Answered step by step

Verified Expert Solution

Question

1 Approved Answer

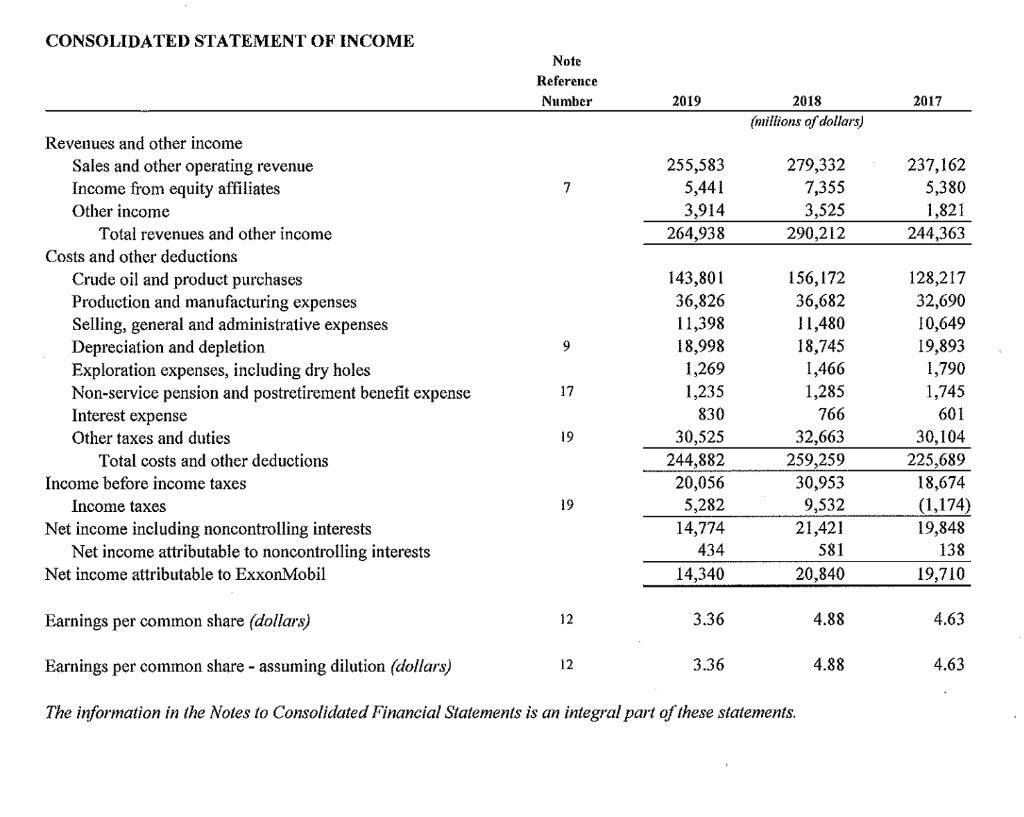

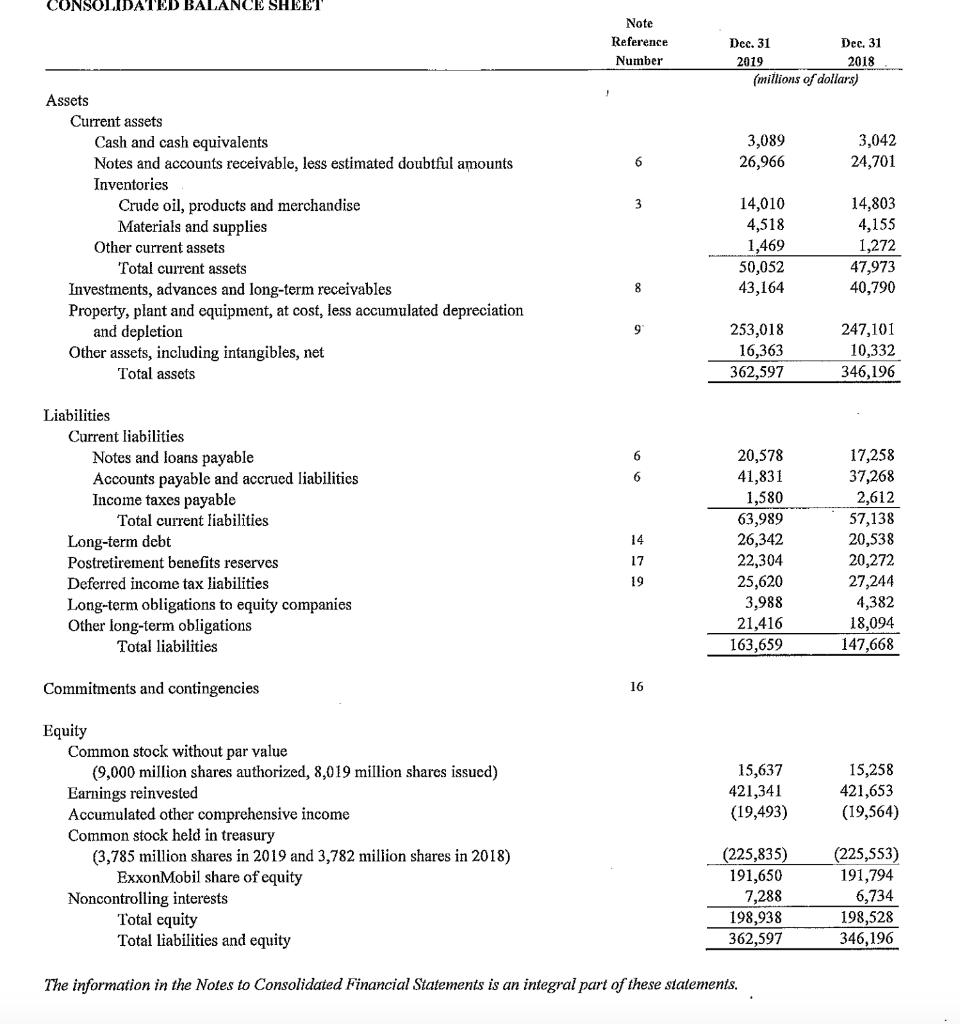

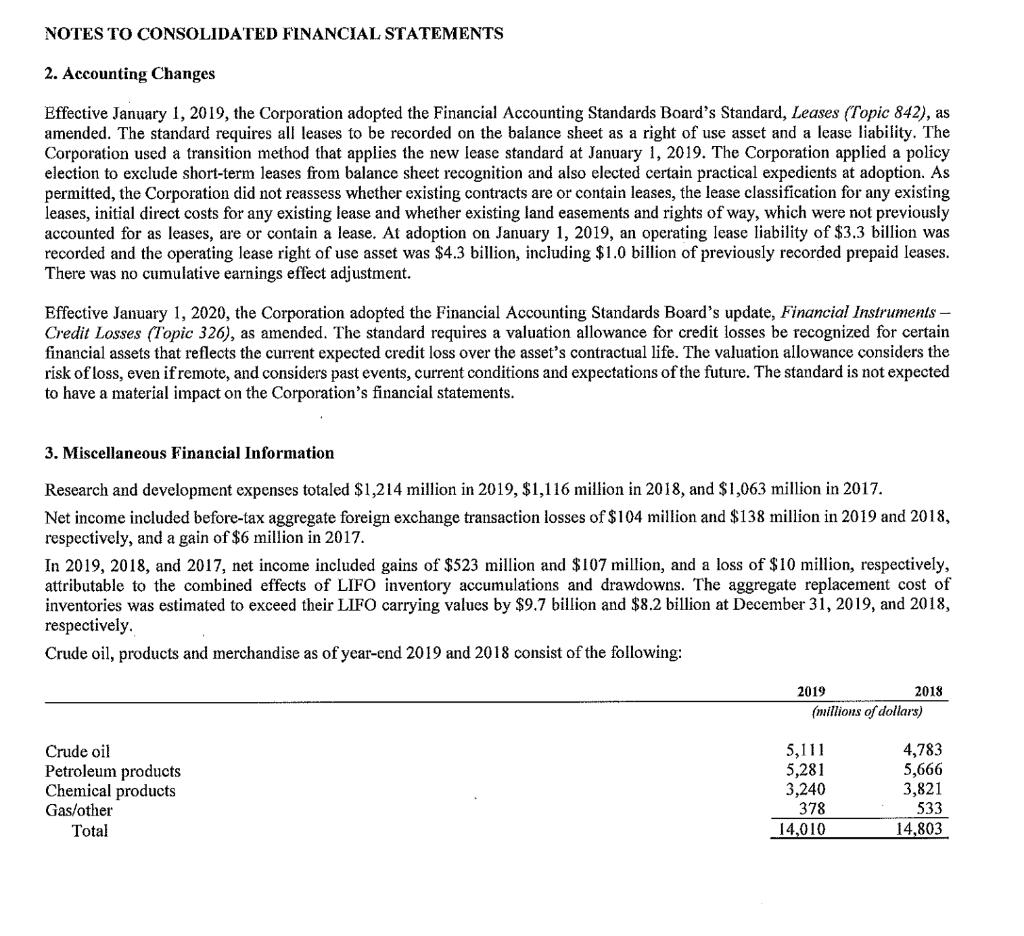

Attached please find Income Statement, Balance Sheet, and footnote 3 on LIFO inventories from ExxonMobil's 2019 Annual Report. Answer the following questions for 2019.

