Answered step by step

Verified Expert Solution

Question

1 Approved Answer

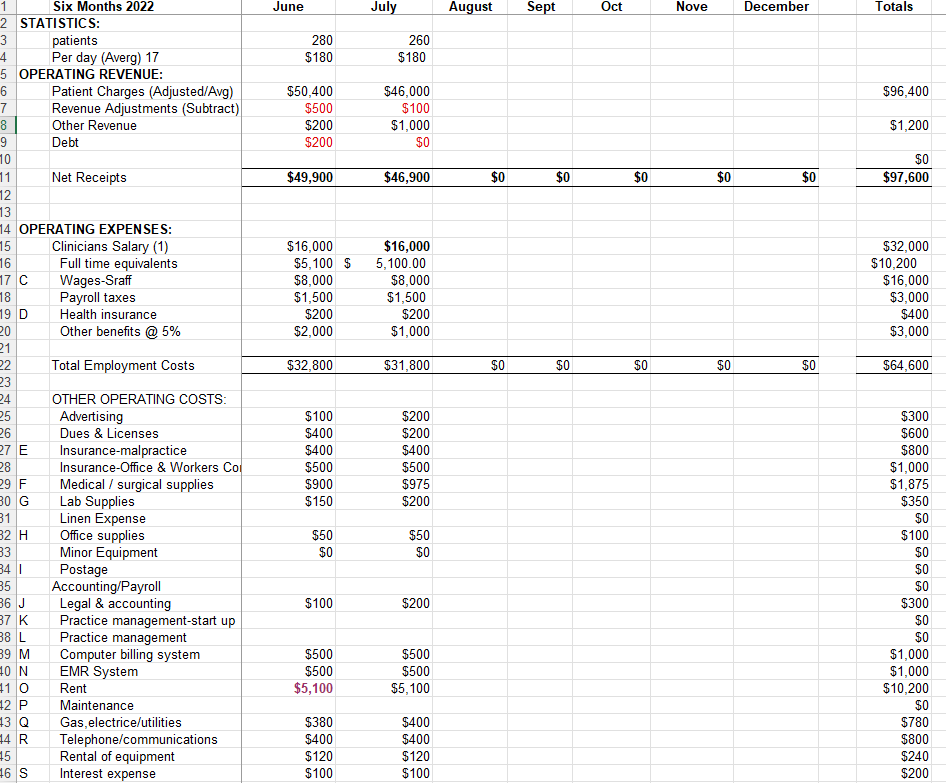

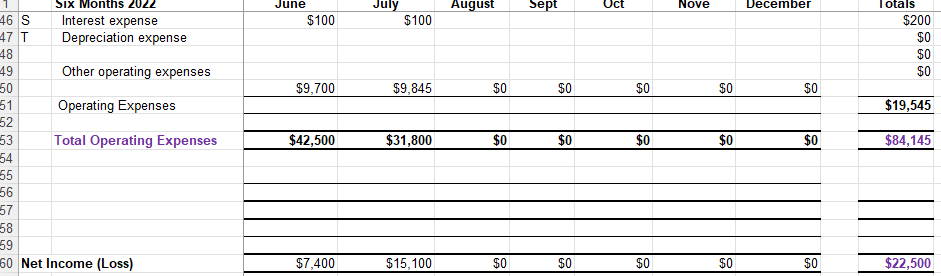

Attached is an incomplete income statement from 2022 for a clinic. That is built for six months of income and expenses. The first two months

Attached is an incomplete income statement from 2022 for a clinic. That is built for six months of income and expenses. The first two months are started, and you are to complete the remaining months to complete the budget. Note: This example is for a clinic or service line, AND the patient reimbursement is an average per patient.

