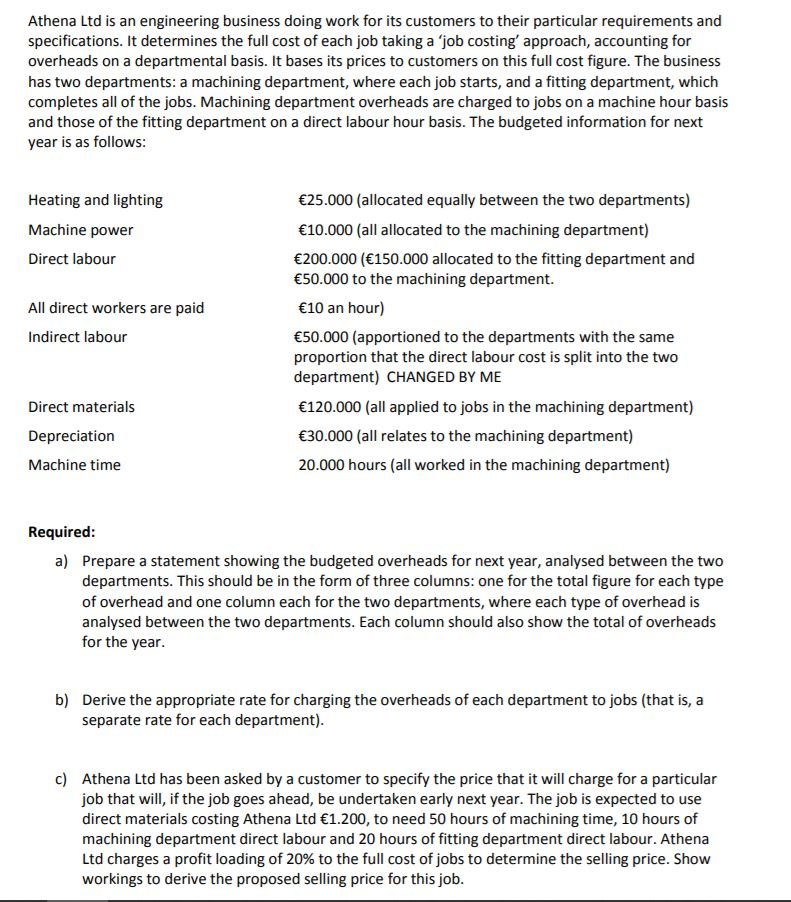

Athena Ltd is an engineering business doing work for its customers to their particular requirements and specifications. It determines the full cost of each job taking a 'job costing' approach, accounting for overheads on a departmental basis. It bases its prices to customers on this full cost figure. The business has two departments: a machining department, where each job starts, and a fitting department, which completes all of the jobs. Machining department overheads are charged to jobs on a machine hour basis and those of the fitting department on a direct labour hour basis. The budgeted information for next year is as follows: 25.000 (allocated equally between the two departments) Heating and lighting 10.000 (all allocated to the machining department) Machine power 200.000 (150.000 allocated to the fitting department and 50.000 to the machining department. Direct labour All direct workers are paid 10 an hour) Indirect labour 50.000 (apportioned to the departments with the same proportion that the direct labour cost is split into the two department) CHANGED BY ME 120.000 (all applied to jobs in the machining department) Direct materials Depreciation 30.000 (all relates to the machining department) Machine time 20.000 hours (all worked in the machining department) Required: Prepare a statement showing the budgeted overheads for next year, analysed between the two a) departments. This should be in the form of three columns: one for the total figure for each type of overhead and one column each for the two departments, where each type of overhead is analysed between the two departments. Each column should also show the total of overheads for the year. b) Derive the appropriate rate for charging the overheads of each department to jobs (that is, a separate rate for each department). Athena Ltd has been asked by a customer to specify the price that it will charge for a particular c) job that will, if the job goes ahead, be undertaken early next year. The job is expected to use direct materials costing Athena Ltd 1.200, to need 50 hours of machining time, 10 hours of machining department direct labour and 20 hours of fitting department direct labour. Athena Ltd charges a profit loading of 20% to the full cost of jobs to determine the selling price. Show workings to derive the proposed selling price for this job