Question

Attached are the condensed balance sheet, income statement and notes for CDX Company. CDX prepares it financial statements in accordance with US GAAP. Its inventory

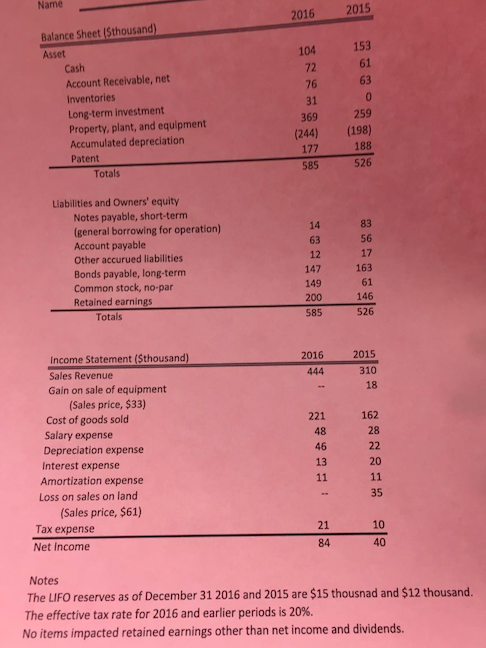

Attached are the condensed balance sheet, income statement and notes for CDX Company. CDX prepares it financial statements in accordance with US GAAP. Its inventory valuation method is LIFO. Assume all purchases and sales are on credit, and there were no disposals of fixed assets during 2016. (although 2016 is a leap year, please assume there are 365 days in 2016)

1.How much inventory did CDX purchase in 2016?

2.How much dividend did CDX pay in 2016?

3.Calculate Number of days of payables of CDX in 2016

4.Calculate Cash conversion cycle of CDX in 2016

5.Calculate Cash flow from operating activities of CDX in 2016

6.Calculate Cash flow from investing activities of CDX in 2016

7.Calculate Cash flow from financing activities of CDX in 2016

8. Calculate Inventory turnover ratio of CDX in 2016 under the FIFO method.

9. What is the cumulative amount of income tax savings that CDX has generated through 2016 using the LIFO method instead of the FIFO method?

Name 2016 2015 Balance Sheet (Sthousand) 104 153 Asset 72 Cash Account Receivable, net inventories Long-term investment 259 369 Property, plant, and equipment (244) 198 Accumulated depreciation 188 Patent 526 585 Totals Liabilities and owners' equity Notes payable, short-term 14 (general borrowing for operation) Account payable 17 other accurued liabilities Bonds payable, long-term 149 Common stock, no par 146 Retained earnings 526 Totals Income Statement (Sthousand) 444 Sales Revenue Gain on sale of equipment (Sales price, $33) 162 221 Cost of goods sold 28 48 Salary expense 22 46 Depreciation expense 13 Interest expense Amortization expense Loss on sales on land (Sales price, $61) Tax expense 40 Net Income Notes The LIFo reserves as of December 31 2016 and 2015 are $15 thousnad and $12 thousand. The effective tax rate for 2016 and earlier periods is 20%. No items impacted retained earnings other than net income and dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started