Answered step by step

Verified Expert Solution

Question

1 Approved Answer

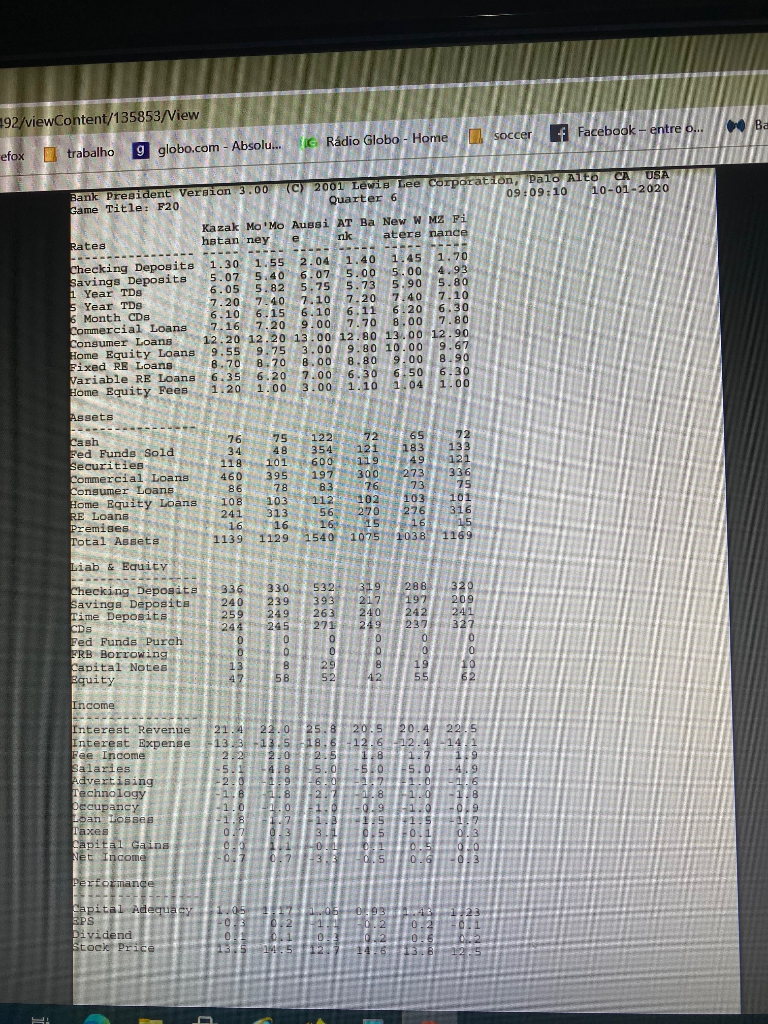

Attach a spreadsheet that breaks -down the ROE for your bank as compared to others. MY BANK IS MZ FINANCE. 192/viewContent/135853 /View G Rdio Globo

Attach a spreadsheet that breaks

Attach a spreadsheet that breaks -down the ROE for your bank as compared to others.

-down the ROE for your bank as compared to others.

MY BANK IS MZ FINANCE.

