Answered step by step

Verified Expert Solution

Question

1 Approved Answer

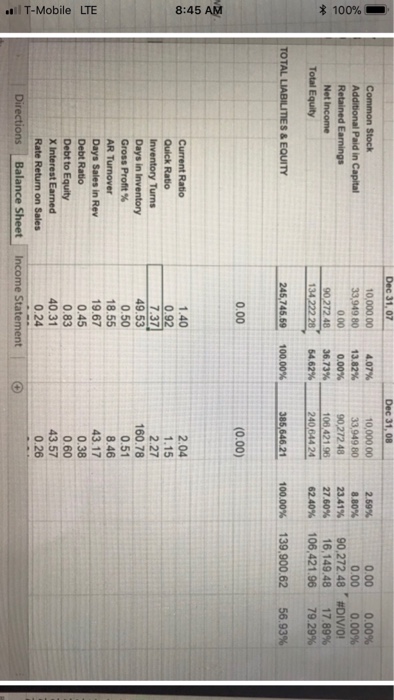

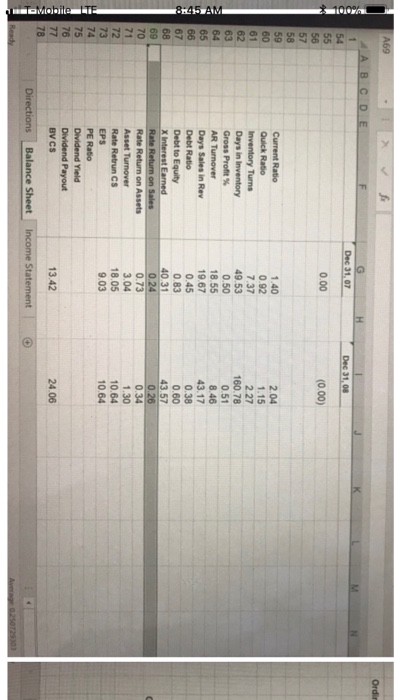

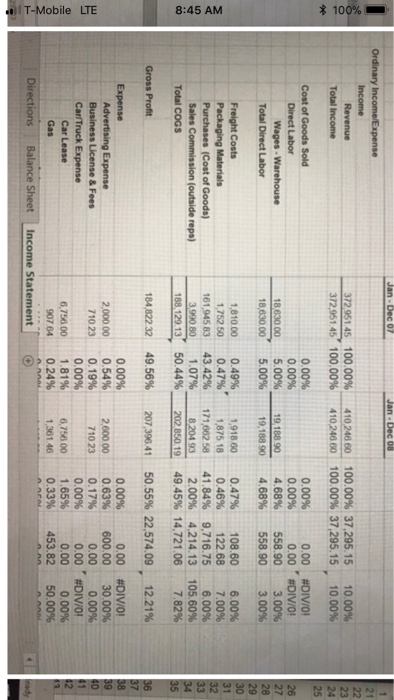

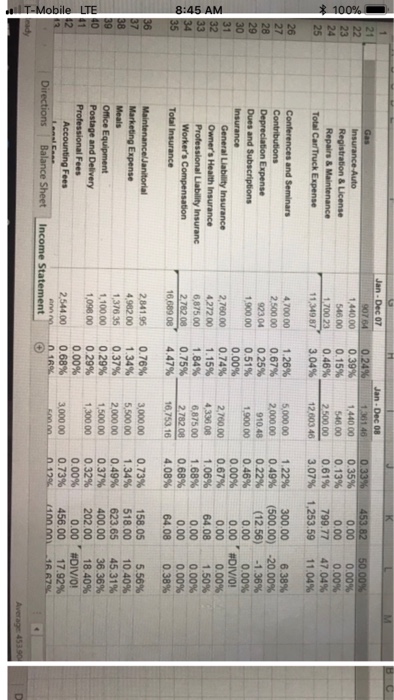

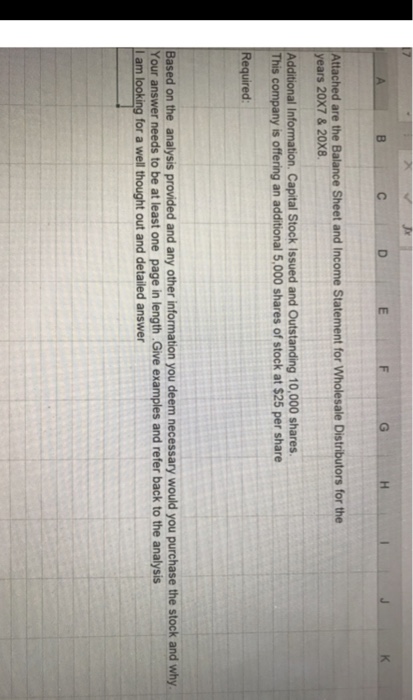

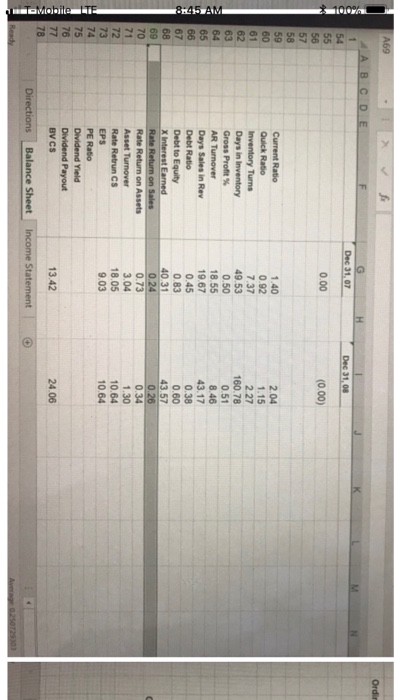