Attached please find Income Statement, Balance Sheet, and footnote 3 on LIFO inventories from ExxonMobil's 2019 Annual Report. Answer the following questions for 2019. 1. Calculate the firm's inventory turnover ratio (COGS/average of beginning and ending inventory). Use "crude oil and product purchases" for COGS, and "Crude oil, products, and merchandise" for inventory. CONSOLIDATED STATEMENT OF INCOME Revenues and other income Sales and other operating revenue Income from equity affiliates Other income Total revenues and other income Costs and other deductions Crude oil and product purchases Production and manufacturing expenses Selling, general and administrative expenses Depreciation and depletion Exploration expenses, including dry holes Non-service pension and postretirement benefit expense Interest expense Other taxes and duties Total costs and other deductions Income before income taxes Income taxes Net income including noncontrolling interests Net income attributable to noncontrolling interests Net income attributable to ExxonMobil Note Reference Number 7 9 17 19 19 12 2019 12 255,583 5,441 3,914 264,938 143,801 36,826 11,398 18,998 1,269 1,235 830 30,525 244,882 20,056 5,282 14,774 434 14,340 3.36 2018 (millions of dollars) 3.36 279,332 7,355 3,525 290,212 Earnings per common share (dollars) Earnings per common share - assuming dilution (dollars) The information in the Notes to Consolidated Financial Statements is an integral part of these statements. 156,172 36,682 11,480 18,745 1,466 1,285 766 32,663 259,259 30,953 9,532 21,421 581 20,840 4.88 4.88 2017 237,162 5,380 1,821 244,363 128,217 32,690 10,649 19,893 1,790 1,745 601 30,104 225,689 18,674 (1,174) 19,848 138 19,710 4.63 4.63 CONSOLIDATED BALANCE SHEET Assets Current assets Cash and cash equivalents Notes and accounts receivable, less estimated doubtful amounts Inventories Crude oil, products and merchandise Materials and supplies Other current assets Total current assets Investments, advances and long-term receivables Property, plant and equipment, at cost, less accumulated depreciation and depletion Other assets, including intangibles, net Total assets Liabilities Current liabilities Equity Notes and loans payable Accounts payable and accrued liabilities Income taxes payable Total current liabilities Long-term debt Postretirement benefits reserves Deferred income tax liabilities Long-term obligations to equity companies Other long-term obligations Total liabilities Commitments and contingencies Common stock without par value (9,000 million shares authorized, 8,019 million shares issued) Earnings reinvested Accumulated other comprehensive income Common stock held in treasury (3,785 million shares in 2019 and 3,782 million shares in 2018) ExxonMobil share of equity J Note Reference Number 6 3 8 9 6 14 17 19 16 Dec. 31 2019 3,089 26,966 14,010 4,518 1,469 (millions of dollars) 50,052 43,164 253,018 16,363 362,597 20,578 41,831 1,580 63,989 26,342 22,304 25,620 3,988 21,416 163,659 15,637 421,341 (19,493) (225,835) 191,650 7,288 Noncontrolling interests Total equity Total liabilities and equity The information in the Notes to Consolidated Financial Statements is an integral part of these statements. Dec. 198,938 362,597 2018 3,042 24,701 14,803 4,155 1,272 47,973 40,790 247,101 10,332 346,196 17,258 37,268 2,612 57,138 20,538 20,272 27,244 4,382 18,094 147,668 15,258 421,653 (19,564) (225,553) 191,794 6,734 198,528 346,196 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 2. Accounting Changes Effective January 1, 2019, the Corporation adopted the Financial Accounting Standards Board's Standard, Leases (Topic 842), as amended. The standard requires all leases to be recorded on the balance sheet as a right of use asset and a lease liability. The Corporation used a transition method that applies the new lease standard at January 1, 2019. The Corporation applied a policy election to exclude short-term leases from balance sheet recognition and also elected certain practical expedients at adoption. As permitted, the Corporation did not reassess whether existing contracts are or contain leases, the lease classification for any existing leases, initial direct costs for any existing lease and whether existing land easements and rights of way, which were not previously accounted for as leases, are or contain a lease. At adoption on January 1, 2019, an operating lease liability of $3.3 billion was recorded and the operating lease right of use asset was $4.3 billion, including $1.0 billion of previously recorded prepaid leases. There was no cumulative earnings effect adjustment. Effective January 1, 2020, the Corporation adopted the Financial Accounting Standards Board's update, Financial Instruments - Credit Losses (Topic 326), as amended. The standard requires a valuation allowance for credit losses be recognized for certain financial assets that reflects the current expected credit loss over the asset's contractual life. The valuation allowance considers the risk of loss, even if remote, and considers past events, current conditions and expectations of the future. The standard is not expected to have a material impact on the Corporation's financial statements. 3. Miscellaneous Financial Information Research and development expenses totaled $1,214 million in 2019, $1,116 million in 2018, and $1,063 million in 2017. Net income included before-tax aggregate foreign exchange transaction losses of $104 million and $138 million in 2019 and 2018, respectively, and a gain of $6 million in 2017. In 2019, 2018, and 2017, net income included gains of $523 million and $107 million, and a loss of $10 million, respectively, attributable to the combined effects of LIFO inventory accumulations and drawdowns. The aggregate replacement cost of inventories was estimated to exceed their LIFO carrying values by $9.7 billion and $8.2 billion at December 31, 2019, and 2018, respectively. Crude oil, products and merchandise as of year-end 2019 and 2018 consist of the following: Crude oil Petroleum products Chemical products Gas/other Total 2019 2018 (millions of dollars) 5,111 5,281 3,240 378 14,010 4,783 5,666 3,821 533 14,803

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the firms Investas tumores o Coas Avoye begint Party Co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started