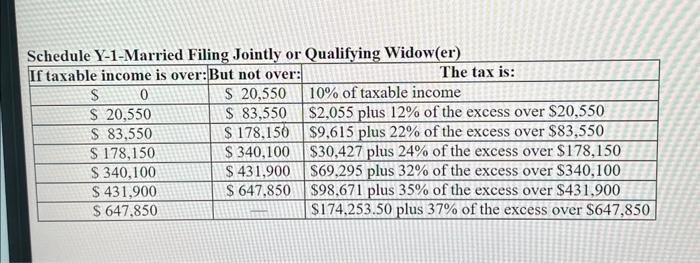

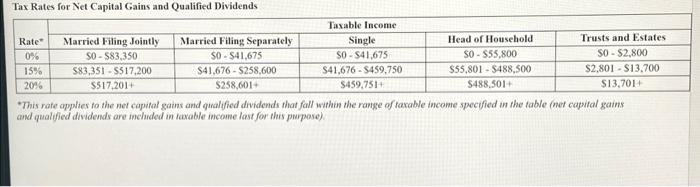

attached are tax rates

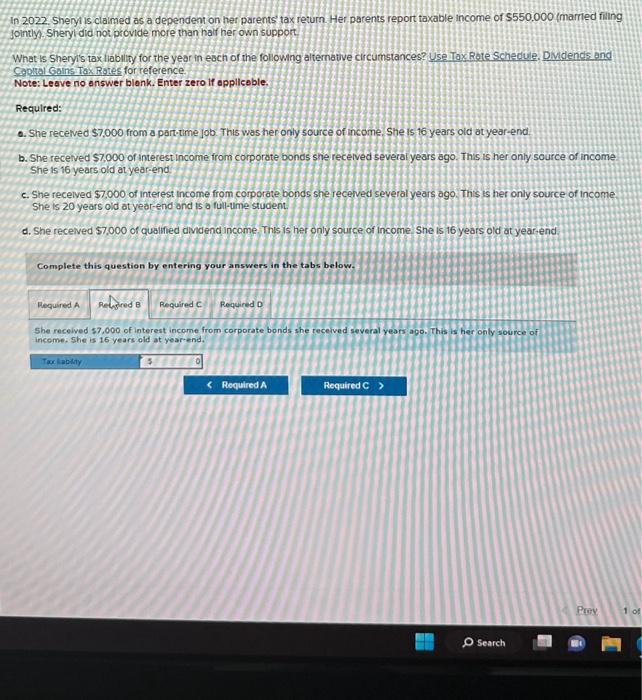

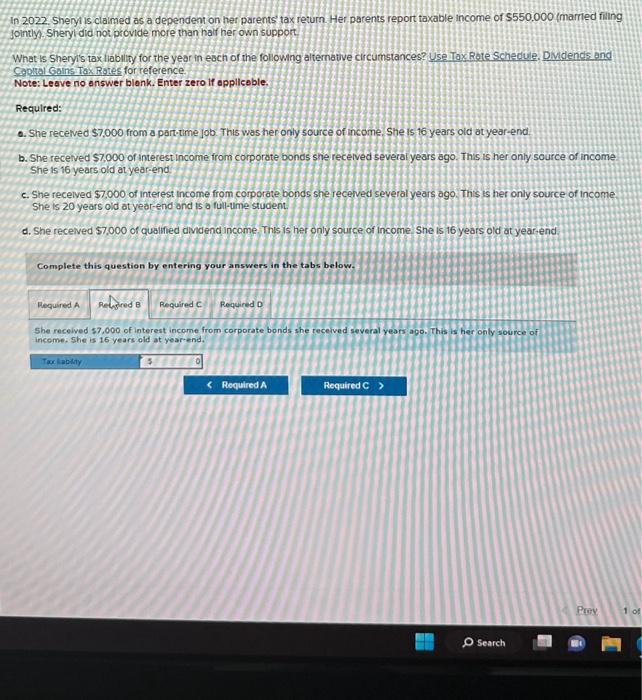

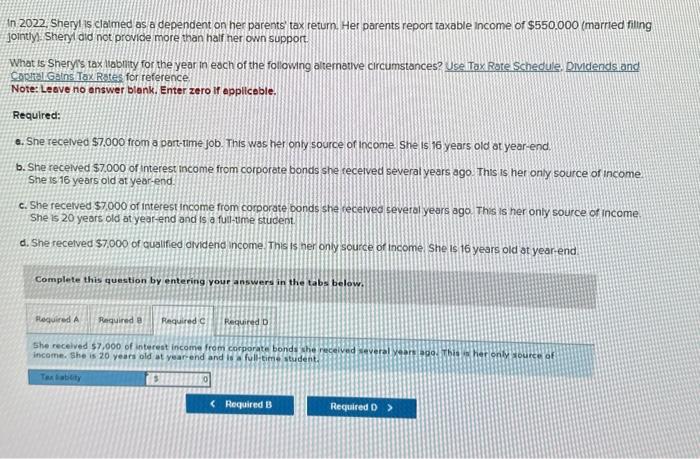

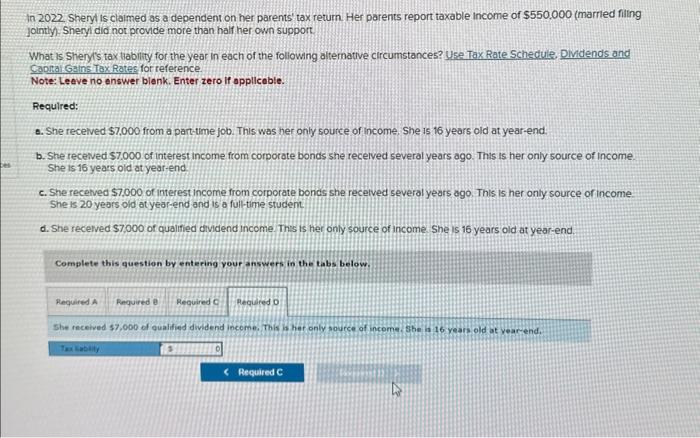

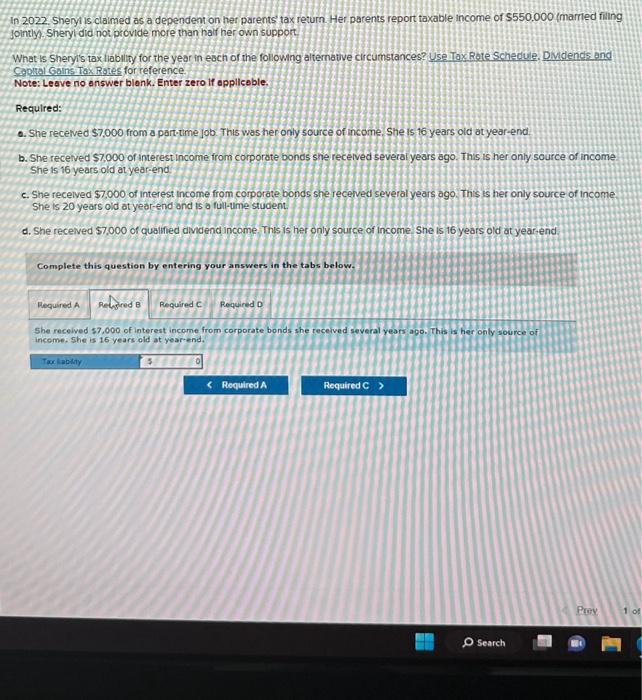

In 2022. Shenyi is claimed as a dependent on her parents tax return. Her parents report taxable income of $550.000 imarried filing jointly. Sheryl did not provide more than haif her own support. What is Sheryis tax liablity for the year in each of the following alternative circumstances? Use Tax Rote Schedule. DMdends and Caplltal Gains Tax Rates for reference. Note: Leave no enswer blonk. Enter zero if appllsoble. Requlred: 0. She recelved $7,000 from a part.time 10b. This was her only source of income. She is 16 years old atyear-end. b. She recelved $7,000 of interest income from corporate bonds she recelved several years ago. This is her only source of income. She is 16 years old at yearend. c. She recelved $7,000 of interest income from comporate bonds she recelved several years ago. This is her only source of income. She is 20 years oid ot year-end and is o full-ume student. d. She recelved $7,000 of quallifed dividend income This is her only source of income she is 16 years old at year-end. Complete this question by entering your answers in the tabs below. She received 57,000 of interest income from corporate bonds she received several years ago. This is her only source of income. She is 16 years old at year-end. In 2022, Sheryl is clalmed as a dependent on her parents' tax retum. Her parents report taxable income of $550,000 (marred filing jointlyl Shenyl did not provide more than half her own support. What is Sheryis tax liabity for the year in each of the following alternative circumstances? Use Tax Rare Schedule, Dividends and Coplicigains Tax Rates for reference. Note: Leove no answer blenk. Enter zero if appliceble. Requlred: 6. She recelved $7,000 from a part-ume job. This was her only source of income