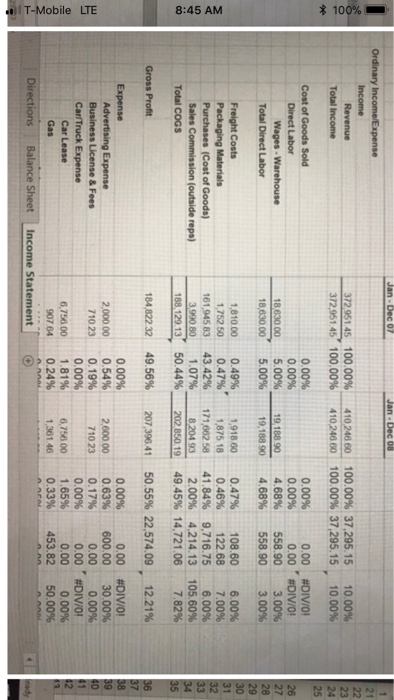

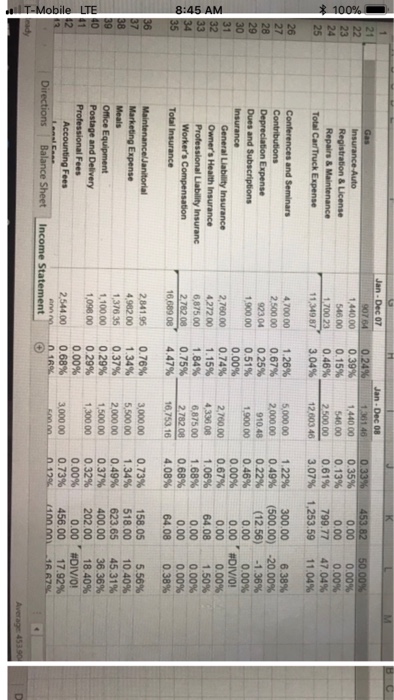

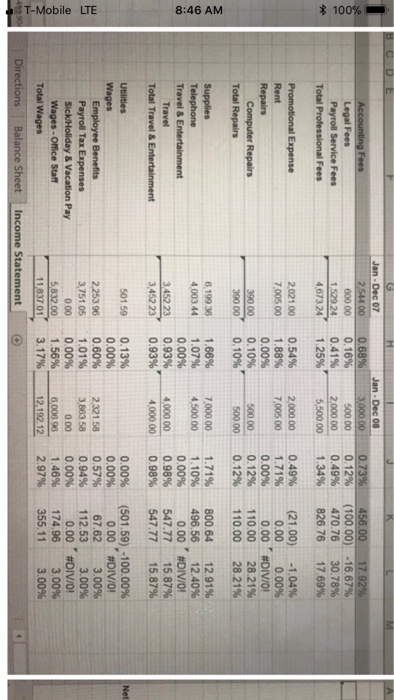

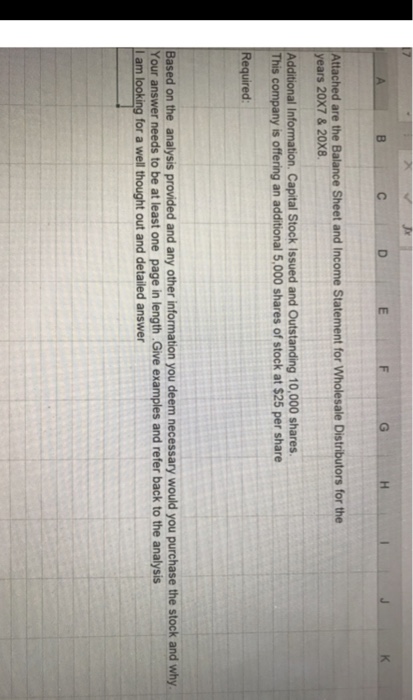

Attached are the Balance Sheet and Income Statement for Wholesale Distributors for the years 20X7 & 20X8. Capital Stock Issued and Outstanding 10,000 shares. This

