Answered step by step

Verified Expert Solution

Question

1 Approved Answer

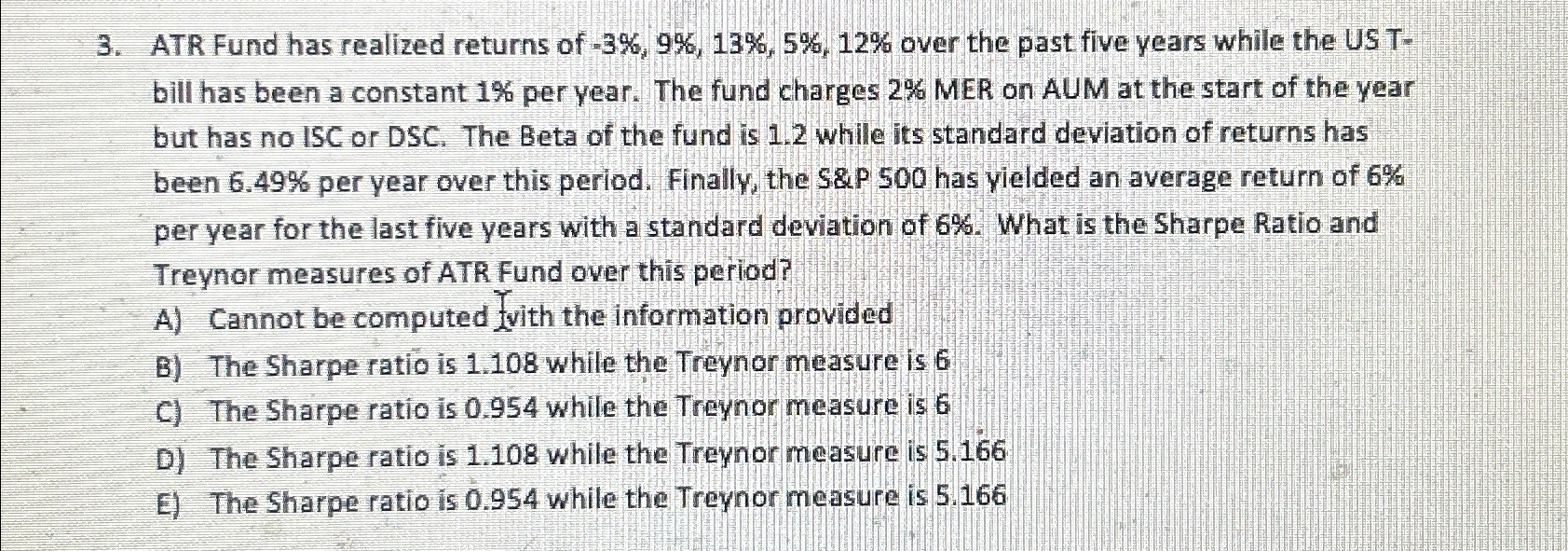

ATR Fund has realized returns of - 3 % , 9 % , 1 3 % , 5 % , 1 2 % over the

ATR Fund has realized returns of over the past five years while the US Tbill has been a constant per year. The fund charges MER on AUM at the start of the year but has no ISC or DSC The Beta of the fund is while its standard deviation of returns has been per year over this period. Finally, the S P has yielded an average return of per year for the last five years with a standard deviation of What is the Sharpe Ratio and Treynor measures of ATR Fund over this period?

A Cannot be computed Ivith the information provided

B The Sharpe ratio is while the Treynor measure is

C The Sharpe ratio is while the Treynor measure is

D The Sharpe ratio is while the Treynor measure is

E The Sharpe ratio is while the Treynor measure is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started