she 15.16 years old at year-end. b. She recelved $7.000 of interest income from corporate bonds she cecelved severalyears ago. This is her only source of income. She is 16 years oid at year-end c. She recefved $7,000 of interest income from corporate bonds she recetved several years ago this is her onty source of income. She 1520 years old at yearend and is a full-tme stucent. d. She recelved $7.000 of qualified olvidend income. This Is ner only source of income. She is 16 years old at year end Complete this question by entering your answers in the tabs below. income. she is 20 years old at yearend and it a fylletime student. In 2022. Sheryt is claimed as a dependent on her parents' tax return. Her parents report taxable income of $550.000 (marrled filing jointly, Sheryl did not provide more than half her own support. What is Shery's tax tiablity for the year in each of the foliowing alternative circumstances? Use Tax Rate Schedule. Dividends and Captal Gains Tax Rates for reference. Note: Leave no enswer blenk. Enter zero li oppllcable. Required: a. She recelved $7,000 from a part-time job. This was her only source of income. She is 16 years old at year-end. b. She received $7.000 of interest income from corporate bonds she recelved several years ago. This is her only source of income. She is 16 years old at year-end c. She recetved $7,000 of interest income from corporate bonds she recetved severalyears ago. This is her only source of income She is 20 years oid at yearend and is a fulltime stucent d. She recelved $7,000 of qualified dividend income. Ths is her only source of income. She is 16 years old at year-end. Complete this auestion by entering your answers in the tabs below. Cohadula V 1_Marvied Filino Inintlv or Onalifving Widow(er) Tax Rates for Net Capital Gains and Qualified Dividends "This rate applies to the net capital gains and qualified dividends that fall within the range of taxable income specified in the table iner capital gains and qualffied dividends are inchided in farable income last for this propose)