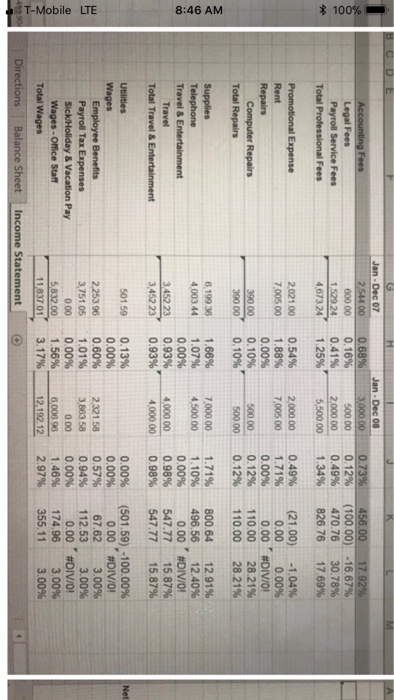

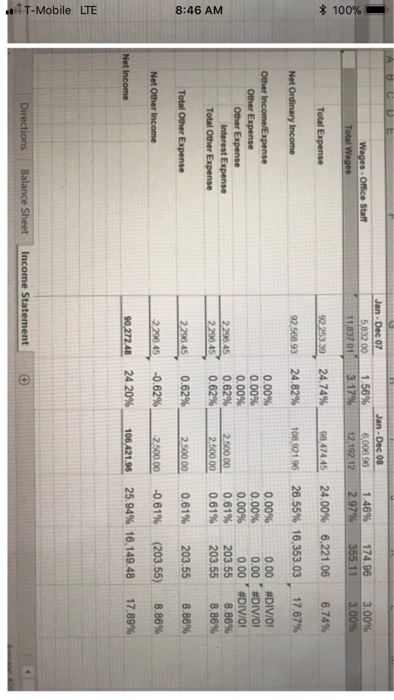

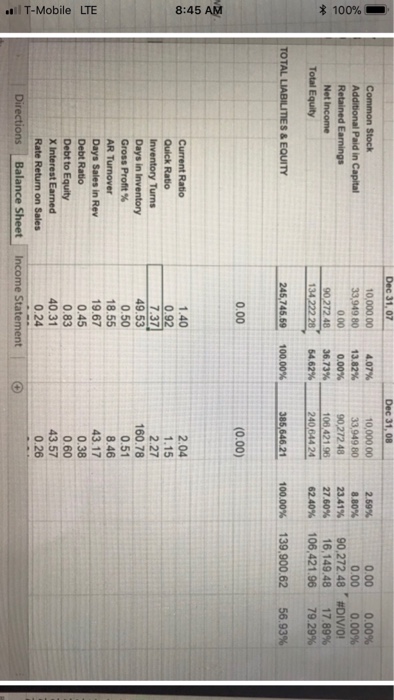

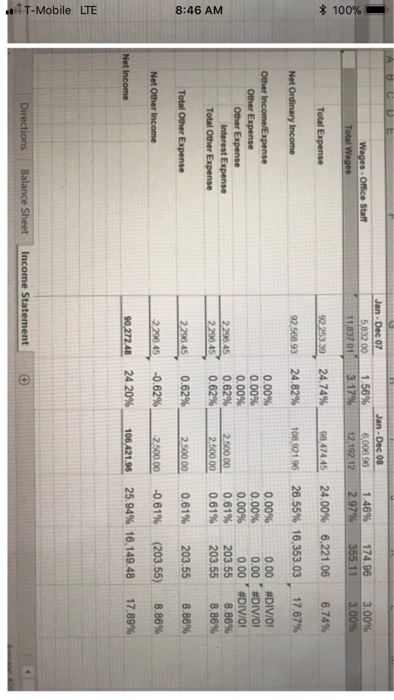

Attached are the Balance Sheet and Income Statement for Wholesale Distributors for the years 20X7 & 20X8. Capital Stock Issued and Outstanding 10,000 shares. This company is offering an additional 5,000 shares of stock at $25 per share. Based on the analysis provided and any other information you deem necessary would you purchase the stock and why?Your answer needs to be at least one page in length.Give examples and refer back to the analysis I am looking for a well thought out and detailed answer

Dec 31,08 000 000% 0.00 0.00% 10,000 00 33,949 80 000 - 9027248, 2.59% a 80% 23.41% 36.73%106421-2760% 4.07% 13.82% 0.00% 10,000 00 33,949 80 90,272 48 Common Stock 90,272 48#DIV/01 16, 149 48 106,421.96 1789% 79.29% Net Income 134222 28,5462% 240 644 24 6240% 24574559 100.00% 385,64621. 