Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Attached is information related to Fuchsia Corporation as of December 31 for the last three years, 20X1, 20X2, and 20X3. REQUIRED: Compute the ending

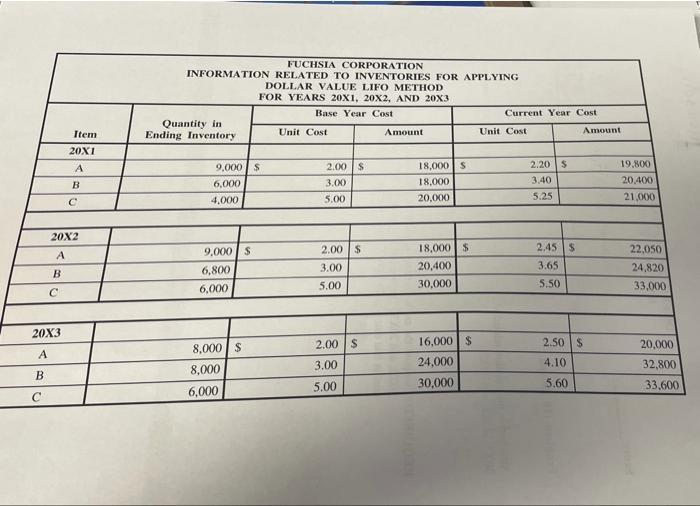

Attached is information related to Fuchsia Corporation as of December 31 for the last three years, 20X1, 20X2, and 20X3. REQUIRED: Compute the ending inventories under the dollar value LIFO method for 20X1. 20X2, and 20X3. The base period is January 1, 20X1, and the beginning inventory cost at that date was $40,000. Compute indexes to two decimal places. FUCHSIA CORPORATION INFORMATION RELATED TO INVENTORIES FOR APPLYING DOLLAR VALUE LIFO METHOD FOR YEARS 20X1, 20X2, AND 20X3 Base Year Cost Current Year Cost Quantity in Ending Inventory Item Unit Cost Amount Unit Cost Amount 20X1 A 9,000| S 2.00 S 18,000 S 2.20 S 19.800 B 6,000 3.00 18,000 3.40 20,400 4,000 5.00 20,000 5.25 21,000 20X2 9,000 S 2.00 S 18,000 $ 2,45 S 22,050 A 6,800 3.00 20,400 3.65 24,820 6,000 5.00 30,000 5.50 33,000 C 20X3 2.00 S 16,000 $ 2.50 $ 20,000 8,000 $ A 3.00 24,000 4.10 32,800 8,000 B 5.00 30,000 5.60 33.600 6,000

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Dollar value LIFO Yr Current yr cost ab Base yr ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started