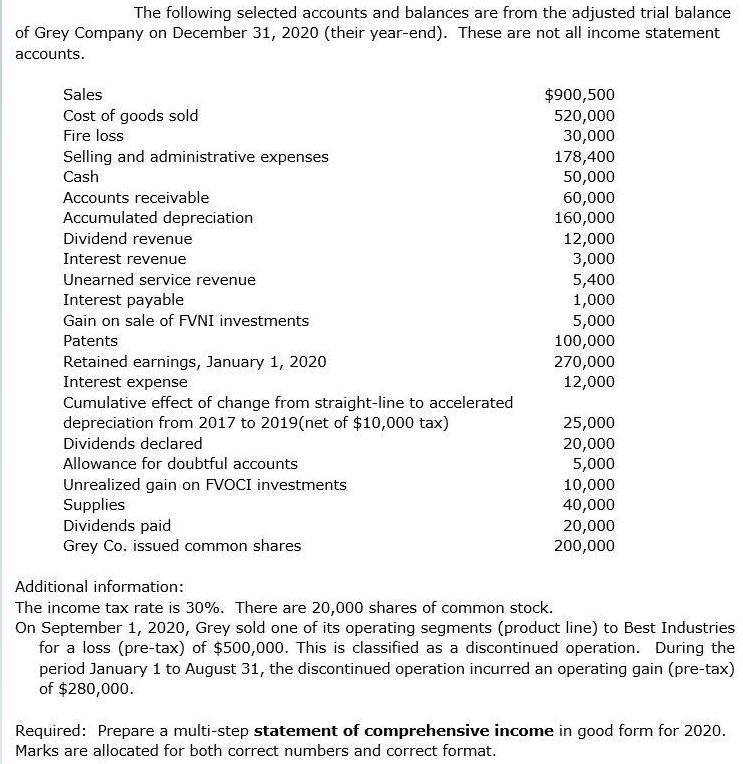

The following selected accounts and balances are from the adjusted trial balance of Grey Company on December 31, 2020 (their year-end). These are not

The following selected accounts and balances are from the adjusted trial balance of Grey Company on December 31, 2020 (their year-end). These are not all income statement accounts. Sales $900,500 Cost of goods sold 520,000 30,000 178,400 50,000 Fire loss Selling and administrative expenses Cash Accounts receivable 60,000 160,000 12,000 3,000 5,400 1,000 5,000 100,000 270,000 12,000 Accumulated depreciation Dividend revenue Interest revenue Unearned service revenue Interest payable Gain on sale of FVNI investments Patents Retained earnings, January 1, 2020 Interest expense Cumulative effect of change from straight-line to accelerated depreciation from 2017 to 2019(net of $10,000 tax) 25,000 20,000 5,000 Dividends declared Allowance for doubtful accounts Unrealized gain on FVOCI investments Supplies Dividends paid Grey Co. issued common shares 10,000 40,000 20,000 200,000 Additional information: The income tax rate is 30%. There are 20,000 shares of common stock. On September 1, 2020, Grey sold one of its operating segments (product line) to Best Industries for a loss (pre-tax) of $500,000. This is classified as a discontinued operation. During the period January 1 to August 31, the discontinued operation incurred an operating gain (pre-tax) of $280,000. Required: Prepare a multi-step statement of comprehensive income in good form for 2020. Marks are allocated for both correct numbers and correct format.

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started