100.00% 139,900.62 56.93% 0.00 (0.00) Quick Ratio Inventory Turns Days in Inventory Gross Profit % AR Turnover Days Sales in Rev Debt Ratio Debt to Equity X Interest Earned 1.40 0.92 7.37 49.53 0.50 18.55 19.67 0.45 0.83 40.31 0.24 State 2.04 1.15 2.27 60.78 0.51 8.46 43.17 0.38 0.60 43.57 0.26 on Sales 00291 781 Dec 31,08 000 000% 0.00 0.00% 10,000 00 33,949 80 000 - 9027248, 2.59% a 80% 23.41% 36.73%106421-2760% 4.07% 13.82% 0.00% 10,000 00 33,949 80 90,272 48 Common Stock 90,272 48#DIV/01 16, 149 48 106,421.96 1789% 79.29% Net Income 134222 28,5462% 240 644 24 6240% 24574559 100.00% 385,64621. 100.00% 139,900.62 56.93% 0.00 (0.00) Quick Ratio Inventory Turns Days in Inventory Gross Profit % AR Turnover Days Sales in Rev Debt Ratio Debt to Equity X Interest Earned 1.40 0.92 7.37 49.53 0.50 18.55 19.67 0.45 0.83 40.31 0.24 State 2.04 1.15 2.27 60.78 0.51 8.46 43.17 0.38 0.60 43.57 0.26 on Sales 00291 781

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started