Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Atlanta Inc. holds an AFS bond investment issued by Falcons Corporation. The amortized cost of the investment is $140,500 on December 31. Atlanta Inc.

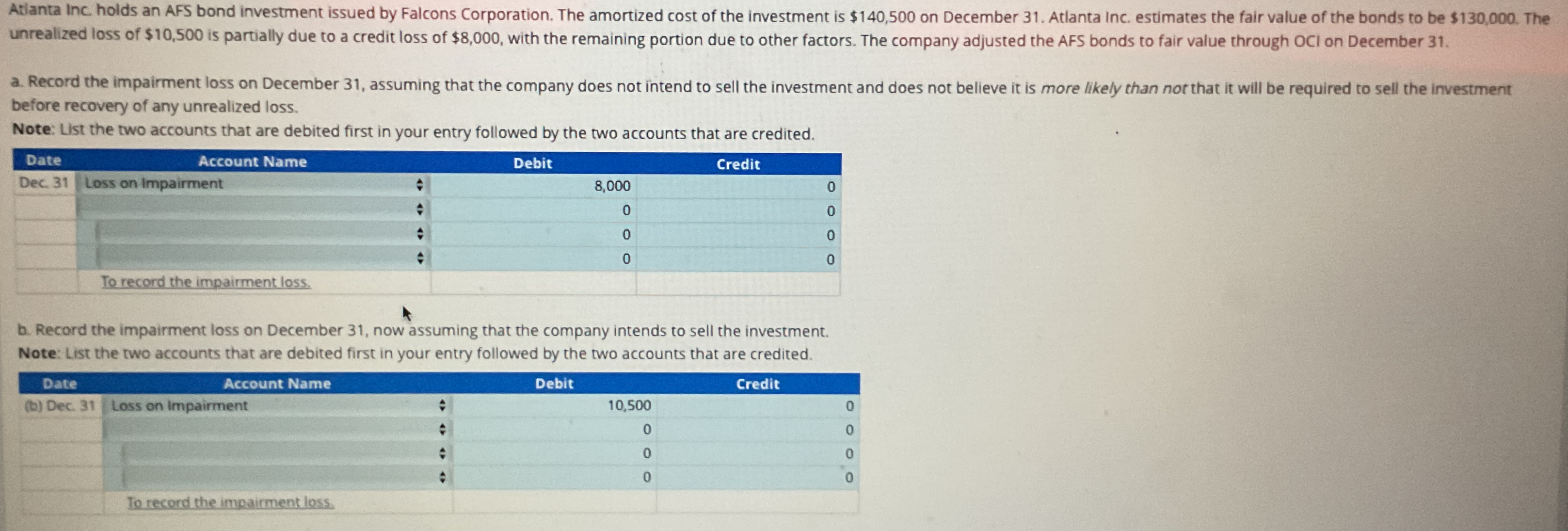

Atlanta Inc. holds an AFS bond investment issued by Falcons Corporation. The amortized cost of the investment is $140,500 on December 31. Atlanta Inc. estimates the fair value of the bonds to be $130,000. The unrealized loss of $10,500 is partially due to a credit loss of $8,000, with the remaining portion due to other factors. The company adjusted the AFS bonds to fair value through OCI on December 31. a. Record the impairment loss on December 31, assuming that the company does not intend to sell the investment and does not believe it is more likely than not that it will be required to sell the investment before recovery of any unrealized loss. Note: List the two accounts that are debited first in your entry followed by the two accounts that are credited. Date Account Name Dec. 31 Loss on Impairment Debit 8,000 0 0 0 Credit To record the impairment loss. b. Record the impairment loss on December 31, now assuming that the company intends to sell the investment. Note: List the two accounts that are debited first in your entry followed by the two accounts that are credited. Date Account Name (b) Dec. 31 Loss on Impairment To record the impairment loss. Debit 10,500 0 0 0 Credit 0 0 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started