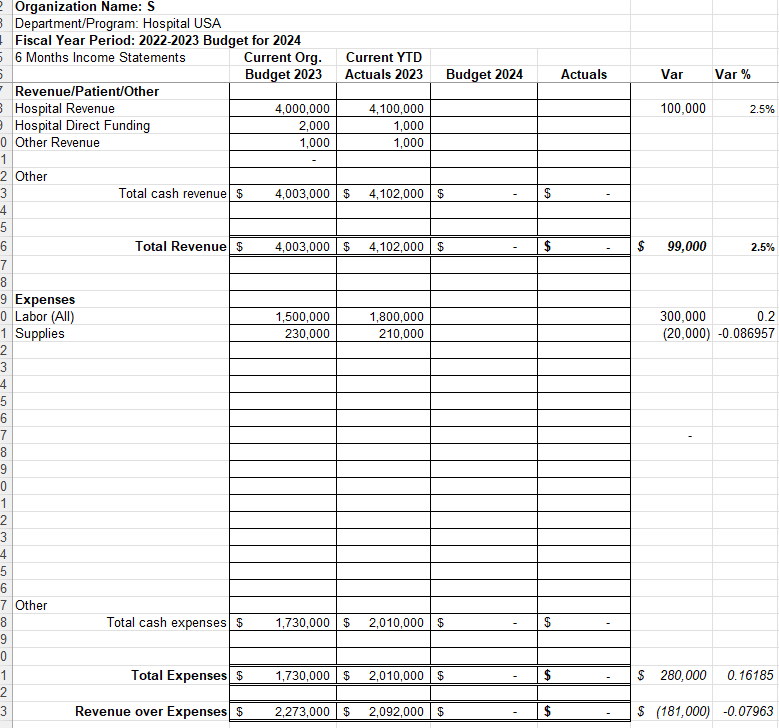

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline & & \multirow{2}{*}{June$100} & \multirow{2}{*}{\begin{tabular}{l} July \\ $100 \end{tabular}} & \multirow{2}{*}{ August } & sept & Uct & \multirow{2}{*}{ wove } & mbe & \multirow{2}{*}{\begin{tabular}{r} Iotals \\ $200 \end{tabular}} \\ \hline & Interest expense & & & & & & & & \\ \hline & Depreciation expense & & & & & & & & $0 \\ \hline & & & & & & & & & $0 \\ \hline & Other operating expenses & & & & & & & & $0 \\ \hline & & $9,700 & $9,845 & $0 & $0 & $0 & $0 & $0 & \\ \hline & Operating Expenses & & & & & & & & $19,545 \\ \hline & & & & & & & & & \\ \hline & Total Operating Expenses & $42,500 & $31,800 & $0 & $0 & $0 & $0 & $0 & $84,145 \\ \hline & & & & & & & & & \\ \hline & & & & & & & & & \\ \hline & & & & & & & & & \\ \hline & & & & & - & & & & \\ \hline & & & & & & & & & \\ \hline & Income (Loss) & $7,400 & $15,100 & $0 & $0 & $0 & $0 & $0 & $22,500 \\ \hline \end{tabular} Organization Name: S Department/Program: Hospital USA Fiscal Year Period: 2022-2023 Budget for 2024 \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline Six Months 2022 & June & July & August & Sept & Oct & Nove & December & \\ \hline \multicolumn{9}{|l|}{\begin{tabular}{l} SIX Months 2022 \\ STATISTICS: \end{tabular}} \\ \hline patients & 280 & 260 & & & & & & \\ \hline Per day (Averg) 17 & $180 & $180 & & & & & & \\ \hline \multicolumn{9}{|l|}{ OPERATING REVENUE: } \\ \hline Patient Charges (Adjusted/Avg) & $50,400 & $46,000 & & & & & & $96,400 \\ \hline Revenue Adjustments (Subtract) & $500 & $100 & & & & & & \\ \hline Other Revenue & $200 & $1,000 & & & & & & $1,200 \\ \hline Debt & $200 & $0 & & & & & & \\ \hline & & & & & & & & $0 \\ \hline Net Receipts & $49,900 & $46,900 & $0 & $0 & $0 & $0 & $0 & $97,600 \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline \multicolumn{9}{|l|}{ OPERATING EXPENSES: } \\ \hline Clinicians Salary (1) & $16,000 & $16,000 & & & & & & $32,000 \\ \hline Full time equivalents & $5,100 & 5,100.00 & & & & & & $10,200 \\ \hline Wages-Sraff & $8,000 & $8,000 & & & & & & $16,000 \\ \hline Payroll taxes & $1,500 & $1,500 & & & & & & $3,000 \\ \hline Health insurance & $200 & $200 & & & & & & $400 \\ \hline Other benefits @ 5% & $2,000 & $1,000 & & & & & & $3,000 \\ \hline & & & & & & & & \\ \hline Total Employment Costs & $32,800 & $31,800 & $0 & $0 & $0 & $0 & $0 & $64,600 \\ \hline & & & & & & & & \\ \hline OTHER OPERATING COSTS: & & & & & & & & \\ \hline Advertising & $100 & $200 & & & & & & $300 \\ \hline Dues \& Licenses & $400 & $200 & & & & & & $600 \\ \hline Insurance-malpractice & $400 & $400 & & & & & & $800 \\ \hline Insurance-Office \& Workers Col & $500 & $500 & & & & & & $1,000 \\ \hline Medical / surgical supplies & $900 & $975 & & & & & & $1,875 \\ \hline Lab Supplies & $150 & $200 & & & & & & $350 \\ \hline Linen Expense & & & & & & & & $0 \\ \hline Office supplies & $50 & $50 & & & & & & $100 \\ \hline Minor Equipment & $0 & $0 & & & & & & $0 \\ \hline Postage & & & & & & & & $0 \\ \hline Accounting/Payroll & & & & & & & & $0 \\ \hline Legal \& accounting & $100 & $200 & & & & & & $300 \\ \hline Practice management-start up & & & & & & & & $0 \\ \hline Practice management & & & & & & & & $0 \\ \hline Computer billing system & $500 & $500 & & & & & & $1,000 \\ \hline EMR System & $500 & $500 & & & & & & $1,000 \\ \hline Rent & $5,100 & $5,100 & & & & & & $10,200 \\ \hline Maintenance & & & & & & & & $0 \\ \hline Gas, electrice/utilities & $380 & $400 & & & & & & $780 \\ \hline Telephone/communications & $400 & $400 & & & & & & $800 \\ \hline Rental of equipment & $120 & $120 & & & & & & $240 \\ \hline Interest expense & $100 & $100 & & & & & & $200 \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline & & \multirow{2}{*}{June$100} & \multirow{2}{*}{\begin{tabular}{l} July \\ $100 \end{tabular}} & \multirow{2}{*}{ August } & sept & Uct & \multirow{2}{*}{ wove } & mbe & \multirow{2}{*}{\begin{tabular}{r} Iotals \\ $200 \end{tabular}} \\ \hline & Interest expense & & & & & & & & \\ \hline & Depreciation expense & & & & & & & & $0 \\ \hline & & & & & & & & & $0 \\ \hline & Other operating expenses & & & & & & & & $0 \\ \hline & & $9,700 & $9,845 & $0 & $0 & $0 & $0 & $0 & \\ \hline & Operating Expenses & & & & & & & & $19,545 \\ \hline & & & & & & & & & \\ \hline & Total Operating Expenses & $42,500 & $31,800 & $0 & $0 & $0 & $0 & $0 & $84,145 \\ \hline & & & & & & & & & \\ \hline & & & & & & & & & \\ \hline & & & & & & & & & \\ \hline & & & & & - & & & & \\ \hline & & & & & & & & & \\ \hline & Income (Loss) & $7,400 & $15,100 & $0 & $0 & $0 & $0 & $0 & $22,500 \\ \hline \end{tabular} Organization Name: S Department/Program: Hospital USA Fiscal Year Period: 2022-2023 Budget for 2024 \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline Six Months 2022 & June & July & August & Sept & Oct & Nove & December & \\ \hline \multicolumn{9}{|l|}{\begin{tabular}{l} SIX Months 2022 \\ STATISTICS: \end{tabular}} \\ \hline patients & 280 & 260 & & & & & & \\ \hline Per day (Averg) 17 & $180 & $180 & & & & & & \\ \hline \multicolumn{9}{|l|}{ OPERATING REVENUE: } \\ \hline Patient Charges (Adjusted/Avg) & $50,400 & $46,000 & & & & & & $96,400 \\ \hline Revenue Adjustments (Subtract) & $500 & $100 & & & & & & \\ \hline Other Revenue & $200 & $1,000 & & & & & & $1,200 \\ \hline Debt & $200 & $0 & & & & & & \\ \hline & & & & & & & & $0 \\ \hline Net Receipts & $49,900 & $46,900 & $0 & $0 & $0 & $0 & $0 & $97,600 \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline \multicolumn{9}{|l|}{ OPERATING EXPENSES: } \\ \hline Clinicians Salary (1) & $16,000 & $16,000 & & & & & & $32,000 \\ \hline Full time equivalents & $5,100 & 5,100.00 & & & & & & $10,200 \\ \hline Wages-Sraff & $8,000 & $8,000 & & & & & & $16,000 \\ \hline Payroll taxes & $1,500 & $1,500 & & & & & & $3,000 \\ \hline Health insurance & $200 & $200 & & & & & & $400 \\ \hline Other benefits @ 5% & $2,000 & $1,000 & & & & & & $3,000 \\ \hline & & & & & & & & \\ \hline Total Employment Costs & $32,800 & $31,800 & $0 & $0 & $0 & $0 & $0 & $64,600 \\ \hline & & & & & & & & \\ \hline OTHER OPERATING COSTS: & & & & & & & & \\ \hline Advertising & $100 & $200 & & & & & & $300 \\ \hline Dues \& Licenses & $400 & $200 & & & & & & $600 \\ \hline Insurance-malpractice & $400 & $400 & & & & & & $800 \\ \hline Insurance-Office \& Workers Col & $500 & $500 & & & & & & $1,000 \\ \hline Medical / surgical supplies & $900 & $975 & & & & & & $1,875 \\ \hline Lab Supplies & $150 & $200 & & & & & & $350 \\ \hline Linen Expense & & & & & & & & $0 \\ \hline Office supplies & $50 & $50 & & & & & & $100 \\ \hline Minor Equipment & $0 & $0 & & & & & & $0 \\ \hline Postage & & & & & & & & $0 \\ \hline Accounting/Payroll & & & & & & & & $0 \\ \hline Legal \& accounting & $100 & $200 & & & & & & $300 \\ \hline Practice management-start up & & & & & & & & $0 \\ \hline Practice management & & & & & & & & $0 \\ \hline Computer billing system & $500 & $500 & & & & & & $1,000 \\ \hline EMR System & $500 & $500 & & & & & & $1,000 \\ \hline Rent & $5,100 & $5,100 & & & & & & $10,200 \\ \hline Maintenance & & & & & & & & $0 \\ \hline Gas, electrice/utilities & $380 & $400 & & & & & & $780 \\ \hline Telephone/communications & $400 & $400 & & & & & & $800 \\ \hline Rental of equipment & $120 & $120 & & & & & & $240 \\ \hline Interest expense & $100 & $100 & & & & & & $200 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started