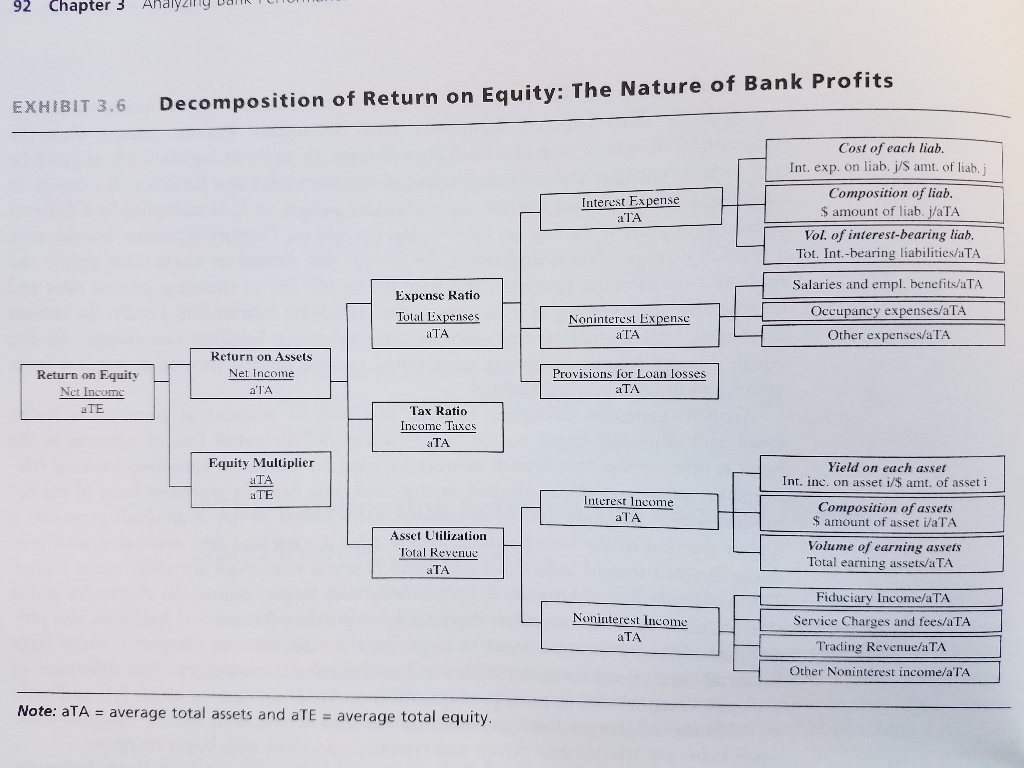

192/viewContent/135853 /View G Rdio Globo - Home Il soccer Facebook - entre o... efox trabalho g globo.com - Absolu... Bank President Version 3.00 (c) 2001 Lewis Lee Corporation, Palo Alto CAUSA Same Title: F20 Quarter 6 09:09:10 10-01-2020 Kazak MoMo Aussi AT Ba New W MZ Fi Rates hstan ney e aters nance ----- ------------- --- 2. - Checking Deposits 1.30 1.55 2.04 1.40 1.45 1.70 Savings Deposits 5.07 5.40 6.07 5.00 5.00 4.93 1 Year TDS 6.05 5.82 5.75 5.73 5.90 5.80 5 Year TDS 7.20 7.40 7.10 7.20 7.40 7.10 6 Month CDs 6.10 6.15 6.10 6.11 6.20 6.30 Commercial Loans 7.16 7.20 9.00 7.70 8.00 7.80 Consumer Loans 12.20 12.20 13.00 12.80 13.00 12.90 Home Equity Loans 9.55 9.75 3.00 9.80 10.00 9.67 Fixed RB Loans 8.70 8.70 8.00 8.80 9.00 8.90 Variable RE Loans 6.35 6.20 7.00 6.30 6.50 6.30 Home Equity Fees 1.20 1.00 3.00 1.10 2.04 1.00 Assets ---- Cash Fed Funds Sold Securities Commercial Loans Consumer Loans Home Equity Loans RE Loans Premises Total Assets 76 75 34 48 118 101 460 395 8678 108 103 241 313 16 16 1139 1129 122 354 600 197 83 112 72 121 119 300 76 102 270 15 1075 65 72 183 133 49 12 273 336 73 75 103 101 276 316 1615 1038 1169 56 16 2540 Liab & Equity -------- Checking Deposits Savings Deposits Time Deposits CDs Fed Funds Purch FRB Borrowing Capital Notes Equity 336 330 240 239 259 249 244 245 0 0 0 13 B 4 5B 532 393 263 271 0 0 29 52 319 217 240 249 0 0 8 12 288 197 242 237 0 0 19 55 320 209 241 327 0 0 10 62 Income 6.0 Interest Revenue Interest Expense Fee Income Salaries Advertising Technology Occupancy Loan Losses Taxes Capital Gains Net Income 21.4 22.0 25.8 20.5 20.4 13.3 13.5 18.6 12.6 2.4 2.2230 2.5 1.8 1.7 5.14.8 -5.0 -5.0 5.0 2.0 B 2.7 1.8 21.0 1.0 0.29 1.B 9.5 +1.5 0.17 3.1 0.5 0 0.0 OL 0.7 0.733.3 0.5 0.6 22.5 14. 1.9 -4.9 1.6 -1.8 0,9 -15 01.3 040 0.3 Perfomance Capital Adequacy EPS Dividend Stock Price 1105 0.3 0.2 0.1 3.5.5 06 1. 0 0.93 0.2 0.2 146 .45 0.2 0.6 1318 1225 92 Chapter 3 Ana EXHIBIT 3.6 Decomposition of Return on Equity: The Nature of Bank Profits Interest Expense TA Cost of each liab. Int. exp. on liab. j/S amt. of liab. Composition of liab. $ amount of liab. j/aTA Vol. of interest-bearing liab. Tot. Int.-bearing liabilities/aTA Expense Ratio Total Expenses aTA Noninterest Expense ATA Salaries and empl. benefits/aTA Occupancy expenses/aTA Other expenses/ATA Return on Equity Net Income ATE Return on Assets Net Income a'TA Provisions for Loan losses aTA Tax Ratio Income Taxes TA Equity Multiplier aTA a TE Interest Income ATA Yield on each asset Int. inc. on asset i/$ amt, of asset i Composition of assets $ amount of asset i/aTA Volume of earning assets Total earning assets/aTA Asset Utilization Total Revenue aTA Fiduciary Income/aTA Noninterest Income ATA Service Charges and fees/ATA Trading Revenue/TA Other Noninterest income/aTA Note: TA = average total assets and aTE = average total equity. 