Answered step by step

Verified Expert Solution

Question

1 Approved Answer

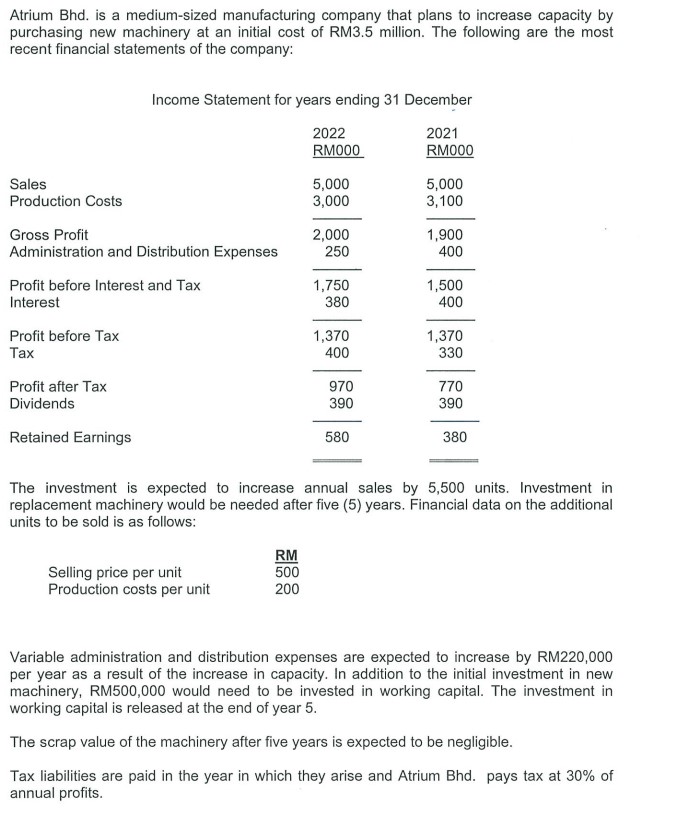

Atrium Bhd. is a medium-sized manufacturing company that plans to increase capacity by purchasing new machinery at an initial cost of RM3.5 million. The

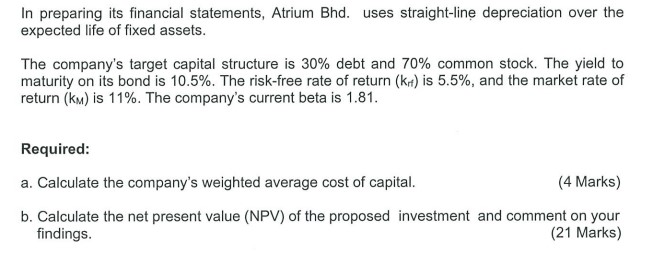

Atrium Bhd. is a medium-sized manufacturing company that plans to increase capacity by purchasing new machinery at an initial cost of RM3.5 million. The following are the most recent financial statements of the company: Income Statement for years ending 31 December 2022 2021 RM000 RM000 Sales 5,000 5,000 Production Costs 3,000 3,100 Gross Profit 2,000 1,900 Administration and Distribution Expenses 250 400 Profit before Interest and Tax 1,750 1,500 Interest 380 400 Profit before Tax 1,370 1,370 Tax 400 330 Profit after Tax Dividends Retained Earnings 970 770 390 390 580 380 The investment is expected to increase annual sales by 5,500 units. Investment in replacement machinery would be needed after five (5) years. Financial data on the additional units to be sold is as follows: RM Selling price per unit Production costs per unit 500 200 Variable administration and distribution expenses are expected to increase by RM220,000 per year as a result of the increase in capacity. In addition to the initial investment in new machinery, RM500,000 would need to be invested in working capital. The investment in working capital is released at the end of year 5. The scrap value of the machinery after five years is expected to be negligible. Tax liabilities are paid in the year in which they arise and Atrium Bhd. pays tax at 30% of annual profits. In preparing its financial statements, Atrium Bhd. uses straight-line depreciation over the expected life of fixed assets. The company's target capital structure is 30% debt and 70% common stock. The yield to maturity on its bond is 10.5%. The risk-free rate of return (Krf) is 5.5%, and the market rate of return (KM) is 11%. The company's current beta is 1.81. Required: a. Calculate the company's weighted average cost of capital. (4 Marks) b. Calculate the net present value (NPV) of the proposed investment and comment on your findings. (21 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started