Answered step by step

Verified Expert Solution

Question

1 Approved Answer

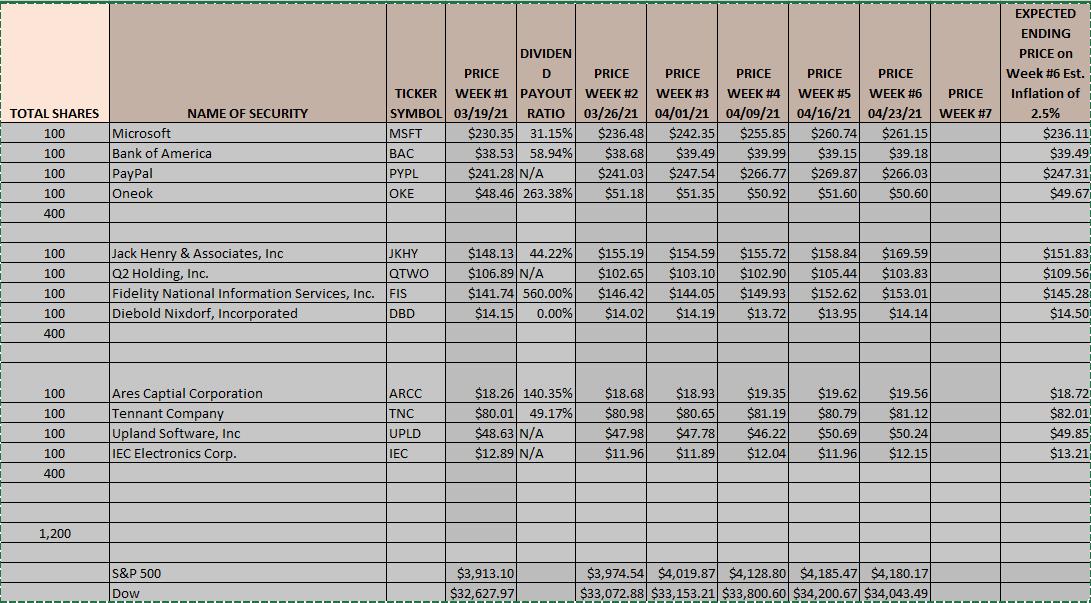

Attached is a 6 weeks tracking of 3 portfolio of stocks. I want to know: How to calculate the ROI for each stock and portfolio

Attached is a 6 weeks tracking of 3 portfolio of stocks.

I want to know:

How to calculate the ROI for each stock and portfolio and their values?

How to calculate and what the Rate of Return, Expected rate of return, Variance, Standard deviation, and Market Beta for each stock and portfolio is?

1 TOTAL SHARES 100 100 100 100 400 100 100 100 100 400 100 100 100 100 400 1,200 NAME OF SECURITY Microsoft Bank of America PayPal Oneok Jack Henry & Associates, Inc Q2 Holding, Inc. Fidelity National Information Services, Inc. Diebold Nixdorf, Incorporated Ares Captial Corporation Tennant Company Upland Software, Inc IEC Electronics Corp. S&P 500 Dow DIVIDEN PRICE PRICE PRICE WEEK #4 WEEK #5 D PRICE PRICE PRICE TICKER WEEK #1 PAYOUT WEEK #2 WEEK #3 WEEK #6 PRICE SYMBOL 03/19/21 RATIO 03/26/21 04/01/21 04/09/21 04/16/21 04/23/21 WEEK #7 MSFT $230.35 31.15% $236.48 $242.35 $255.85 $260.74 $261.15 BAC $38.53 58.94% $38.68 $39.49 $39.18 PYPL $241.28 N/A $241.03 $247.54 $266.03 OKE $48.46 263.38% $51.18 $51.35 $39.99 $39.15 $266.77 $269.87 $50.92 $51.60 $50.60 JKHY QTWO FIS DBD ARCC TNC UPLD IEC $148.13 44.22% $106.89 N/A $141.74 560.00% $14.15 0.00% $18.26 140.35% $80.01 49.17% $48.63 N/A $12.89 N/A $3,913.10 $32,627.97 $155.19 $154.59 $102.65 $103.10 $102.90 $105.44 $146.42 $144.05 $149.93 $152.62 $14.02 $14.19 $13.72 $13.95 $155.72 $158.84 $169.59 $103.83 $153.01 $14.14 $19.62 $19.56 $18.68 $18.93 $19.35 $80.98 $80.65 $81.19 $80.79 $81.12 $47.98 $47.78 $46.22 $50.69 $50.24 $11.96 $11.89 $12.04 $11.96 $12.15 $3,974.54 $4,019.87 $4,128.80 $4,185.47 $4,180.17 $33,072.88 $33,153.21 $33,800.60 $34,200.67 $34,043.49 EXPECTED ENDING PRICE on Week #6 Est. Inflation of 2.5% $236.11 $39.49 $247.31 $49.67 $151.83 $109.56 $145.280 $14.50 $18.72 $82.01) $49.85 $13.21

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

ROI Return on Investment This can be be calculated for each stock by subtracting the initial price from the ending price and then dividing that by the initial price Then multiply by 100 to express the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started