192/viewContent/135853 /View G Rdio Globo - Home Il soccer Facebook - entre o... efox trabalho g globo.com - Absolu... Bank President Version 3.00 (c) 2001 Lewis Lee Corporation, Palo Alto CAUSA Same Title: F20 Quarter 6 09:09:10 10-01-2020 Kazak MoMo Aussi AT Ba New W MZ Fi Rates hstan ney e aters nance ----- ------------- --- 2. - Checking Deposits 1.30 1.55 2.04 1.40 1.45 1.70 Savings Deposits 5.07 5.40 6.07 5.00 5.00 4.93 1 Year TDS 6.05 5.82 5.75 5.73 5.90 5.80 5 Year TDS 7.20 7.40 7.10 7.20 7.40 7.10 6 Month CDs 6.10 6.15 6.10 6.11 6.20 6.30 Commercial Loans 7.16 7.20 9.00 7.70 8.00 7.80 Consumer Loans 12.20 12.20 13.00 12.80 13.00 12.90 Home Equity Loans 9.55 9.75 3.00 9.80 10.00 9.67 Fixed RB Loans 8.70 8.70 8.00 8.80 9.00 8.90 Variable RE Loans 6.35 6.20 7.00 6.30 6.50 6.30 Home Equity Fees 1.20 1.00 3.00 1.10 2.04 1.00 Assets ---- Cash Fed Funds Sold Securities Commercial Loans Consumer Loans Home Equity Loans RE Loans Premises Total Assets 76 75 34 48 118 101 460 395 8678 108 103 241 313 16 16 1139 1129 122 354 600 197 83 112 72 121 119 300 76 102 270 15 1075 65 72 183 133 49 12 273 336 73 75 103 101 276 316 1615 1038 1169 56 16 2540 Liab & Equity -------- Checking Deposits Savings Deposits Time Deposits CDs Fed Funds Purch FRB Borrowing Capital Notes Equity 336 330 240 239 259 249 244 245 0 0 0 13 B 4 5B 532 393 263 271 0 0 29 52 319 217 240 249 0 0 8 12 288 197 242 237 0 0 19 55 320 209 241 327 0 0 10 62 Income 6.0 Interest Revenue Interest Expense Fee Income Salaries Advertising Technology Occupancy Loan Losses Taxes Capital Gains Net Income 21.4 22.0 25.8 20.5 20.4 13.3 13.5 18.6 12.6 2.4 2.2230 2.5 1.8 1.7 5.14.8 -5.0 -5.0 5.0 2.0 B 2.7 1.8 21.0 1.0 0.29 1.B 9.5 +1.5 0.17 3.1 0.5 0 0.0 OL 0.7 0.733.3 0.5 0.6 22.5 14. 1.9 -4.9 1.6 -1.8 0,9 -15 01.3 040 0.3 Perfomance Capital Adequacy EPS Dividend Stock Price 1105 0.3 0.2 0.1 3.5.5 06 1. 0 0.93 0.2 0.2 146 .45 0.2 0.6 1318 1225 92 Chapter 3 Ana EXHIBIT 3.6 Decomposition of Return on Equity: The Nature of Bank Profits Interest Expense TA Cost of each liab. Int. exp. on liab. j/S amt. of liab. Composition of liab. $ amount of liab. j/aTA Vol. of interest-bearing liab. Tot. Int.-bearing liabilities/aTA Expense Ratio Total Expenses aTA Noninterest Expense ATA Salaries and empl. benefits/aTA Occupancy expenses/aTA Other expenses/ATA Return on Equity Net Income ATE Return on Assets Net Income a'TA Provisions for Loan losses aTA Tax Ratio Income Taxes TA Equity Multiplier aTA a TE Interest Income ATA Yield on each asset Int. inc. on asset i/$ amt, of asset i Composition of assets $ amount of asset i/aTA Volume of earning assets Total earning assets/aTA Asset Utilization Total Revenue aTA Fiduciary Income/aTA Noninterest Income ATA Service Charges and fees/ATA Trading Revenue/TA Other Noninterest income/aTA Note: TA = average total assets and aTE = average total equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started