Attached is the whole problem.

the following ten paragraphs describe control weaknesses in customer order and account management business processes. listed below are 11 controls that may help control the weaknesses: Required: In the blank next to each number, list one capital letter representing the best control to address the sustem weakness. You will use each letter only once, and one letter will not be used.

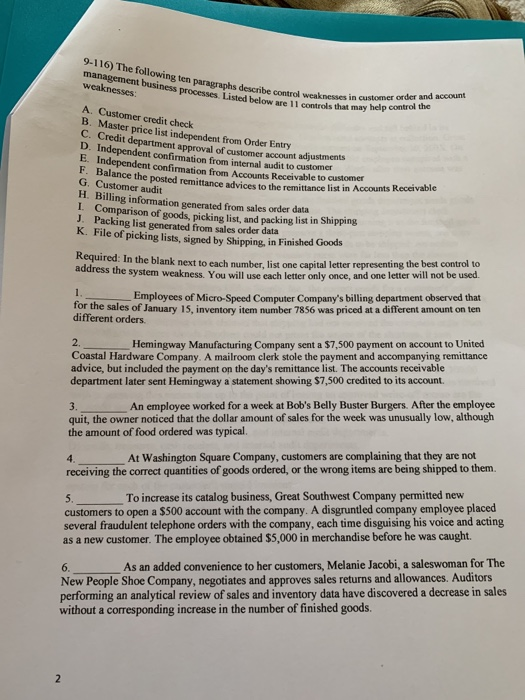

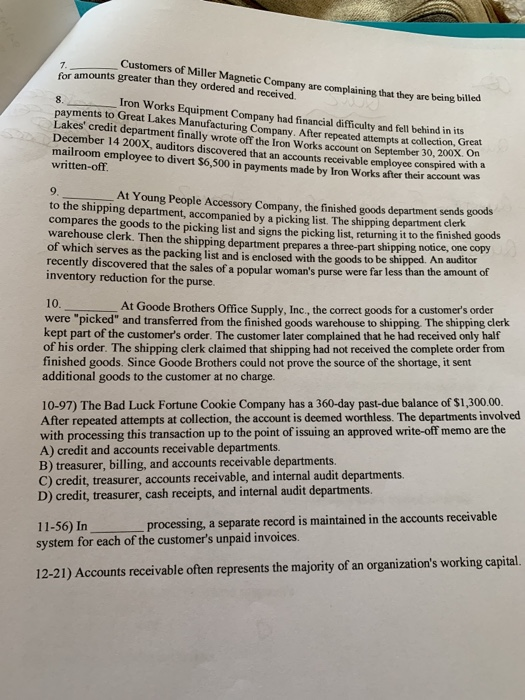

9-116) The following ten paragraphs describe control weaknesses in customer order and account management business processes Listed below are 11 controls that may help control the weaknesses: A Customer credit check B. Master price list independent from Order Entry C. Credit department approval of customer account adjustments D. Independent confirmation from internal audit to customer E Independent confirmation from Accounts Receivable to customer F. Balance the posted remittance advices to the remittance list in Accounts Receivable G. Customer audit H. Billing information generated from sales order data I Comparison of goods, picking list, and packing list in Shipping J. Packing list generated from sales order data K. File of picking lists, signed by Shipping, in Finished Goods 1 Required: In the blank next to each number, list one capital letter representing the best control to address the system weakness. You will use each letter only once, and one letter will not be used. Employees of Micro-Speed Computer Company's billing department observed that different orders for the sales of January 15, inventory item number 7856 was priced at a different amount on ten 2. Hemingway Manufacturing Company sent a $7,500 payment on account to United Coastal Hardware Company. A mailroom clerk stole the payment and accompanying remittance advice, but included the payment on the day's remittance list. The accounts receivable department later sent Hemingway a statement showing $7,500 credited to its account. 3. An employee worked for a week at Bob's Belly Buster Burgers. After the employee quit, the owner noticed that the dollar amount of sales for the week was unusually low, although the amount of food ordered was typical At Washington Square Company, customers are complaining that they are not receiving the correct quantities of goods ordered, or the wrong items are being shipped to them. 5. To increase its catalog business, Great Southwest Company permitted new customers to open a $500 account with the company. A disgruntled company employee placed several fraudulent telephone orders with the company, each time disguising his voice and acting as a new customer. The employee obtained $5,000 in merchandise before he was caught. 6. As an added convenience to her customers, Melanie Jacobi, a saleswoman for The New People Shoe Company, negotiates and approves sales returns and allowances. Auditors performing an analytical review of sales and inventory data have discovered a decrease in sales without a corresponding increase in the number of finished goods. 4 2 7. 8 9 Customers of Miller Magnetic Company are complaining that they are being billed for amounts greater than they ordered and received Iron Works Equipment Company had financial difficulty and fell behind in its payments to Great Lakes Manufacturing Company. After repeated attempts at collection, Great Lakes' credit department finally wrote off the Iron Works account on September 30, 200x. On December 14 200x, auditors discovered that an accounts receivable employee conspired with a mailroom employee to divert $6,500 in payments made by Iron Works after their account was written-off At Young People Accessory Company, the finished goods department sends goods to the shipping department, accompanied by a picking list. The shipping department clerk compares the goods to the picking list and signs the picking list, returning it to the finished goods warehouse clerk. Then the shipping department prepares a three-part shipping notice, one copy of which serves as the packing list and is enclosed with the goods to be shipped. An auditor recently discovered that the sales of a popular woman's purse were far less than the amount of inventory reduction for the purse. 10. At Goode Brothers Office Supply, Inc., the correct goods for a customer's order were "picked" and transferred from the finished goods warehouse to shipping. The shipping clerk kept part of the customer's order. The customer later complained that he had received only half of his order. The shipping clerk claimed that shipping had not received the complete order from finished goods. Since Goode Brothers could not prove the source of the shortage, it sent additional goods to the customer at no charge. 10-97) The Bad Luck Fortune Cookie Company has a 360-day past-due balance of $1,300.00 After repeated attempts at collection, the account is deemed worthless. The departments involved with processing this transaction up to the point of issuing an approved write-off memo are the A) credit and accounts receivable departments. B) treasurer, billing, and accounts receivable departments. C) credit, treasurer, accounts receivable, and internal audit departments. D) credit, treasurer, cash receipts, and internal audit departments. 11-56) In processing, a separate record is maintained in the accounts receivable system for each of the customer's unpaid invoices. 12-21) Accounts receivable often represents the majority of an organization's working capital