Answered step by step

Verified Expert Solution

Question

1 Approved Answer

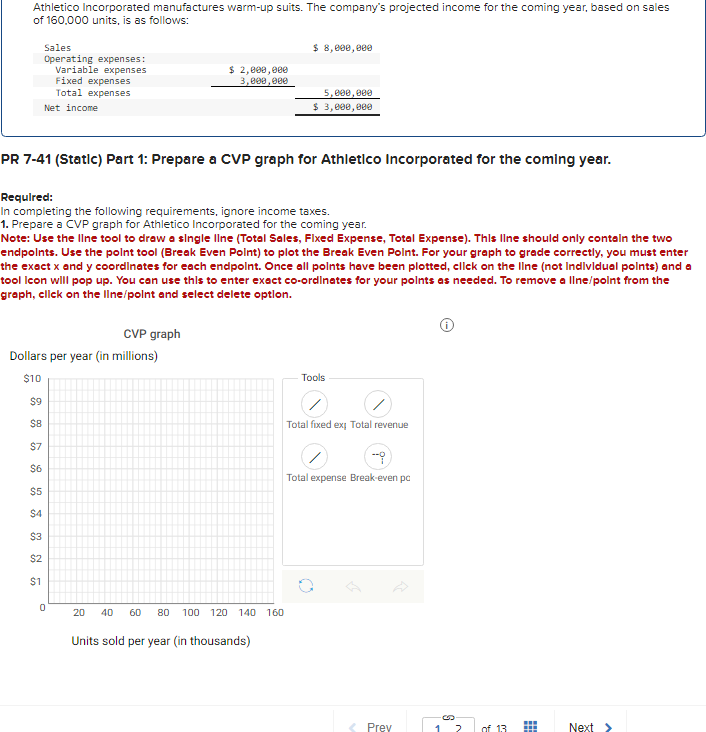

Athletico Incorporated manufactures warm-up suits. The company's projected income for the coming year, based on sales of 160,000 units, is as follows: PR 7-41 (Statlc)

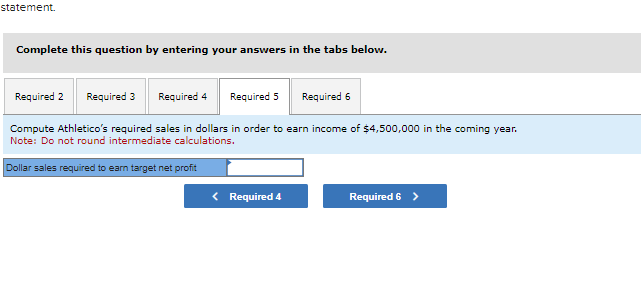

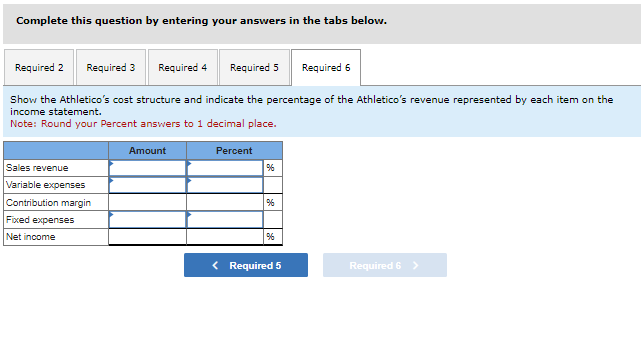

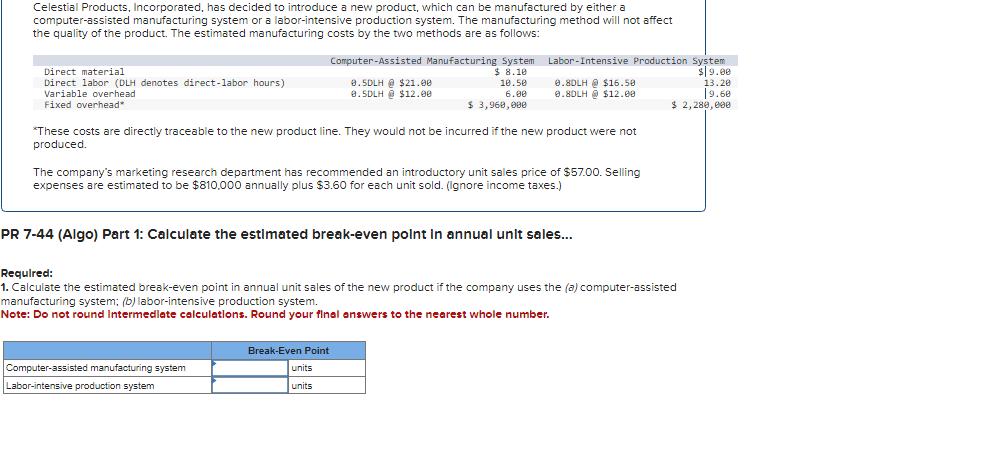

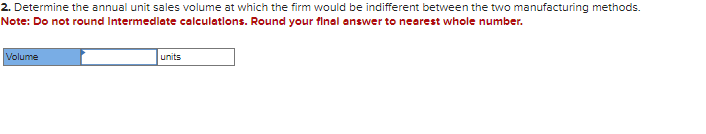

Athletico Incorporated manufactures warm-up suits. The company's projected income for the coming year, based on sales of 160,000 units, is as follows: PR 7-41 (Statlc) Part 1: Prepare a CVP graph for Athletlco Incorporated for the coming year. Requlred: In completing the following requirements, ignore income taxes. 1. Prepare a CVP graph for Athletico Incorporated for the coming year. Note: Use the Ilne tool to drow o single llne (Totol Sales, Flxed Expense, Total Expense). Thls llne should only conteln the two endpolnts. Use the polnt tool (Break Even Polnt) to plot the Break Even Polnt. For your graph to grade correctly, you must enter the exoct x and y coordinates for each endpolnt. Once all polnts have been plotted, cllek on the line (not Indlvidual polnts) and tool lcon will pop up. You con use thls to enter exect co-ordlnates for your polnts as needed. To remove a llne/polnt from the groph, cllck on the llne/polnt and select delete option. statement. Complete this question by entering your answers in the tabs below. Calculate the firm's break-even point for the year in sales dollars. Note: Do not round intermediate calculations. statement. Complete this question by entering your answers in the tabs below. What is the company's margin of safety for the year? Note: Do not round intermediate calculations. statement. Complete this question by entering your answers in the tabs below. Compute Athletico's operating leverage factor, based on the budgeted sales volume for the year. statement. Complete this question by entering your answers in the tabs below. Compute Athletico's required sales in dollars in order to earn income of $4,500,000 in the coming year. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Show the Athletico's cost structure and indicate the percentage of the Athletico's revenue represented by each item on the income statement. Note: Round your Percent answers to 1 decimal place. Celestial Products, Incorporated, has decided to introduce a new product, which can be manufactured by either a computer-assisted manufacturing system or a labor-intensive production system. The manufacturing method will not affect the quality of the product. The estimated manufacturing costs by the two methods are as follows: *These costs are directly traceable to the new product line. They would not be incurred if the new product were not produced. The company's marketing research department has recommended an introductory unit sales price of \$57.00. Selling expenses are estimated to be $810,000 annually plus $3.60 for each unit sold. (Ignore income taxes.) PR 7-44 (Algo) Part 1: Calculate the estimated break-even point In annual unlt sales... Requlred: 1. Calculate the estimated break-even point in annual unit sales of the new product if the company uses the (a) computer-assisted manufacturing system; (b) labor-intensive production system. Note: Do not round Intermedlate colculations. Round your flnol onswers to the nearest whole number. Determine the annual unit sales volume at which the firm would be indifferent between the two manufacturing methods. Note: Do not round Intermedlate colculatlons. Round your flnal answer to neorest whole number

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started